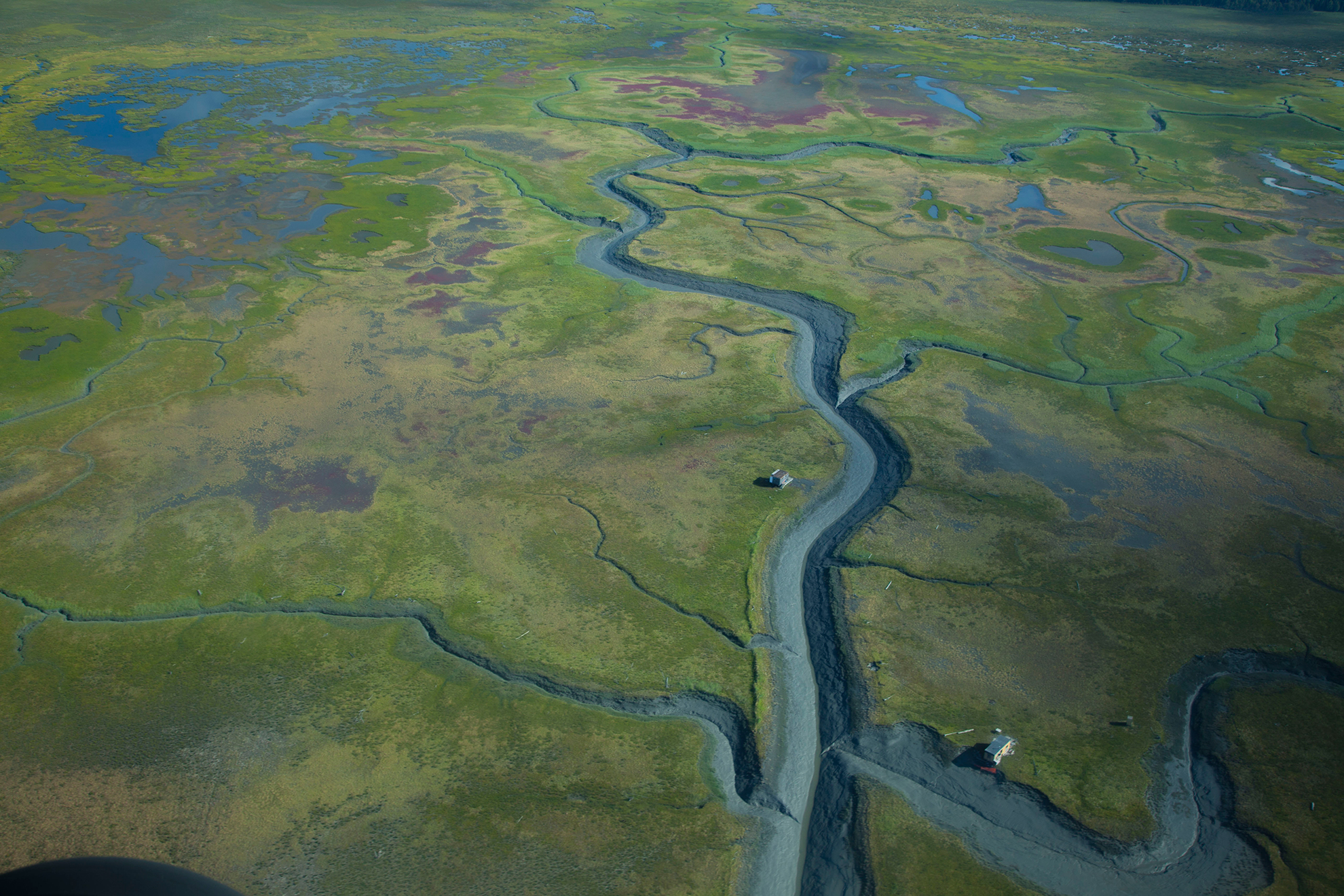

Squeezing into a wobbly four-seater propeller plane is the only way to reach the tiny tribe of Tyonek, tucked deep in the roadless Alaskan wilderness. Gliding above the long mudflats and the serpentine curves of streams, I spot the fat white backs of beluga whales surfacing at the mouth of a river and an island covered by sunning sea lions.

As the plane gets closer, the mudflats give way to swamps, which give way to dense evergreens. A towering mountain range materializes from the clouds, and, nestled in an inlet, the gently meandering lines of the Chuitna River come into focus.

This is the place where a coal company backed by a wealthy Texas family — one whose fabled legacy of gambling on energy markets extends back to a game of cards with an oil rig at stake — wants to sink a 300-foot-deep coal mine over 30 square miles of wetlands and forest. The $700 million project, commonly called the Chuitna mine, currently masquerades under the guise of a tiny Alaskan coal company called PacRim. If the project goes forward, it would all but obliterate Tyonek tribe’s fishing and hunting grounds.

The coastal village of Tyonek lies on Cook Inlet, about 45 miles west of Anchorage, just a few miles downriver from the proposed mine site. For the tribe, which numbers fewer than 200 people, the mine represents an existential threat. “We will go to war if someone comes down here and starts plowing over us,” tribal president Art Standifer tells me. “We’ll go to battle.”

With the locals deeply opposed, the controversy over the Chuitna mine raises another, deeper question: Why, in 2016, is anyone willing to go to such lengths for a dirty and dying industry?

The signs of coal’s demise are everywhere, from Wall Street to the campaign trail. “The U.S. coal industry is in worse economic straits than it has been since the rise of the industry,” says Robert N. Stavins, director of Harvard University’s Environmental Economics Program.

The facts are stark: Coal prices in most major U.S. producing regions have fallen about 50 percent over the past five years. In the beginning of 2016, U.S. coal production declined by 29 percent over 10 weeks compared to the same period the previous year. Exports from the U.S. plummeted by nearly a quarter last year.

From the outside, it looks like the end is nigh. Three of America’s four largest coal companies — Peabody Energy Corp., Arch Coal Inc., and Alpha Natural Resources — have declared bankruptcy in the past year. Coal plants, which are the country’s largest single source of greenhouse gas emissions, are hemorrhaging employees. And natural gas is fast outpacing coal as the most popular fuel for U.S. electricity generation.

But what about Asia — isn’t the continent still coal crazy as it industrializes and increases its energy needs? For many years, coal companies were counting on Asia to be their savior, but even there, projections for endless growth in coal imports have fizzled. India’s coal imports have tanked amid calls by the country’s energy minister to cut them off completely, while China’s coal consumption is slowing as the economy turns toward cleaner fuel. Japan may have brought in record-high coal imports last year, but its consumption is minuscule compared to China.

“Projections are flattening as we move forward,” says Diane Kearney, an analyst who studies coal for the U.S. Energy Information Administration. The bigger geopolitical picture doesn’t help, either: The December signing of the landmark Paris climate agreement spells bad news for coal expansion in developing countries. This, coupled with the emissions restrictions coming from the Obama administration’s Clean Power Plan, has created a tough environment for the coal industry.

And yet, across the United States, coal executives are pushing forward on more than a handful of new coal projects, including mines, export terminals, railway lines, and power plants. In the fight over coal’s final frontier, it’s coal-hungry billionaires in one corner, vulnerable communities in the other. If coal companies win, it’s lose-lose for the rest of us. Communities in their way will be trampled, and the planetary implications are startling: The greenhouse gases released by these coal projects could ensure that no currently feasible climate solution can ever succeed.

Despite this bleak outlook, coal companies are playing the long game.

“There’s still going to be a lot of coal burned in America, and an awful lot burned across the world,” says Colin Marshall, CEO of Cloud Peak Energy, America’s third-largest coal producer.

It’s easy to understand why people whose fortunes depend on coal would be rooting for it to rebound. But it means that communities like the tiny Tyonek tribe remain trapped, forced to wonder what will die first: a doomed and destructive industry, or their way of life.

High Stakes

Grist/Melissa Cronin

Art Standifer is talking about the Chuitna mine project at a tribal council meeting in a log cabin in July. He’s wearing a shirt that says “World’s Greatest Papa.” There’s a gumball machine to his right, and he’s eating Pringles.

“What will we be left with?” he asks, his white mustache in contrast with his straight black hair. “The leftovers of their tailings, their coal dust? No salmon, no moose, no nothing.”

If approved, the Chuitna coal mine would be a leviathan. Standifer and the rest of the council painted the scene throughout the meeting: PacRim’s power shovels and dump trucks would trundle over the grasses, pulling down the shore pines and balsams, rolling them over the river’s watery bogs. The drills would dig into 14 miles of stream and send salmon fleeing one of two ways: upriver, back toward the spawning grounds where they were born, or downriver, toward the ocean where they spend their adult lives. One group will die, trapped upriver; the other will never make it back to reproduce.

Where the salmon once swam would sit an enormous coal mine, surrounded by an access road, a 10,000-foot elevated coal conveyor, an airstrip, a logistics center, and a brand new export terminal. The machines would burrow into the surface to reach a sparkling, black seam of ultra-low sulfur sub-bituminous coal — 300 million metric tons of it, to be exact. Layer by layer, the coal would tumble into trucks that would drive it to a conveyor belt to the sea. Some 500 workers in hard hats would gut the land like a salmon, and then float its innards 3,000 miles away to be burned in “countries in the Pacific Rim, Indonesia, India, and Chile,” according to PacRim’s website.

The first stage of the project is scheduled to last 25 years, but that wouldn’t be the end of it. The surrounding land, leased from the Alaska Mental Health Trust property, is expected to yield 1 billion metric tons of coal. PacRim owns a total of 20,571 acres of coal leases in the area — a swath that it could continue to mine decades into the future.

The bed of the Chuitna river is littered with seveal-ton lumps of coal. Paul Moinester/Alaskans First

Tyonek is what’s known as a “closed tribe,” meaning outsiders cannot visit tribal property without signed consent from tribal leadership. But once a guest is invited onto the tribe’s land, that intimidating veneer slides right off. The residents are welcoming and friendly, though not overly eager to appease outsiders. The coastal village is pleasant and sleepy, with soft winds blowing down from the mountains, off the beach, and over the dusty roads. Members of the tribe meet at the tribal center, where women sit, share waffles, and chat about this year’s salmon run.

“Taking everything from the land is like taking the blood out of your vein,” says Janelle Baker, a member of the tribal council. She pulls up her sleeve and gestures to her wrist. “You can only take so much before it shuts down.”

PacRim has promised that the salmon run will be recreated decades from now, after the coal has been extracted. Mark Vinsel, executive administrator of the United Fishermen of Alaska, tells me that the project would “obliterate” the fishery, and that he is “not confident that it is possible” to restore the river after the damage is done.

In the near-pristine wild of Alaska, it’s not easy to dig something up and then put it back together, as Lance Trasky, a now-retired habitat biologist with the Alaska Department of Fish and Game, wrote in an email. “I am confident that the salmon habitat that would be mined in the proposed Chuitna coal lease area could not be restored to its former level of productivity after coal mining,” he says, adding that what PacRim is proposing has never been done before.

Another looming specter: The Chuitna region is one of many coal-rich sites in Alaska, and opening a mine there could open the floodgates for more down the line.

“Alaska has a lot of coal,” says Carly Wier, campaign director with the environmental group Cook Inletkeeper and one of the most vocal opponents of the mine proposal. “If this gets permitted, it would certainly set a precedent for other coal in Alaska — the other 5.5 trillion tons of it.”

The members of the tribe aren’t just worried about the immediate effects of the mine on their food sources and the coal ash dust that would invariably blanket the land. They already see the effects of climate change, they say, and they know the mine will only make things worse.

“Our fish runs are coming early, our berries are coming early — we can tell that climate change is happening,” Baker says, shaking her head from side to side.

Alaska is warming twice as fast as the rest of the United States. Stronger storms wallop its icy shores. In some parts of the state, permafrost holds up the foundations of houses; thaw could push these Alaskans to pack up and move.

The broader climate implications of the Chuitna project would be nothing short of staggering. The first phase of digging is expected to unearth coal that would, when burned, release 650 million metric tons of CO2 — as much as 17 times the annual emissions of the entire state of Alaska. According to calculations put together by Cook Inletkeeper, if PacRim digs up all its reserves in Alaska, another 1.6 billion metric tons would be released — equivalent to all the U.S. transportation emissions annually. While the Chuitna site is located in the south-central Alaska, the gargantuan coal reserves of Arctic Alaska, the state’s real coal treasure chest, aren’t far away.

“Coal in the Arctic is a ticking time bomb,” says Ryan Schryver, deputy director of the Alaska Center for the Environment. “If you were to develop that, it’s game over for climate change mitigation.”

The Gamblers

Alaskans First

William Herbert Hunt is an 87-year-old man with white hair, a slow southern drawl, and an easy command of a room. He once appeared at a news conference to address his own bankruptcy wearing a full Boy Scouts of America uniform, including the sash.

Hunt, an oilman, is worth an estimated $3 billion. He’s the son of oil tycoon Haroldson Lafayette Hunt. He’s also one of the driving forces behind the Chuitna mine.

“Yes, we will mine through the Chuitna out there,” Hunt growled into a microphone in front of Alaska’s Resource Development Council during a breakfast in 2014. In a grainy video, he can be seen touting the benefits of the “environmentally friendly” project. It’s the only time a member of the Hunt family has publicly addressed the Chuitna project.

The mine is a gamble, a bet that coal’s value will rebound. It’s a risky bet — only the latest in a long line placed by the Hunt family.

In the 1920s, as legend has it, H.L. Hunt, Herbert’s father, won his first oil rig in a game of cards. At the time, Hunt was a professional gambler. Over the next few decades, he won a lot more bets while prospecting oil in Arkansas and Texas. By 1950 he was in charge of one of the country’s grandest oil empires. H.L. Hunt kicked off the golden age of the wildcatters, a band of brazen young men with oil dripping from their fingers and dollar signs in their eyes.

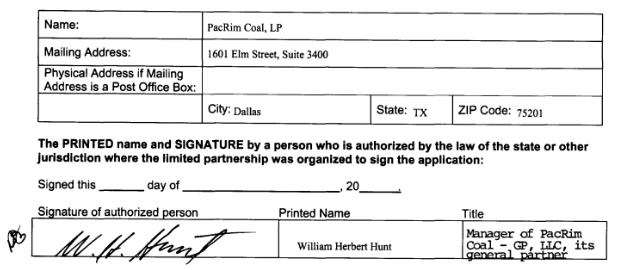

Now, H.L.’s son Herbert is putting his chips on coal. In 2005, he created PacRim Coal to carry out his quest for coal in Alaska. PacRim continues a long-standing family tradition of giving companies six-letter names beginning with P — supposedly a sign of luck. Several federal and state regulatory agencies began reviewing the Chuitna project, kicking off a still-ongoing process of seeking permits.

Today, the Hunts keep quiet about their connection to PacRim. Both have been unwilling to discuss this project publicly or with reporters. In an email exchange with me, Joe Lucas, PacRim’s vice president, at first denied any connection to Herbert Hunt’s oil and gas exploration company, Petro-Hunt. But tax filings obtained by Grist from Delaware’s Division of Corporations, as well as PacRim’s business registration (signed by Herbert Hunt himself in 2005) and business license, all trace back to the Hunts. Even the domain for the website pacrimcoal.com was registered via an IP address belonging to an employee at Petro-Hunt. Lucas has since ignored multiple requests for clarification. Since I started asking, a passage from the Petro-Hunt website that references PacRim Coal has been removed.

What I really wanted to ask the Hunts and reps from PacRim was: Why place such a large bet on a dying industry?

Although the Hunts refused multiple requests for comment, I did speak to some coal company executives who flat-out denied that coal was “dying.” Vic Svec, a senior vice president at Peabody Energy, the top coal producer in the United States, says that even strict regulations and gloomy market projections can’t stop coal.

“At its core, coal remains an essential element in the U.S. and the global mix,” he says. “Coal is likely to remain a strong provider of baseline electricity not for years — for decades to come.”

Jeff Holmstead, an attorney and lobbyist for the coal industry, called coal “the lowest-cost way of bringing people out of poverty,” and says that its influence in the developing world is only growing.

That was the refrain for many of the executives: Coal is a cheap way of producing energy, can stimulate local economies, and provides a better quality of life, even if it does emit pollution.

PacRim has tried to sell Tyonek residents on an economic boon, too.

“[T]here are very few job opportunities in Tyonek and the unemployment rate is very high,” Lucas wrote in one of our earlier email exchanges.

It’s true that Alaska is in dire need of new money and opportunities. Thanks to a population drop, a budget crisis, and continued subsidies for the oil and gas industries, warnings of an economic crash on the scale of the 1980s recession keep popping up. Nearly every person I met in Anchorage, Tyonek, and small towns in between managed to somehow work the state’s financial woes into the conversation. Alaska needs jobs, and coal can (maybe) bring them.

But members of the tribe I spoke with rebuffed Lucas’ offer to work on the mine. In 2011, the tribe delivered a formal resolution opposing the mine to PacRim. The resolution referred to the results of the survey of residents that showed that 98 percent of its members opposed the mine.

“No matter how you look at it, no matter how rich they say we’re going to get off this — this is gonna kill us,” says Standifer, the president of the Tyonek.

The Odds

Paul Moinester/Alaskans First

Could the coal market really bounce back? It’s a long shot, but there’s still a chance, says Stavins, the Harvard professor. If international demand were to pick up, or if carbon-capture technologies were to become viable on a large scale, the coal market could ramp up once again.

“In terms of making predictions, I would be surprised if it did rebound in the short term,” says Stavins. “But in the medium and long term — I wouldn’t even try to guess. If you look back in history, trying to make predictions like this makes one very humble.”

Clark Williams-Derry, director of energy finance at the Sightline Institute, a sustainability think tank in Seattle, notes that the export market offers the best chance for U.S. coal producers. “The ability to export coal gives you the ability to take advantage of future prices — if those prices move in the right direction, you might be able to make some money.”

The Chuitna mine’s proximity to Asia is where PacRim sees an opening. During the 1980s and after, coal exporters looked to developing economies to provide new markets. China, which now burns nearly half of the world’s coal, had looked like a safe bet — until China’s coal consumption peaked in 2013 and started falling. Still, other Asian markets may grow in the next few years. According to the Energy Information Administration, South Korea, India, Indonesia, and Malaysia are all expected to see an uptick in demand over the next 25 years.

“PacRim is trying to get this through the permitting process now so that they have a turn-key mine and export operation ready to go the minute global markets rebound,” says Schryver of the Alaska Center for the Environment.

Meanwhile, money for the Chuitna proposal keeps pouring in. A letter sent by PacRim to the mayor of Alaska’s Kenai Peninsula Borough stated that by its own calculation, the company had already spent $20 million by 2009 developing the mine plans. This July, PacRim unveiled a new website to promote the mine, promising that construction will begin in 2017.

The Tyonek tribe would seem to have little chance of beating billionaires, but there is hope. Earlier this year, members of the Lummi Nation, a tribe based in the Pacific Northwest, successfully blocked the creation of the largest coal export terminal ever proposed in North America. The Lummi fought the proposal from its inception, and, citing treaty-protected fishing rights, kept the project’s developer, SSA Marine, at bay.

Right now, the Chuitna proposal is sitting in regulatory limbo, awaiting a complete draft of its environmental impact statement, which is being compiled by the Army Corps of Engineers. Once the draft is submitted (the expectation is sometime in October), a comment period will allow the public to weigh in before a final statement is produced and a decision reached on whether the project can go forward. The tribe, along with a coalition of commercial fishers, sport fishers, and local activists, has vowed to fight the proposal every step of the way.

Standifer, Tyonek’s president, knows what he’s up against. He told me that the river was given the name “Chuitt,” after the last name of his grandfather, decades ago. Standifer has been here a long time, he says, beaming at the mention of his grandchildren, who recently moved back to the village. Their fate, he says, is wrapped up in the proposal’s outcome.

“The river has always been a part of this village, and we’ve always been a part of that river,” he says. “What kind of future are the children gonna have?” A lot is riding on that question.