The following is a guest essay by Britt Lundgren and Jason Funk. Britt Lundgren is an agricultural policy fellow at Environmental Defense Fund. Jason Funk is a Lokey Fellow in the Land, Water and Wildlife program at Environmental Defense Fund.

—–

The recent fires in California and the severe drought in the Southeast are just two of the litany of disasters that have hit agriculture in recent memory. When natural disasters happen, members of Congress (at least those who want to get reelected) want to respond quickly, with cash for those that are affected.

Currently they must go through the clunky and often-slow process of getting disaster dollars for their district by passing an emergency supplemental appropriations bill (PDF). For this reason, the Senate approved a farm bill that includes a new $5.1 billion piggy bank, called the Agricultural Disaster Assistance Trust Fund, for the seemingly innocuous purpose of having money set aside in advance to help farmers out when they’re struck with calamity.

Unfortunately, there are many reasons to think that this new trust fund is itself going to be a disaster for taxpayers, most farmers, and the environment.

To understand why this disaster trust fund is such bad news, let’s first take a look at the history of disaster payments. The Environmental Working Group has analyzed the federal government data, and the results are not pretty. The federal government spent about $26 billion on disaster relief payments from 1985 to 2005, and those payments have increased by an average of $65 million per year.

The relative randomness of natural disasters should ensure that no particular region has more disasters than any other over a period of time, but the reality is that disaster payments have become concentrated in just a handful of states. In fact, more than half of the total disaster funding between 1985 to 2005 went to just nine states: Texas, North Dakota, Minnesota, South Dakota, Kansas, Iowa, Georgia, Florida, and Nebraska, according to the EWG data. (Two-thirds — 66 percent — of the disaster payments to Florida from 1995 to 2005 occurred in two years heavily impacted by hurricanes, 2004 and 2005.)

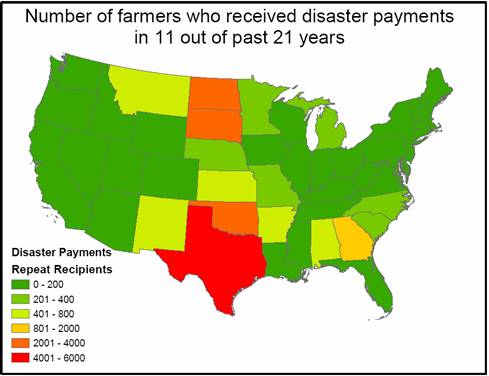

The payments have also become increasingly concentrated in the hands of a small number of recipients. Nationally, more than 21,000 recipients received disaster payments in at least half of the years from 1985-2005. They represent about 1 percent of the disaster relief recipients during that time, but they collected nearly 10 percent of the money. About two-thirds of them lived in just five states: Texas, South Dakota, North Dakota, Oklahoma, and Georgia.

(Map based on Environmental Working Group data.)

It’s possible that those disaster payments simply reflect a bigger number of disasters in those states. But if that were true, one would expect the farmers who have received the most disaster payments to be having a heck of a time just staying in business. However, the numbers contradict this expectation. The states with the most repeat disaster payment recipients have also experienced significant expansion in the number of acres planted to crops over the past decade. Between 1982 and 2003, farmers converted 5.77 million acres of land to cropland in the Northern Plain states of Kansas, Nebraska, North Dakota, and South Dakota, while farmers in the Southern Plain states of Oklahoma and Texas converted 2.82 million acres, according to the Government Accountability Office.

A recent USDA Economic Research Service report (PDF) shows that by repeatedly insulating these farmers from all of the risk of crop losses, disaster payments have become an expected form of farm income and have encouraged the expansion of cropland onto marginal land. These payments have also prevented farmers from switching to production methods that would be more in tune with the prevalent weather patterns in their region. In a recent analysis of conditions from 2003 to 2007 in South Dakota, the GAO showed that the combination of disaster payments and other subsidies to a model farm made growing corn more profitable than a cow-calf grazing operation in three years out of five. Without payments, corn would have been more profitable in only one year.

The evidence suggests that disaster payments lead to a vicious cycle: risky production decisions result in crop failures; failures are rewarded with disaster payments; disaster payments lead farmers to bring more marginal land into production; risky production decisions lead to more crop failures.

This cycle has major environmental consequences. Producers trying to coax crops from the soil on marginal lands are likely to use higher amounts of fertilizers and pesticides. These lands are much more likely to be highly erodible, resulting in a loss of topsoil and damage to air and water quality. Wildlife habitat is lost as well.

The Senate’s version of the farm bill does contain one important protection against the conversion of native grasslands to cropland. The “Sod Saver” provision prevents producers who convert native sod (grassland) to cropland from receiving crop insurance or disaster assistance payments. If this important provision is included in the final version of the bill, disaster payments will no longer be an incentive for producers to convert native grasslands into cropland. However, native sod is defined as grassland that has never been cropped. This represents just a fraction of the land that farmers can bring into production. Marginal lands that have historically shifted in and out of production will still be eligible for disaster payments.

Farm bill conference negotiations between the House, Senate, and White House are moving slowly. The debate is focused on how to pay for all of the new spending called for in the House and Senate versions of the bill. The pay-go rule under which Congress is currently operating requires that any new spending in the farm bill be offset by decreases in spending elsewhere within the bill or increased revenue (i.e., taxes). President Bush is threatening to veto the bill if it doesn’t contain certain reforms and uses taxes to pay for spending increases.

Both the House and Senate versions of the farm bill call for significantly increased spending on USDA conservation programs, programs that help consumers and people with low incomes get better access to healthy, locally grown produce, and programs that help farmers transition to organic production. However, much of this funding could be in jeopardy if Congress also has to find $5.1 billion to pay for future agricultural “disasters,” while simultaneously keeping total spending in the bill at a level that won’t provoke a veto. The new Agricultural Disaster Trust Fund is a bad deal for taxpayers and the environment, and it should not be included in the final 2008 farm bill. There are much better uses for the money.