If there were an M.B.A. school for green executives, Joel Makower undoubtedly would be its dean, historian, and booster-in-chief.

Joel Makower.

During a 20-year career, Makower has chronicled the rise of the green movement in corporate America through books, hundreds of stories, and countless speeches. Along the way, he has carved out a mini green business empire for himself. He is executive editor and chairman of Greener World Media, which owns Greenbiz.com, a website that reports on the burgeoning industry. He also has marketing ties to green business groups and sits on the boards and advisory committees of various green associations and organizations.

The recent explosion in everything green has kept Makower in demand, and that no doubt partly accounts for his absence from the book-writing business. It’s been 14 years since his last book, but that dry spell came to an end earlier this year with the publication of Strategies for the Green Economy — a blend of cautionary tales and how-to’s for business leaders contemplating a green battle plan.

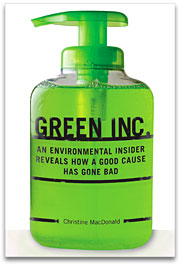

Strategies for the Green Economy, by Joe... Read more