Self-congratulatory poster of Gadhafi in Green Square in Tripoli, LibyaPhoto: QuigiboMoammar Gadhafi is a crazy dictator who is murdering his populace and needs to get a cruise missile shat down his neck, but what we all really want to know is: how are the actions of this homicidal crazypants going to affect our summer vacation?

Self-congratulatory poster of Gadhafi in Green Square in Tripoli, LibyaPhoto: QuigiboMoammar Gadhafi is a crazy dictator who is murdering his populace and needs to get a cruise missile shat down his neck, but what we all really want to know is: how are the actions of this homicidal crazypants going to affect our summer vacation?

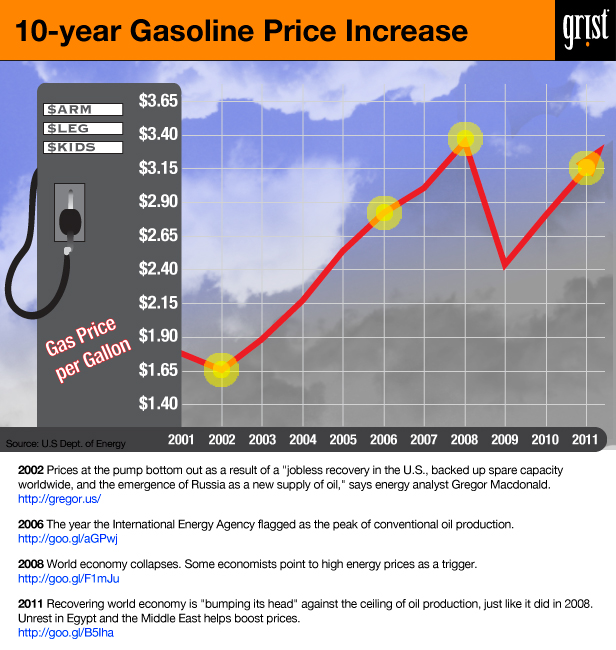

Those of you heading to the Jersey Shore for copulation and spray-tan are going to have fewer dollars to drop on wine coolers, for one. A combination of economic and political factors could see gas reach its highest level, ever — higher even than the $4.11 record set in July 2008 that may have been a precipitating factor in the most recent economic collapse.

If unrest spreads, we’re staring down $5 a gallon gas, say analysts:

Any production losses out of Libya could be quickly absorbed by other countries like Saudi Arabia, which can ramp up production as much as another five million barrels per day. The main concern stalking markets is that revolts in the Middle East and North Africa will spread to OPEC heavyweights, particularly Iran, the group’s second-largest producer.

Even if unrest doesn’t spread, gas prices are still headed up and up and up:

While troubles in Libya and brewing unrest in the Middle East are fueling higher crude prices, other catalysts are driving gas prices. The U.S. economy, higher traditional consumption in spring and rising demand from China and other countries are likely to push gas to $3.75 to $4 a gallon by midsummer.

“The economic impact could be huge.”

“Above $4 a gallon, we’ll see consumers hunker down,” says Moody’s Economy.com economist Ryan Sweet. “It could take steam out of spending just as consumers were getting their sea legs.”

Oil prices in ‘danger zone’ for world economy: Fatih Birol, head of the International Economic Agency, must have been pumping the Kenny Loggins when he gave a reporter at The Guardian this gem:

“Oil prices are a serious risk for the global economic recovery,” he said. “The global economic recovery is very fragile — especially in OECD countries.” He said oil prices had entered a “danger zone” for the recovery at above $90 a barrel.

Revvin’ up your engine / Listen to her howlin’ roar: Now might be a good time to brace for fuel shortages by buying one o’ them ‘Lectric Cars those Eastern boys been yapping about, only there aren’t any left. Seriously:

Save for a few hundred lucky individuals, the Nissan North America roll out of the 2011 Leaf has been a bit of a disaster.

In case you missed it, Grist’s handy guide to recent trends in gas prices: