The boat ride down southeastern Peru’s Urubamba River cuts through mountains and sweltering jungle, passing wooden shacks of colonos — mixed race and grindingly poor Peruvians lured to the jungle with promises of free land — and nativos, tribes recently brought into contact with the modern world. The area is a biological gold mine, home to endemic and rare species, and some of the world’s last uncontacted humans. It’s also home to an asset that may become the Amazonian rainforest’s biggest threat: the mamma jamma of South America’s natural-gas lodes.

The Camisea pipeline.

Big Oil has been pushing its pipelines into the Amazon rainforest frontier since the 1960s. Nowadays, prompted by high oil prices and militarization of the Middle East’s fossil fuels, the eastern slope of the Andes and the Amazonian jungle lowlands are being stripped, sawed, plowed, and piped into a global barrel of politically cheap fossil fuels. From Colombia to Ecuador, Brazil to Peru, themes are common: sloppy extractive industries tainting key ecosystems, polluting water, killing plants and animals, and causing strange human illnesses. The Camisea Natural Gas Project is the king of all extraction projects in this region, a billion-dollar operation that taps jungle gas here in the Lower Urubamba, then pipes it over the Andes and down to the Peruvian coast.

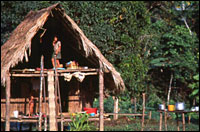

In the tiny village of Camisea, a community of Machiguenga Indians downriver from a processing plant, nude children play in the river water. Mangy dogs with floppy teats sniff for food as half-starved chickens peck at dust for invisible morsels. Past a group of shacks where women sit weaving traditional cloth and boiling yucca, Matias Rios, Camisea’s chief, tells me how barges and helicopters arrived in 2001, driving away fish and wildlife, causing malnutrition. “We have almost nothing to eat,” he says. “We did not need chickens five years ago because we could fish and hunt. Now we have to bring them here by boat.”

Indigenous communities are at risk.

Photo: © Amazon Watch.

He calls over his 5-year-old son and another boy, whose backs and chests are covered with tiny lesions, which Rios and his wife say are caused by bathing in contaminated water. “The companies have sent representatives here to look at the problem, but they always say the water is clean,” he says.

Supported by the Inter-American Development Bank (IDB) — which is backed by the U.S., among other nations — and part-owned by U.S.-based Hunt Oil, the Camisea project promises cheap gas for Lima, Peru’s capital. It also promises future tax revenues when natural-gas products are eventually sold to Mexico and the U.S.

But big promises have turned into big problems: The pipeline has ruptured five times in the first 18 months of its operation. The country’s prime minister, who reportedly has ties to Hunt Oil, has blamed at least one failure on local saboteurs. And now concerned residents, activists, and workers are trying to shed light on the project before things get even worse.

Time for a Breakdown

Camisea is “a tale of political scandal, technical flaws, and environmental degradation,” says Maria Ramos of Amazon Watch, a California-based watchdog group that has worked alongside the World Wildlife Fund, Oxfam, and international civic organizations to draw attention to the project’s failings.

Pipeline route.

In 2000, the Peruvian government gave a petroleum consortium including Texas-based Hunt Oil and Argentina’s Pluspetrol the right to mine the area’s gas reserves. It also handed another consortium, Transportadora de Gas del Peru (TGP) — formed in part by Pluspetrol and Hunt — the right to build two pipelines to carry natural gas and natural-gas liquids (NGL) out of the deep jungle. Together they help form Camisea, a $1.6 billion Herculean straw for sucking out an estimated 11 trillion cubic feet of natural gas.

Getting it to North American markets will require another link in the chain: another phase of Camisea is the construction of a 4.4 million ton per year liquefaction plant on Peru’s southern coast, a project estimated to cost $2.1 billion. Hunt Oil, the lead shareholder for the facility, has completed “front-end engineering and design,” according to the company’s website, and the Camisea consortium is asking for $400 million in backing from the IDB for the project. The Washington Post reported last week that Hunt is also seeking IDB help in lining up an additional $400 million in loans from private commercial banks.

The project has been an activist howler from the get-go. The Overseas Private Investment Corporation and Export-Import Bank of the U.S. rejected Camisea financing for environmental reasons, and financial services company Citigroup withdrew under pressure from activists. But the Inter-American Bank gave Camisea the OK, arguing that its endorsement would lend credibility and policing power to the embattled project. In September 2003, the bank coughed up $135 million, committing itself to continuous monitoring of the companies and tacking on loan conditions that demanded, among other things, heightened environmental and social controls and evaluations.

A plant among plants.

Photo: Amazon Watch.

After Camisea went online in 2004, things quickly went south. In late December, just five months into operation, a 14-inch section of the NGL pipe ruptured, dumping an estimated 183 cubic meters of liquid, which was cleaned up by the companies. Eight months later, in August 2005, there was another rupture without a substantial spill. Two more failures with spills occurred in September and November of that year.

Under fire, TGP promised to invest up to $30 million to fix the problems. But Camisea was already topping the Amazonian enemy list. And while many of the same companies that are in the Camisea consortium proceed with plans to tap into some 2.5 million acres of nearby jungle, questions mount: Why did a brand-new pipeline have four breaks in 15 months? Where was the IDB, which bought into the project to keep it on the up and up? Where was the independent audit it had required as part of the loan? And were problems going to be fixed before future projects got rolling?

Fitting the Pieces Together

During the rainy season, the Lower Urubamba is Peru’s most dangerous region, prone to rockfalls and mudslides that turn chunks of mountainside into brown milkshake. The consortium and the IDB have cited the soil’s instability as the main reason for the failures. But in February, E-Tech, a California-based nonprofit technical-assistance organization, issued a stinging independent audit of the pipeline — one that caught attention from the press, and will likely form part of a recently announced safety inspection being planned by the Peruvian government.

The key to E-Tech’s report was Carlos Salazar, a welder who’d worked on the pipeline as a supervisor for Techint, an Argentine company. He’d seen improprieties. He wanted to talk.

“He said, ‘I want to be part of an independent audit,'” says Bill Powers, an engineer with E-Tech. Salazar — whom Powers says has since gotten anonymous threats — painted a picture of slapdash construction, hurried by company fears of contractual late fees that could have hit $90 million. Delivered to IDB in February, the report concluded that the pipeline was weak and could rupture at six different places.

The report packed hard allegations: improperly certified welders; fast promotions from welder’s helper to welder; improperly welded pipe ends; risky pipe jointing used to adapt to difficult terrain rather than searches for more stable routes. One claim — that 30 to 40 percent of the pipe materials were left over from other South American projects and of substandard quality — hit so hard, Powers said TGP threatened him with a lawsuit. That threat dissolved, however, when on March 4, for a fifth time in now 18 months, the pipeline ruptured again, in a place E-Tech had flagged as vulnerable. The ensuing explosion burned a woman and her child.

That’s when the government of Peru jumped, promising to fund an independent audit — an inspection of the pipeline’s safety. But it reversed that decision days later, announcing that TGP would instead give funds for that purpose to Osinerg, the Peruvian government agency responsible for overseeing the pipeline. Alfredo Dammert, an Osinerg official, stressed to reporters that TGP would have no hand in the audit. Meanwhile, a Peruvian congressional committee has launched an inquiry, and plans to call construction contractors to testify next month.

You Can’t Bank On It

Powers, an engineer with a degree from Duke University, says one rupture on a new pipe is rare, and five is unheard of. The IDB should have been watching, he says, and should now step up and demand real audits and fixes before signing on to other projects in the region. “But the bank is behaving more like a member of the consortium rather than the set of eyes they claimed they would be,” says Powers.

Wrong-of-way through the Andean foothills.

Photo: Terra Erosion Control.

The IDB, which has poured billions of dollars into Latin American extractive-industry projects in recent years, stands behind its work. The bank’s environmental and social expert, Robert Montgomery, says it has done its job. “Step way back to the start and look at it now in terms of social and environmental standards,” he says. “Even critics say IDB made a big difference.”

Montgomery said the bank monitors Camisea on an ongoing basis, using “external, independent environmental and social consultants in the field on a daily basis.” Echoing claims by the consortium members, Montgomery says the ruptures “in several cases” were generally due to shifting soil putting lateral pressure on the pipes. “The E-Tech report makes a series of allegations, some quite serious, but does not provide any specific information or documentation to really support these allegations,” he says, adding that “the principal reasons for spill event are generally known, and do not necessarily correlate to the allegations made in the report. Regardless, the IDB, the government of Peru, and TGP are clearly interested in resolving the spill issues and are open to any input.”

As for the breaks: “People ask me if the breaks are normal, but it’s hard to say what is normal for this, because there aren’t many projects that take natural-gas liquids from the jungle and go over the Andes with it,” says Montgomery. “You can’t build that kind of pipeline and not have some unanticipated issues, but the number of events in this time period was not expected.” He says IDB had required the consortium companies to perform an audit as part of the project approval by the bank, but after the last spill decided “to enhance the process to help alleviate worries in communities.”

The IDB did release an environmental and social impact report two years after Camisea broke ground. But Amazon Watch says it was “woefully inadequate, calling into question whether its real purpose was to provide cover for the project rather than seriously engage with the urgent issues facing the Lower Urubamba and its peoples.” The group says only 21 of the report’s 138 pages actually dealt with environmental and social impacts.

Tribe This On for Size

Ecological worries aren’t the only factor raising alarm. Earlier this year, the Peruvian government’s Office of the People’s Defender, the public ombudsman, criticized Camisea for violating indigenous rights. The report cited early Peruvian government studies saying that technically prohibited contact between workers and some native communities has caused startling upticks in cases of diarrhea, syphilis, and other illnesses.

The study said one isolated tribe, the Nanti, has been hit so hard with foreign germs and infectious disease that only one in four children reach adolescence. Despite the fact that contact is prohibited by the Camisea project and by the International Labor Convention 169, critics say oil companies still seek contact with tribes living atop lands they want to use.

Aliya Ryan of the Peruvian nonprofit Shinai, an advocacy group for indigenous causes, says she and her colleagues know of one tribe that was contacted by a Dominican Catholic Mission arriving in helicopters owned by Pluspetrol. The missionaries “went to give vaccinations, but they baptized people and gave them Christian names,” she said. “They came in a helicopter, visited for a short time, and then left. They could have brought illnesses, but [because there are no communication links] there is no way of knowing other than traveling there.” Pluspetrol did not respond to an interview request, and a Hunt Oil representative in Houston referred questions about the pipeline to TGP.

So where do Peru’s top politicians stand on the mess? Critics of Prime Minister Pedro Pablo Kuczynski say he is an apologist for Big Oil. Last month, after Kuczynski suggested that the fifth pipe failure was likely sabotage by locals, the newspaper La Republica criticized him, noting he had good reason to dance an industry beat. Citing testimony given before the Peruvian Congress’ oversight committee, the article said Kuczynski had once served as a financial adviser to Ray Hunt, Hunt Oil CEO. (Hunt is a Bush presidential campaign contributor and board member of Halliburton.)

Alcides Huinchompi of the Machiguenga Council of the Urubamba River — which represents the region’s indigenous communities — says talk of sabotage is simply not true. “We want justice, but we have been fighting for it through dialogue, not violence,” he says. “But if we are pushed, there is a point that we will defend ourselves and what is ours.”

They may get some help. Col. Ollanta Humala, the popular front-runner in a presidential runoff election set for May, has criticized the pipeline project, and, more broadly, called for boosting taxes and royalties on foreign companies operating in Peru.

As the IDB and Peruvian government appear to be pressing for solid audits, Hunt Oil and others are still counting on bank funding for the planned liquefaction plant and associated facilities. In April, however, Luis Alberto Moreno, IDB president, told The Financial Times the environmental concerns were too great to proceed before a study was completed. “We are not even close to approving the loan,” he said. “Without the audit we can’t go to the second phase.”