If you’ve followed the modern David-and-Goliath battle against Big Oil, you know everyone’s talking about divestment. Online campaigns for divestment focus on members of large institutions convincing leadership to phase out holdings in petroleum companies. But when your college isn’t divesting yet, and your employer doesn’t offer fossil-free retirement plans, it can seem like all an individual can do for the whole divestment movement is sign a petition or participate in the next scheduled protest.

What if you want to root out petroleum investments in your own life? Could you?

Granted, your contribution may be small (as ever), but divestment is picking up steam. It got name checked by the president during his now-legendary Sweaty Forehead Speech, and it’s getting attention from the mainstream media. Here’s The New York Times on Sept. 6:

In the 1980s, it was South Africa. In the 1990s, it was tobacco. Now fossil fuels have become the focus of those who would change the world through the power of investing.

Their laundry list phrasing doesn’t exactly get me fired up, but I find myself using the same terminology to explain divestment to others. “You know in the 1980s, when people boycotted South African stocks because of apartheid?” I asked my dad. “It’s like that.” Judging from the maudlin media coverage of Nelson Mandela’s failing health 27 years later, America must’ve felt involved in ending apartheid.

But it’s about more than just feeling involved. When you have the ear of a wealth manager or banker, you have the opportunity to bend money culture and wisdom. They might ask you why you’re doing this, you can enforce the idea that you’re concerned about your money, given the bleak future of these unsustainable industries. You’re demonstrating to the self-appointed Masters of the Universe that there’s something to be involved in, that the money-havers are involved in it, and — perhaps most importantly to them — there’s money to be made in doing it.

So are you fired up yet? Let’s start with all you HNWIs. (High Net Worth Individuals. They read this site, don’t they?)

“I am filthy rich! What do I tell my financial planner?”

To my surprise, when I began reporting this piece, half of the financial planners I talked to had not heard of this movement. If you’re lucky enough to have a personal investment portfolio and it’s managed by a professional, a good start is to simply call them and ask if they can phase out fossil fuels for you. If this confuses them, tell them there’s a movement afoot to divest these stocks. Now you’re the first person to preach the gospel of divestment to that financial planner.

A (very rough) rule of thumb is that if you have less than half a million dollars to invest, your planner will hem and haw, and maybe not do it for you. If you have millions of dollars invested with them, there’s a good chance they’ll do whatever you say. If you have between $500 thousand and $2 million, you’re in the donut hole: Your planner might go for it, and they might not.

They’ll compare what you’re doing to divesting “sin stocks:” stocks that investors find distasteful and avoid out of principle (or sometimes they find them sexy, and invest in them with gusto).

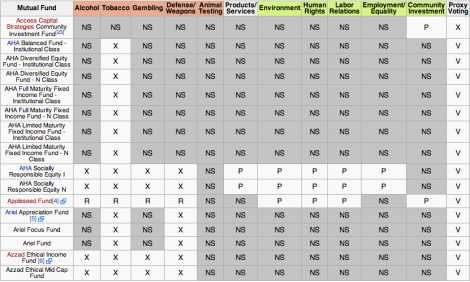

Wikipedia’s breakdown of Socially Responsible Investments.

Even for financial planners who are a part of the movement, listening to their conscience isn’t everything. But listening to your conscience is.

For Mitchell Krauss, of Capital Intelligence Associates, going along with divestment is part of an overall business strategy that can sound a little mercenary. He called divestment “the biggest, hottest topic,” at the moment, but says he just asks every client “Is there anything you want to invest in, and anything you want to exclude?”

“Some of my clients are Catholics who don’t want to do anything that funds abortion,” Krauss said. Regardless of his personal stance, he’ll act on your behalf.

In other words, if you are a 0.1 percenter, your finance person will be willing to invest only in, say, companies with Presbyterian CEOs born in March if that’s what you want. Face it: Whether cause or personal quirk, being loaded offers access.

THIS PART IS REALLY IMPORTANT: When I gave Orange County, Calif., wealth manager Shawn Dewane a hypothetical about getting rid of fossil fuel investments he was dubious. He reasoned that “most clients would be unwilling to pay enough to cover the cost of the research.”

So make the research part easy for them.

Gofossilfree.org points to these specific 200 companies [Excel spreadsheet] as the best targets. Some planners might point out that other companies enable the fossil fuel industry, but if you’re pulled into that debate, acknowledge that it is indeed a messy issue, and just say you feel inclined to stick to the big 200.

“What about middle class people like me?”

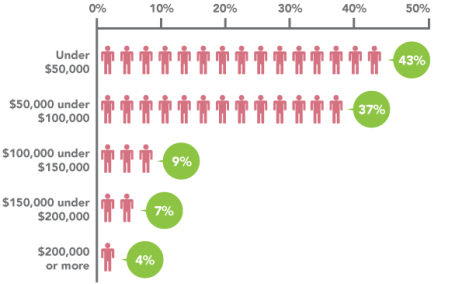

Save My 401kWho has “matched” retirement plans? Not the rich.

If you have a financial planner and sit comfortably in the middle class, most research indicates they’re probably putting your retirement money in mutual funds and ETFs (exchange traded funds). It’s unlikely they’re willing to comb through each one for fossil fuel “positions” and divest those for you. In the likely event that your financial planner doesn’t offer a prepackaged “green portfolio,” or some similar financial product they’ve devised, you’re probably going to have to pull your money out and invest with someone who does.

Luckily, you’ve got options. Here’s Gofossilfree.org’s list of financial planners who want the business of shrewd treehuggers like you:

-

Capital Intelligence Associates – Santa Monica, Calif.

-

First Affirmative Financial Network – Colorado Springs, Colo.

-

Natural Investments – Many locations

-

Progressive Asset Management, Inc. – Oakland, Calif.

-

Quantum Financial Planning, LLC – Grayslake, Ill.

If your employer manages your retirement investments in a “matched” plan like a 401(k) or a 457(b), it’s even tougher. In a 401(k) you might be able to choose only financial products that are petroleum free (see below). If you have a 457(b), it appears very unlikely that you’ll be able to do any such thing. Perhaps a few dozen retirement plans have gone fossil free, with thousands and thousands left to go. If you want to be free of fossil fuel investments, you might have to opt out of your employer’s plan and manage your own finances.

(Note: I’d be remiss if I didn’t say that in situations like this, you could and should be a squeaky wheel. Organize your coworkers, and push as a group for your employer to obtain fossil-free alternative products for you to invest in. But this guide is essentially intended to prepare you for the more likely situation of going it alone.)

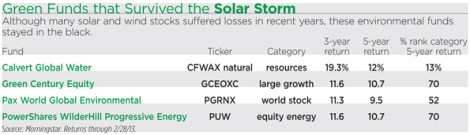

Here are some fossil-free mutual funds (from the list on Greenamerica.org). These are not necessarily just funds full of green tech stocks or sustainable companies; they’re also chock full of the usual Jim Cramer-approved companies:

“I don’t have any investments. Do I get a pass?”

Sure — but only because we don’t endorse stuffing your life savings in a Serta. You probably have some oil-stained money somewhere in the interest accruing on your savings account.

There’s little doubt that The Big Four banks invest in fossil fuels: Bank of America, Citigroup, Wells Fargo, and Chase haven’t shown any signs of shunning, for instance, the fracking-related mergers and acquisitions that made up over $40 billion in deals in 2011. Knowing whose money went into which Wall Street deal would be like working out which Niagara falls water molecule winds up in which toilet, but it would be helpful for the divestment movement if someone would please do the legwork. (A foreign case study is instructive: Australian activists did an amazing job of publicizing which of their biggest banks invested in petroleum and where, and are lobbying them to divest. So someone should totally get on this stateside; I would, but my intern quit.)

Meanwhile, American banks side with whichever kind of energy is winning at the moment. Citigroup is a cheerleader for renewable energy in the long term (previously), but with the cold pragmatism characteristic of bankers, they acknowledge that before renewables take over, fracking is just going to expand for a while. Bank of America’s energy fact sheet calls petroleum “the lifeblood of America’s economy,” but goes onto say that solar might be “competitively priced with other energy sources by 2015.”

RBFCUAd for a credit union’s green loans.

If you haven’t already, you could move your money into a credit union and make yourself feel better, but that would just be a good thing to do. The big banks suck. Most credit unions aren’t big enough to give a loan to an oil company (although some are obviously mixed up with the oil industry in other ways). If you want to put your money somewhere where oil companies probably wouldn’t even think of borrowing it, go with a local credit union. Credit unions mostly deal in friendlier, local investments. Mostly: If you pull back enough curtains, though, you’re eventually going to see something you don’t like. All of which means right now, you might be saying:

“That sounds like a lot of effort just to be a part of something.”

That’s kind of the point.

Right now it’s not as simple as just flipping a switch. Those with millions to invest and the inclination to fight climate change don’t have to divest anything. They can just not invest in their eccentric list of “sin stocks,” and the people who broker the trades won’t bat an eye.

But when we go out there with our middle-class savings and bump up against people’s expectations, ignore entreaties not to throw away our money, and explain at every turn that this is a movement, the hope is that they’ll see that we mean business. A mainstream switch to divestment might be a long way off — but we can get the ball rolling if enough people start having more long, awkward conversations with financial planners about it.