Sandia National LaboratoriesThree Mile Island: still not popular.

The nuclear power industry is melting down in America, and in the rest of the Western Hemisphere too.

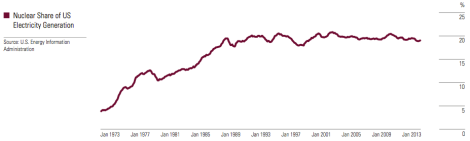

Nuclear plants still generate nearly 20 percent of electricity in the U.S. But a report by investment research firm Morningstar in its latest Utilities Observer publication warns about the sector’s risks. The report says “the ‘nuclear renaissance’ is on hold indefinitely” in the West thanks to low electricity prices, largely driven by the natural-gas fracking boom but also by new renewable energy projects, and controversy in the wake of the Fukushima meltdown:

Aside from the two new nuclear projects in the U.S., one in France (Flamanville), and a possible one in the U.K. (Hinkley Point C), we think new-build nuclear in the West is dead. …

We don’t expect an end to the new nuclear construction in China and South Korea or the development interest in India and elsewhere in Asia. … Nuclear power is not going to disappear as a long-term option and it will continue to evolve. However, an investment in a new Western nuke plant even with the best available technology today will remain a rare experiment.

Another problem for the sector: Nuclear power plants are ill-suited to modern energy-pricing schemes, as The New York Times recently reported. Nuclear plants can’t be quickly powered up or down to meet demand as prices rise and fall throughout the day and night, so sometimes reactor operators are forced to sell electricity at a loss when demand is lowest.

Five U.S. nuclear power plants have recently shuttered or announced upcoming closures: Vermont Yankee in Vermont, San Onofre in California, Kewaunee in Wisconsin, Crystal River in Florida, and Oyster Creek in New Jersey. Those closures have been largely the result of falling power prices and rising maintenance costs.

Here are six more nuclear plants that Morningstar identifies as the most likely to close next:

1. & 2. R.E. Ginna, opened in 1984 in Onatario, N.Y., and James A. FitzPatrick, opened in 1974 in Scriba, N.Y.

Blame it on the wind. “Renewable energy has flooded the wind-rich region, driven by New York’s renewable portfolio standard,” the Morningstar report notes. “Upstate New York off-peak power prices have fallen to $32 per megawatt hour as of mid-2013 from $55/MWh in 2008. Transmission bottlenecks prevent the plants from tapping the state’s eastern markets, where power prices are 30% higher.”

3. Pilgrim, opened in 1972 in Plymouth, Mass.

The power plant’s operating license was extended until 2032 despite fierce opposition last year. Still, says Morningstar, “Entergy is not obligated to operate it for that long and could exit if power prices sink much further.”

4. Three Mile Island, opened in 1974 in Middletown, Penn.

One of Three Mile Island’s two reactors closed down in 1979 because, well, because it partially melted down. Now Morningstar says the other reactor is at risk of closure because it “faces challenging economics,” and those challenges will be exacerbated if several large natural-gas plants are built nearby as proposed.

5. Davis Besse, opened in 1977 in Oak Harbor, Ohio

Morningstar notes “strong opposition” to efforts to extend the power plant’s operating license after it expires in 2017 and the plant’s “tarnished reputation.” The facility closed in 2002 after corrosion was discovered in the main vessel and it didn’t resume operations until 2004. Still, U.S. Nuclear Regulatory Commission staff declared in September that there were no safety issues at the plant that would affect its relicensing effort.

6. Indian Point, opened in 1973 in Buchanan, N.Y.

Neighbors and many lawmakers really want to shut down this plant, located less than 50 miles north of Manhattan. “When you have this much local opposition and opposition from state government, what I’ve seen over time is that it’s very difficult to operate plants,” former U.S. Nuclear Regulatory Commissioner Michael Jaczko told Bloomberg in October. “The best solution is to sit down with all the interested stakeholders and think about a way to shut down the plant on a reasonable time frame.” Still, Morningstar’s analysts say that “owing to transmission constraints and Indian Point’s relatively low cost, we think there is a strong probability that the plant will eventually be relicensed.”

Maybe somebody should tell James Hansen about the nuclear industry’s mounting woes.