When the national climate bill crashed this summer in a flaming streak of senatorial ineptitude, climate hawks could take a little comfort in the progress that continued on the state level.

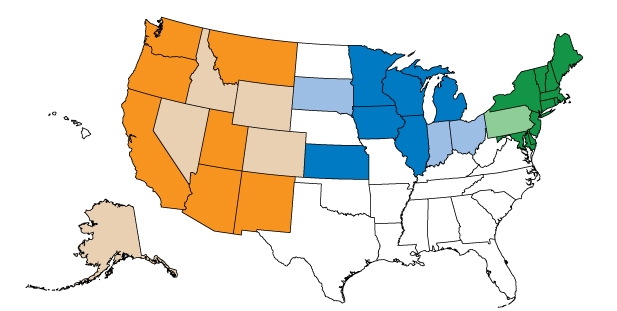

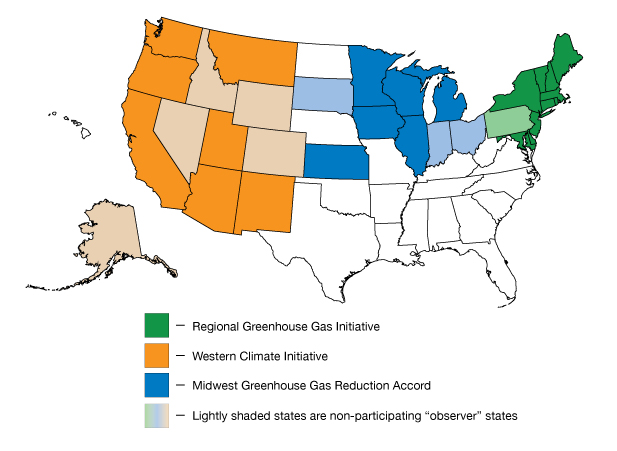

Ten northeastern states have been running an active cap-and-trade program for power plants that has produced modest greenhouse-gas cuts and raised $729 million for clean-energy programs. Two clusters of states in the West and Midwest have been inching toward their own regional cap-and-trade plans.

But then the election happened, bringing in a host of new governors and switching control of state legislatures, mostly from Democratic to Republican. What does it mean for regional cap-and-trade?

It means most of the action will happen on the coasts. Democratic victories in Northeastern states will probably keep that region’s program stable for the next few years. And California’s overwhelming ballot victory for its climate law provides a backbone for the Western program, which is scheduled to go online in 2012 even if only a few states follow through. In the Midwest, however, regional cap-and-trade is probably stalled out for the next few years, with the program’s original architects out of office and clean-energy-hostile Republicans taking charge in Wisconsin, Kansas, and Ohio.

Recent research from the World Resources Institute found that a combination of state efforts and regulation from the EPA could keep the nation roughly on track with President Obama’s Copenhagen emissions pledge, a 17 percent cut from recent levels by 2020. That’s not nearly what science requires, but it’s not nothing either.

The bigger promise of these programs is the beta testing they can do for a national system. Regional cap-and-trade initiatives can work out kinks and develop best practices. Just as important, they provide a rebuttal to the doomsayers who have made cap-and-trade a toxic phrase in national discourse.

“People don’t understand [cap-and-trade] well, so it’s relatively easy for those who don’t want it to happen to sow fear where there is a vacuum of real, working experience,” said K.C. Golden, policy director at the advocacy group Climate Solutions. “It’s easier for people who want it to happen to build the politics for it when there’s success to point to.”

In the two years that the Northeast’s program has been up and running, there have been no spikes in electricity rates and no Enron-style market corruption, according to independent watchdogs. Also, Christmas has not been cancelled, Sharia law has not been imposed, and kittens have not drowned.

One public energy company that’s required to buy emissions permits, New Jersey’s PSEG, has been pleased with the program and has not lost business to neighboring Pennsylvania, according to Vice President of Policy Eric Svenson. “It’s worked out better [than our expectations],” he said. “It’s gotten people comfortable with the concept of cap-and-trade for carbon … We’d like to see them stay the course.”

Here’s a closer look at the future of the three regional programs and how they might serve as test labs for a national plan.

Northeast

The Regional Greenhouse Gas Initiative (RGGI, pronounced “Reggie”), which involves Northeastern and mid-Atlantic states, is the nation’s only active cap-and-trade program, although it’s limited in scope by addressing only power plants — about 23 percent of total emissions from the area.

Democratic gubernatorial victories in New York, Massachusetts, Maryland, Vermont, New Hampshire, and Connecticut mean those states should remain participants. Rhode Island Independent governor-elect Lincoln Chafee is likely to support RGGI, based on his Senate record. Pennsylvania governor-elect Tom Corbett (R) isn’t likely to join in, but his coal-heavy state was only an “observer” of the accord even under a Democratic governor.

The biggest uncertainties come from New Jersey Gov. Chris Christie (R) and Maine governor-elect Paul LePage (R). Christie has shown he’s will to block forward-looking regional investments by killing a major rail-tunnel project last month, while LePage is a climate skeptic who opposes his state’s clean-energy goals and has called for abolishing the federal Department of Energy and EPA on radio talk shows.

Both have been pushed to drop out of RGGI by Americans for Prosperity, a Koch Industries-funded astroturf group. LePage hasn’t spoken about RGGI, but he did sign AFP’s “No Climate Tax” pledge, suggesting he may be sympathetic.

Christie also has not responded publicly to AFP’s campaign. Svenson of PSEG, New Jersey’s largest utility, said he hopes the governor makes his decision “in a very deliberative manner,” as pulling out would disrupt businesses’ long-term planning. Because both states joined RGGI with the support of their legislatures, it’s unlikely the governors would be able to pull out on their own.

So onlookers expect the program to hum along. Pollution permits so far have been surprisingly cheap ($1.86 per ton in the latest auction), which means companies owning coal plants are finding it easier to buy permits than clean up dirty plants. The program was designed to start cautiously, and targets become stronger in 2014.

At least 25 percent of revenue generated by RGGI’s auctions is supposed to go to energy-efficiency programs, but New York, New Jersey, and New Hampshire have raided their RGGI funds to plug holes in their budgets. Still, more of the $729 million raised has gone toward protecting ratepayers through efficiency investments. In Delaware, 15 percent of auction proceeds help low-income consumers seal their homes through a Weatherizing Assistance Program. In Maryland, auction proceeds are funding a weatherization workforce training program at 13 community colleges.

West

With California voters affirming the state’s landmark climate plan by the widest margin of any vote in the state last week (22 points), it’s set to launch cap-and-trade in 2012. Unlike RGGI’s power-plant-only focus, California will address manufacturing and, in 2015, transportation fuels. It would be, as Brad Plumer puts it, the real thing. And in governor-elect Jerry Brown (D), the state will have a leader who’s eager to enact it.

The original plan for the Western Climate Initiative was to have seven states and four Canadian provinces jump into cap-and-trade together, but California

may not have much company at first. A governor-appointed board in New Mexico signed up for the plan last week, but incoming Republican Gov. Susana Martinez opposes it and will try to block that move. Washington and Oregon have Democratic governors who support the cap-and-trade plan, but their legislatures refused to sign off on joining it even before they gained new Republican members last week. Arizona Gov. Jan Brewer (R) supports some of the WCI’s non-cap-and-trade programs, like energy efficiency and clean fuels measures, but issued an executive order in February pulling her state out of the cap-and-trade plan.

California’s most likely partners are the Canadian provinces Ontario, Quebec, and British Columbia; B.C. already has a carbon tax that could be integrated into the program. It’s possible Colorado could join under the new leadership of clean-energy backer John Hickenlooper (D), although when Grist asked him about WCI over the summer, he wouldn’t say whether he supported it.

Golden of Climate Solutions said more states could join if California’s launch goes well in 2012. “California leads because it’s a trend-setter and a big economy, but also in this case because it has the strength and depth in its agencies to do the heavy lifting it takes to pass a law like this, work out all the kinks, and defend it legally,” he said. “That sort of paves the way for other states to move forward.”

Midwest

Republicans made big gains in the Midwest last week, which lowers the odds that the Midwest Greenhouse Gas Reduction Accord will grow into a functional cap-and-trade system. Not that it was making much progress anyway.

The accord, a younger project than RGGI and the Western initiative, was a collaboration of governors who have already left office or will finish their terms next month — Kathleen Sebelius (D) of Kansas left to join President Obama’s cabinet; Rod Blagojevich (D) of Illinois left to make a fool of himself; Jennifer Granholm (D) of Michigan was term-limited; and Tim Pawlenty (R) of Minnesota abandoned his clean-energy support to position himself for a presidential run.

They’ll be replaced by a crop of fossil-fuel defenders including Sam Brownback (R) in Kansas, Scott Walker (R) in Wisconsin, and John Kasich (R) in Ohio (which hasn’t been part of the accord and definitely won’t be now). Midwestern clean-energy advocates are hopeful they’ll have success working with Republicans Rick Snyder of Michigan and Terry Branstad of Iowa, although the accord isn’t likely to get much attention.

“I think that action on the climate portion of the accord is going to be stalled for a while,” said Howard Learner, a former Obama campaign advisor and president of the Environmental Law and Policy Center in Chicago. “[New governors] are going to be focused on budget crises in their states, getting cabinet members and department heads in place, and dealing with whatever legislation comes up right away. There’s only so much oxygen in the room.”

RGGI shows that regional cap-and-trade can raise money to help fill budget gaps, but it’s not a quick solution to shortfalls. Governors aren’t likely to make a difficult push to get their legislatures to approve the accord — at least not in the next few years, Learner said.

Svenson of PSEG in New Jersey, a company that owns both low-emission nuclear plants and heavy-emission coal plants, said it’s not encouraging that governors “might” consider starting up cap-and-trade plans in a few years. He’d like to see those programs launching and linking together now — or, better yet, see them replaced by a unified national program.

“Our hope was that we would’ve seen national legislation by now,” Svenson said. “I keep coming back to this: Climate change is real. We really do believe that human activities are the cause. And delayed action on addressing this is only going to cost us all more money.”