This story was originally published by Mother Jones and is reproduced here as part of the Climate Desk collaboration.

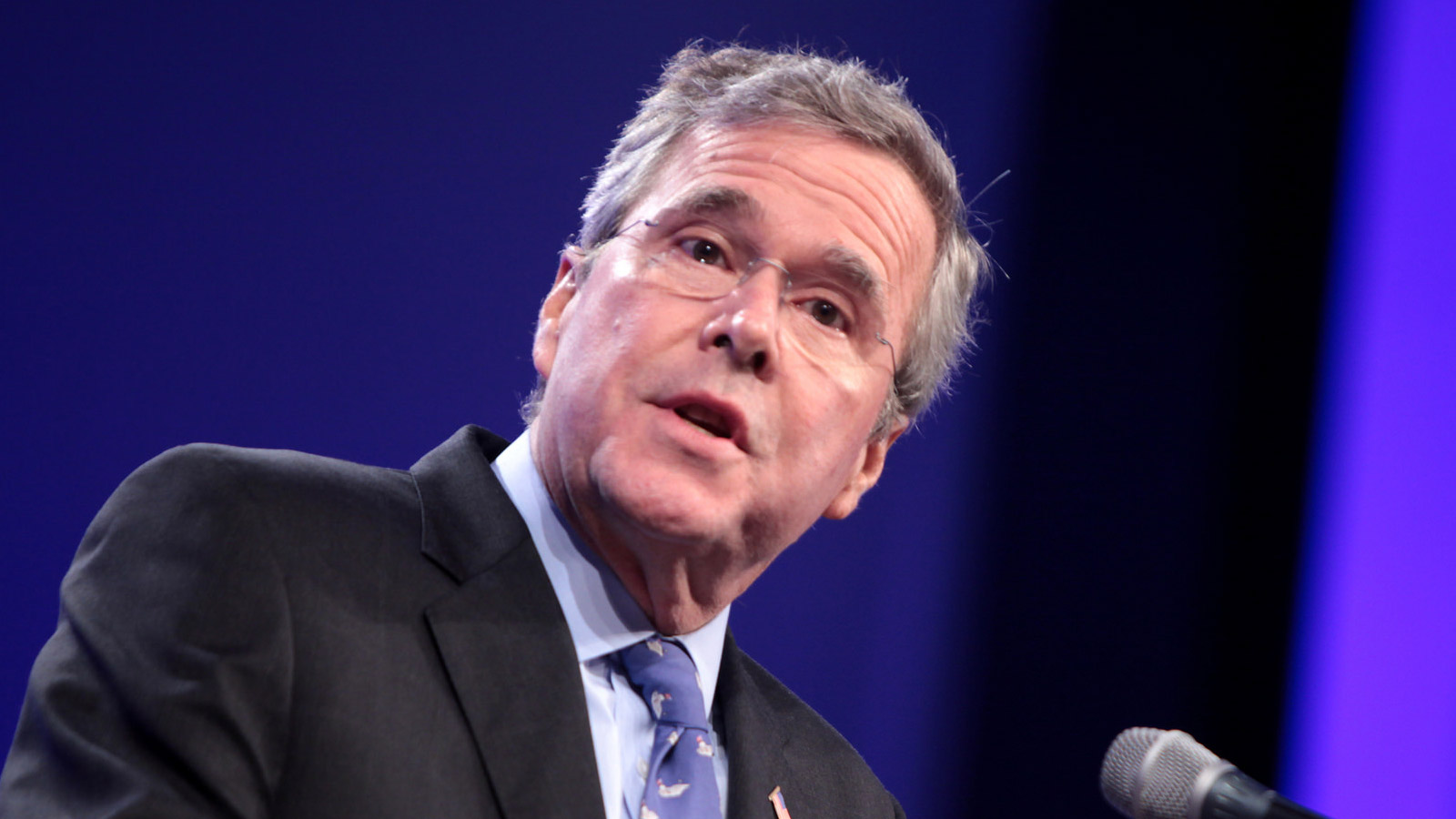

The federal government spends several billion dollars each year subsidizing the oil and gas industry. These tax breaks are extremely unpopular with the American public, but they have considerable support from congressional Republicans, who have opposed the Obama administration’s efforts to eliminate them. So it was a bit surprising when video surfaced yesterday of GOP presidential candidate Jeb Bush calling for an end to all energy subsidies, including for wind, solar, and oil and gas. You can watch it above. As the National Journal reported:

“I think we should phase out, through tax reform, the tax credits for wind, for solar, for the oil and gas sector, for all that stuff,” [Bush] said in New Hampshire on Wednesday, according to a video recorded by grassroots environmental group 350 Action.

“I don’t think we should pick winners and losers,” Bush added, saying: “I think tax reform ought to be to lower the rate as far as you can and eliminate as many of these subsidies, all of the things that impede the ability for a dynamic way to get to where we need to get, which is low-cost energy that is respectful of the environment.”…

When pressed by the activist on whether he would get rid of all fossil-fuel subsidies, Bush replied: “All of them. Wind, solar, all renewables, and oil and gas.”

Eliminating fossil fuel subsidies has long been a goal of environmentalists and climate activists, but if Bush’s proposal were to become law, the subsidy-dependent renewable energy industry would take a hit as well. Quantifying energy subsidies is a bit complicated, but according to one measure from the Energy Information Administration, renewables received upward of $15 billion in government support in 2013, compared to just $2.3 billion for oil and gas and $1.1 billion for coal. The wind and solar power industries received $5.3 billion and $5.9 billion, respectively.

As Andy Kroll explained in a Mother Jones magazine story last year, the relatively recent clean energy subsidies are much more defensible than the oil tax breaks, which have been enshrined in the tax code for decades. “The difference is that renewables are at the stage where oil was a century ago: a promising yet not fully developed technology that needs a government boost to come to scale,” Kroll wrote. “That’s what motivated the original tax giveaways to what would become Big Oil.” The wind industry in particular has relied on a federal tax incentive called the Production Tax Credit. Congress has allowed it to expire several times in recent years, and in each instance, wind investment has plummeted. The PTC expired again at the end of last year.

Michael Dworkin, an environmental law professor at Vermont Law School, praised Bush’s comments. “If he really means it, great,” said Dworkin in an email. “Just let’s be sure that it’s ALL of the traditional energy subsidies, not just a few symbolic ones.”

I also reached out to various energy industry groups to get their reaction. The American Wind Energy Association, which is calling for the PTC to be renewed, declined to comment. But the Alliance for Solar Choice, which represents rooftop solar companies such as SolarCity, embraced Bush’s proposal. “Bush is right — we shouldn’t pick winners and losers,” said TASC spokesperson Evan Dube in statement. Of course, the solar industry isn’t ready to disarm unilaterally. “We would welcome the phase out of all energy incentives,” added Dube, “but until that happens, the solar ITC [Investment Tax Credit] goes a small way to level the playing field against decades of fossil fuel subsidies.”

The American Petroleum Institute didn’t respond to requests for comment.