It may be true, but domestic oil drilling won’t help.This post originally appeared on the Great Energy Challenge blog, in partnership with National Geographic and Planet Forward.

It may be true, but domestic oil drilling won’t help.This post originally appeared on the Great Energy Challenge blog, in partnership with National Geographic and Planet Forward.

It’s an unfortunate fact that stress has a way of making people crazy. At the moment, rising oil prices are creating a lot of stress.

One of the problems with our deep dependence on oil is that oil prices can (and do) swing wildly in relatively short periods of time. Between January 2007 and July 2008, the average price of crude oil paid by U.S. refineries went from about $51 to $129 per barrel, an increase of over 150 percent.

People, on the other hand, aren’t nearly so flexible. We don’t change where we live, work, go to school, or how we get to any of these places at anything like that pace. We can’t respond to a doubling of prices by cutting our use in half.

Oil prices are on the rise again, and generous people that we are, Americans are making sure we share our pain with our elected leaders. Rising oil prices lead to rising stress levels and an increasing reports of insanity on Capitol Hill.

The latest, of course, is the insistence that the administration and congressional Democrats are responsible for rising oil prices and that they should do something to stop it. Like increasing oil exploration and drilling in the Gulf of Mexico, the Arctic National Wildlife Refuge, and any other place that might have dead dinosaurs hiding beneath it.

I hate to admit it, but I have now been around long enough to have seen this cycle play out several times, and frankly, it drives me a little batty.

Despite the apparent simplicity of the “solution” that congressional Republicans are demanding (increasing supply seems like a reasonable way to reduce prices), it’s wrong in just about every way that matters.

Let’s review a few key oil facts:

Oil is sold in global markets: Oil tankers move across the oceans delivering oil to consumers not based on wind or currents, but on who is willing to pay the most. If you want to move oil prices in any one place, you must move them in all places simultaneously. The only way to reduce prices for U.S. consumers is either to get the rest of the world to lower the price they’re offering, or add enough supply to make a dent in global oil demand.

The U.S. can’t make a dent in global oil demand: Although we consume roughly 25 percent of global oil, the U.S. only sits on roughly 2 percent of global oil reserves. We simply don’t own enough oil to change market fundamentals.

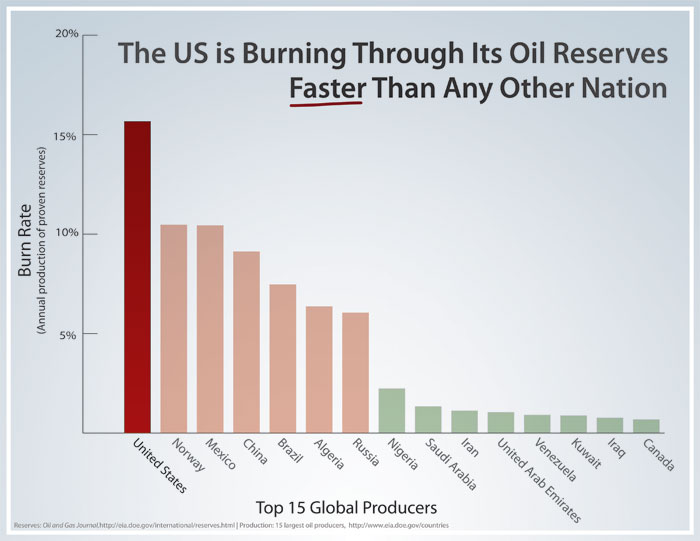

Increasing supply in the short run hurts us in the long run: Our meager 2 percent of global oil reserves is unlikely to grow significantly over the long run, so every barrel we take out now is one less that we can take out in the future. In a House Energy and Commerce Committee hearing last week, Rep. Ed Markey (D-Mass.) put up the following chart showing that the U.S. is drawing down its reserves faster than any other major oil producing country:

I follow these things pretty closely, and I have to admit, I was a little stunned by these numbers.

In the exchange that followed, Markey asked Ed Caruso, head of the Energy Information Agency under George W. Bush, which countries benefit the most from rapid drawing down of our reserves. Caruso seemed as stunned by his own answer as I was by the numbers: “OPEC.”

Imagine two people sitting across from each other in a desert. One has a several barrels of water, the other has a canteen and lot of money. Now imagine the first watching as the second gulps down the contents of his canteen. What do we think is going to happen next? Someone’s going to get robbed, figuratively or literally.

Framing the problem as an “us vs. them” issue like this is a little misleading. While it’s true that government-owned oil companies in the Middle East or elsewhere could refuse to sell to countries they don’t like politically (they’ve done it before), the real enemy here is increasing global demand, stagnant global supply, and a fair bit of regional instability thrown into the mix. None of these things can be dealt with by pumping what little oil we have at a faster rate.

Every time this cycle of high oil prices comes along, we hear a lot about drilling more at home to reduce our dependence on foreign oil. But keep in mind that the price that American oil companies sell American oil to other Americans is determined by what’s going on not just in America but in every other country that either buys or sells oil.

So as soon as you hear these same people also call for a complete ban on both exports and imports, you’ll know they’re serious. Until then it’s just a political ploy (albeit a pretty successful one).

Or perhaps they might suggest that we spend a little bit of effort or even money on figuring out how to break our addiction to oil, no matter where it comes from.

Now that really would be crazy.