The EconomistCarbon cheapification at work.

I know you’ve all been following the developments around the European Union’s carbon-trading system and are concerned that … hm? What’s that? You say you have a life?

OK, fine, some background then.

In 2005, the EU launched the world’s first (and still biggest) carbon trading system, the Emissions Trading System (ETS), which now covers over 30 countries and some 11,000 industrial facilities and power plants. The ETS has been a source of hope for supporters of carbon policy, who aren’t exactly wallowing in hope these days.

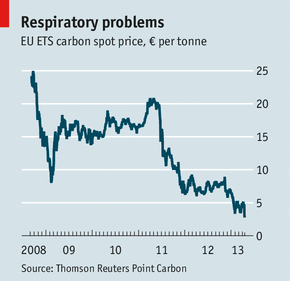

Problem is, haggling among EU countries and industries, some of them considerably bigger emitters than others, meant that the ETS launched by issuing way too many pollution permits for free. Then the recession hit and the EU economy went in the tank, where it remains, which has driven the cost of carbon down to almost nothing — under $10 a ton, not enough to drive much investment in clean alternatives. That’s why coal’s having a bit of a renaissance in Europe.

Recently, the European Commission proposed a fix: yank 900 million metric tons worth of permits, half a year’s worth, off the market and reintroduce them later, after the economy has recovered. This “backloading” would create an artificial short-term scarcity, pushing carbon prices up. Last week, to the shock and consternation of many, the European Parliament voted the plan down, 334 to 315. Prices promptly plunged another 40 percent. Backloading was supposed to be the first of a series of reforms, but now no one knows if any reform will happen at all.

The reaction has been a great hue and cry and rending of garments. The Economist: “ETS, RIP?” The Financial Times: “Europe’s carbon market left in disarray.” The Wall Street Journal: “Vote Leaves EU Emissions Trading in Tatters.” Bryan Walsh at Time: “If Carbon Markets Can’t Work in Europe, Can They Work Anywhere?” And so on.

Brad Plumer, as is his wont, has written a smart and level-headed post on this that says most of what I’d want to say. I’ll reiterate a couple of his points and make a few of my own.

First off, the ETS is not a mess/broken/dying, it’s working like it’s supposed to. The goal of a cap-and-trade system is not to create a high price on carbon, or a low price on carbon, or any particular price on carbon. It is to reduce carbon emissions along a pathway specified by a series of targets (17 percent by 2020, etc.). The EU is on that pathway. Emissions are expected to come in under the cap, which means the cap-and-trade program is working.

Now, as it happens, the recession is what did most of the work to put the EU on that pathway. Complementary clean-energy policies (renewable energy mandates, feed-in tariffs) also played a big role. That just didn’t leave much work for a carbon price to do. The EU doesn’t need a high price on carbon to stay on the emissions-cutting pathway, at least in the short term, so the short-term price on carbon is low. Presumably, when the EU economy picks back up, there will be more work for a carbon price to do. If so, the price will go up. Cap-and-trade programs are designed to be responsive to circumstances.

Lemme just emphasize: Insofar as you are happy with the carbon pathway your cap-and-trade system prescribes, the fact that carbon is cheap is good news. Who wants high prices for high prices’ sake?

I know lots of enviros feel otherwise, but I kind of agree with Poland that backloading is a daft idea. The whole point of a cap-and-trade program is that prices are set by markets (thus is it “market-based”). If politicians start jury-rigging the system whenever they don’t like the price on carbon, it will destroy investor confidence. It’s not a great precedent.

Now, it is true that the current price on carbon in the EU is not high enough to drive the kind of long-term investments that will be needed to lower emissions substantially by 2030 or 2050. There are legitimate timing issues here: If those investments aren’t begun now, then later, when carbon targets tighten and carbon prices rise, there’s going to be a crunch.

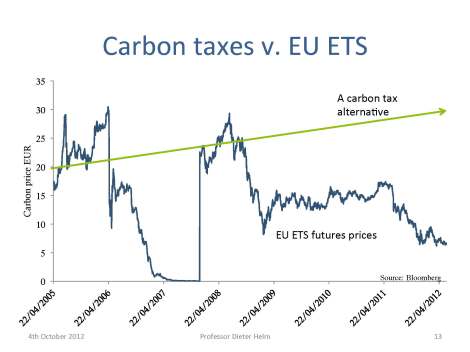

One way to address this problem would be to switch from a cap-and-trade system to a carbon tax, which allegedly offers price certainty (though why people think a tax would be immune to political meddling is beyond me). Brad borrows this illustrative graph from Oxford’s Hans Dieter [PDF]:

What the graph shows is that a tax forgoes the great benefit of cap-and-trade, which is precisely that prices are responsive to economic conditions. Do you really want to maintain the same high price in a recession that you have in boom times?

The other way to solve the problem — the obvious way, the correct way, which no one is talking about for reasons unclear to me — is to lower the carbon caps. If it’s “too cheap” to hit current targets, then current targets are insufficiently ambitious. If EU members want a higher carbon price to drive more clean-energy investment, they should reduce emissions more. That, not the failure to pass some unholy kludge, is what people ought to be yelling at the European Parliament about.

It looks like the EU is going to have another run at this in June, so backloading may pass after all, perhaps with some modifications. The EU climate commissioner has vowed to push longer-term structural reforms.

I think everyone should take a deep breath. There are certainly positive ways to reform the ETS: reduce the allocation of free permits and the use of offsets, tighten the rules on those offsets, and perhaps put in a carbon-price floor. But the goal should not be to tweak short-term carbon prices. Remember, the point of a carbon-trading system is not the prices, it’s the targets.

And one final point: Whatever the tribulations faced by the ETS, carbon pricing is on the march. As Silvio Maracci notes in an excellent roundup, China is launching pilot carbon-trading programs in seven provinces, which alone would instantly make it the world’s largest carbon market. Australia is also planning a carbon-trading system and has announced that it will develop its program in tandem with China, along with New Zealand and South Korea. In other words, a pan-Asian-Pacific carbon market is taking shape.

In North America, the Regional Greenhouse Gas Initiative is still going strong [PDF] in the Northeast, and California is going to hook its system up with Quebec’s. Overall, the North American carbon market is expected to double in value to $2.5 billion this year.

I think the idiotic and ill-informed debate over cap-and-trade in the U.S. in 2009-2010 distorted how many Americans see carbon trading. And as many recent media reports illustrate, people everywhere still have trouble grasping how such programs are supposed to work. But carbon markets remain a powerful tool, popular among policymakers, and they are slowly creeping their way across the globe. We are, admittedly, a long way off from a global carbon market, but that once-fanciful goal is at least visible on the horizon. So let’s chill out a little.