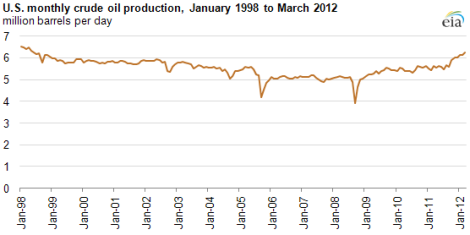

Great news, America! The amount of crude oil produced within our borders is at the highest levels we’ve seen since 1998.

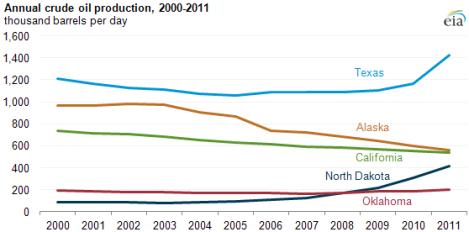

This is mostly because of the drilling booms in North Dakota and Texas.

This is basically the scenario that fossil fuel companies argue for. Let’s drill more, they say, and then gas prices will go down. It makes intuitive sense, right? The more oil to make gas with, the more gas; the more gas, the lower the price. Good old supply and demand.

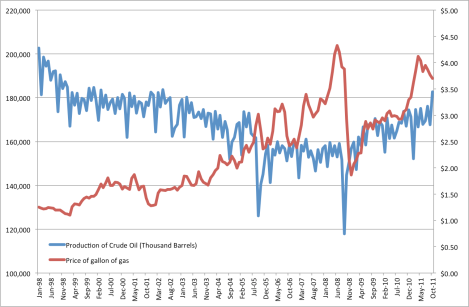

But — and I don’t want to freak you out or imply that fossil fuel companies are being disingenuous — gas prices are not at the lowest point since 1998. In fact, they may be starting to go back up.

Here’s what prices have done over the last 18 months.

Isn’t that strange? It’s almost as if gas prices and production aren’t linked at all, which we know not to be the case because the fossil fuel industry, which has an economic stake in drilling more, says that they are.

Here’s what gas prices have done since that 1998 peak. As production dropped, gas prices went up and down. When production picked back up, gas prices went up and down.

The reason: Gas prices are linked to the price of oil, not production. Oil is bought and sold in a massive global marketplace, in which U.S. production is just a small percentage. It’s like if you sold your home-squeezed orange juice alongside mass-produced Tropicana. Even if you double your production to three gallons a day, that’s not going to reduce the price of orange juice in the grocery store.

But, on the other hand: politics! Fossil fuel companies and their allies say domestic drilling will drop gas prices — they promise. So drilling more will drop gas prices — the end.

[Gas price data from GasBuddy.com; production figures from the Energy Information Administration.]