Last month, the National Renewable Energy Laboratory (NREL) released the “2010 Renewable Energy Data Book” [PDF], which is a cornucopia of charts, facts, and figures on energy use in the U.S. The top-line conclusion for climate hawks is familiar: Renewable energy is growing rapidly, but not rapidly enough; it remains a small fraction of overall energy production and consumption.

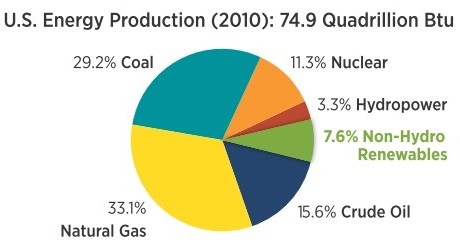

Here’s the graphic that best captures the current situation:

Click for larger version.NREL: 2010 Renewable Energy Data Book [PDF]

Click for larger version.NREL: 2010 Renewable Energy Data Book [PDF]

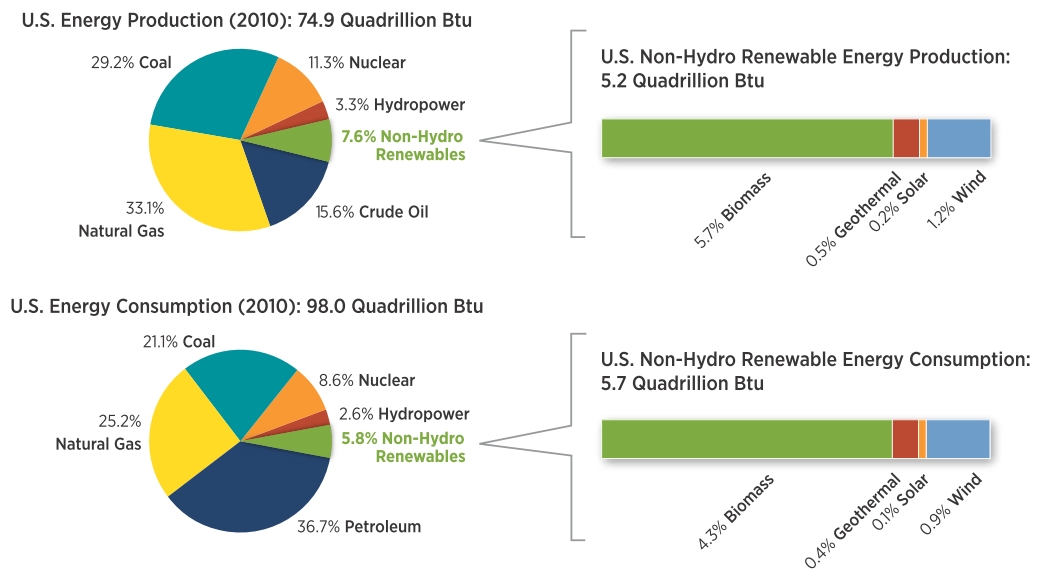

Non-hydro renewables remain a small part of the U.S. energy story. More to the point, the sexy renewables — solar, wind, and geothermal — are a rounding error. Of the total energy consumed in the U.S. in 2010, solar was 0.1 percent and wind was 0.9 percent. Even with biomass, hydropower, and nuclear thrown in, low-carbon energy amounts to just 17 percent of energy consumed in the U.S.

The growth rate doesn’t look all that great either. In 2000, non-hydro renewables accounted for 3.5 percent of total energy consumed in the U.S.; in 2010, that number was only up to 5.8 percent. At that rate, by 2100, only a quarter of the energy we consume will be renewables.

And yet!

Seen from another angle, growth in renewables has been crazy-fast. From 2000 to 2010 in the U.S., non-hydro renewables have grown at a compounded annual average of almost 14 percent, even faster recently. Here’s what that looks like:

Click for larger version.NREL: 2010 Renewable Energy Data Book [PDF]

Click for larger version.NREL: 2010 Renewable Energy Data Book [PDF]

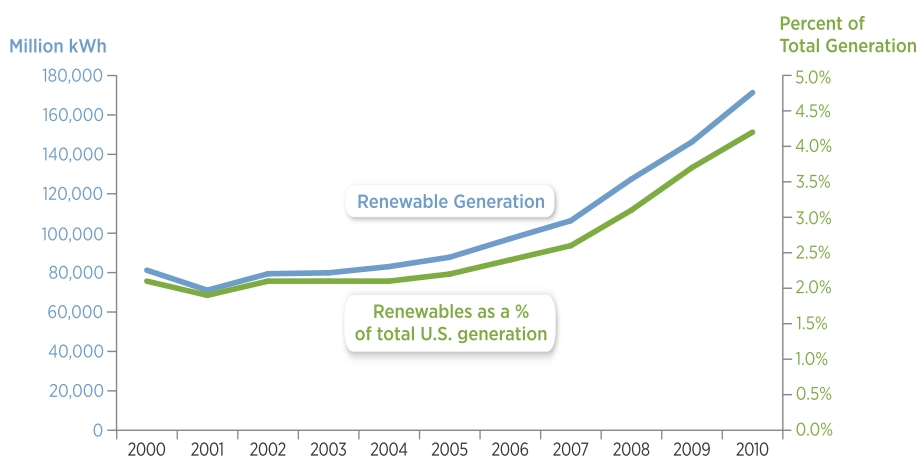

Looking more closely, we can see that the vast bulk of that growth in renewables is due to wind:

Click for larger version.NREL: 2010 Renewable Energy Data Book [PDF]

Click for larger version.NREL: 2010 Renewable Energy Data Book [PDF]

Click for larger version.NREL: 2010 Renewable Energy Data Book [PDF]

Click for larger version.NREL: 2010 Renewable Energy Data Book [PDF]

Biomass and geothermal are fairly stable. Solar PV is growing at a faster rate, at least in the last year or two, but that’s from a tiny base — it was 0.0 percent of total electrical generating capacity in the U.S. in 2000; in 2010, it reached 0.2 percent. For all practical purposes, when you talk renewables in the U.S., you’re talking wind.

And that’s why get the seemingly counterintuitive result that George-Bush-Rick-Perry Texas has the most installed renewable electric capacity of any U.S. state. It’s not that they’ve embraced green. It’s just that they have a huge wind industry!

The state maps showing the concentration of various renewables (too many to show here) also implicitly illuminate the nature of the political problem in the U.S., namely: the South doesn’t have much clean energy. Or rather, they have biomass, but that’s about it. (Good thing for policymakers to keep in mind: if you want the South on board, include biomass.)

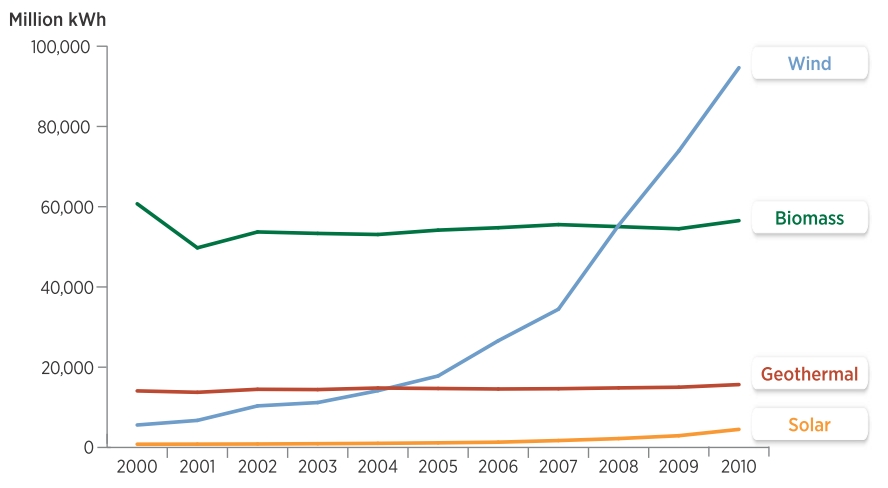

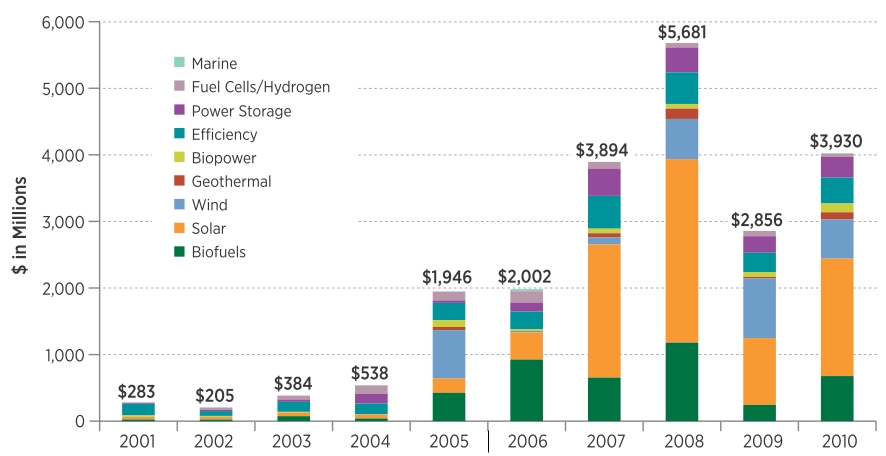

So as to not leave a depressing impression overall, here’s a graph showing the enormous growth of venture capital and private equity investment in renewables companies over the last decade:

Click for larger version.NREL: 2010 Renewable Energy Data Book [PDF]

Click for larger version.NREL: 2010 Renewable Energy Data Book [PDF]

You can see here that solar is getting an enormous amount of attention from investors, all out of proportion to its present contribution. Part of that is just that solar is sexy, but part is that investors seem to believe that solar is set to explode.

The other thing to note from this graph is that the economic downturn has hit investment in renewables as hard as the rest of the economy. The greater danger, which a chart can’t show, is that investment is about to fall off a cliff — the incentives for investment put in place by the Obama administration are going to lapse, along with several incentives (like the production tax credit for wind) put in place prior to Obama. If Republicans continue their anti-spending, anti-government, anti-clean energy jihad, it’s unlikely those incentives will be renewed.

Even if that happens, the rest of the world is moving ahead. As Bloomberg reported last week, global investment in renewable power plants has exceeded investment in fossil fuel plants for the first time ever. Still, the U.S. is (for now, anyway) the world’s leading economy — it’s tough to see how renewables can get to the growth rates they need without enthusiastic U.S. participation.