Articles by David Roberts

David Roberts was a staff writer for Grist. You can follow him on Twitter, if you're into that sort of thing.

All Articles

-

“More research” into geoengineering is not such a hot idea

In the geoengineering debate, "just research" is the default position of Serious People. But it's more problematic than they acknowledge.

-

The fight over Obama’s Clean Power Plan heats up in the states

States are charged with implementing Obama's carbon rule for power plants. Which ones will cooperate and which ones won't?

-

Obama’s carbon rule hangs on this one legal question

The EPA's plan to reduce CO2 from existing power plants relies on an ambitious new interpretation of the Clean Air Act. Will it stand up in court?

-

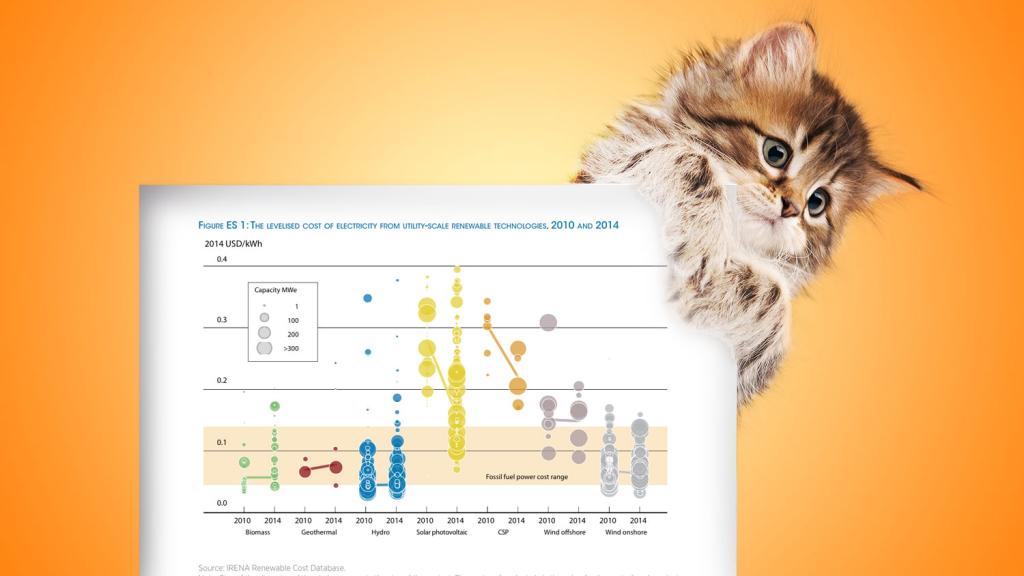

Here’s how to make sure renewables keep getting cheaper

What distinguishes expensive renewable energy projects from cheaper ones is not technology, but "soft costs" like financing and permitting.