For a president who campaigned on the promise to end new oil and gas leasing on public land, Joe Biden has been dragging his feet, to say the least. A long-anticipated government report on the federal oil and gas leasing program that was released last November did not indicate any end in sight. And while the Biden administration has yet to auction off any new leases on public land, it has approved almost 900 more drilling permits than former President Donald Trump did during his first year in office, according to a recent analysis.

But last week an update popped up on the Interior Department’s website that showed Biden might be ready to make a change to the oil and gas leasing program that no other administration has dared to make for the last 100 years: increase royalty rates. The notice, which was published by accident and quickly removed from the site, said the agency would increase the royalty rate on leases sold in upcoming auctions from 12.5 percent of the value of the oil or gas produced to 18.75 percent, according to E&E News.

That would bring royalty rates for federal leases in line with those for oil and gas leases on state-owned lands, which range from 16.6 percent to a whopping 25 percent in Texas.

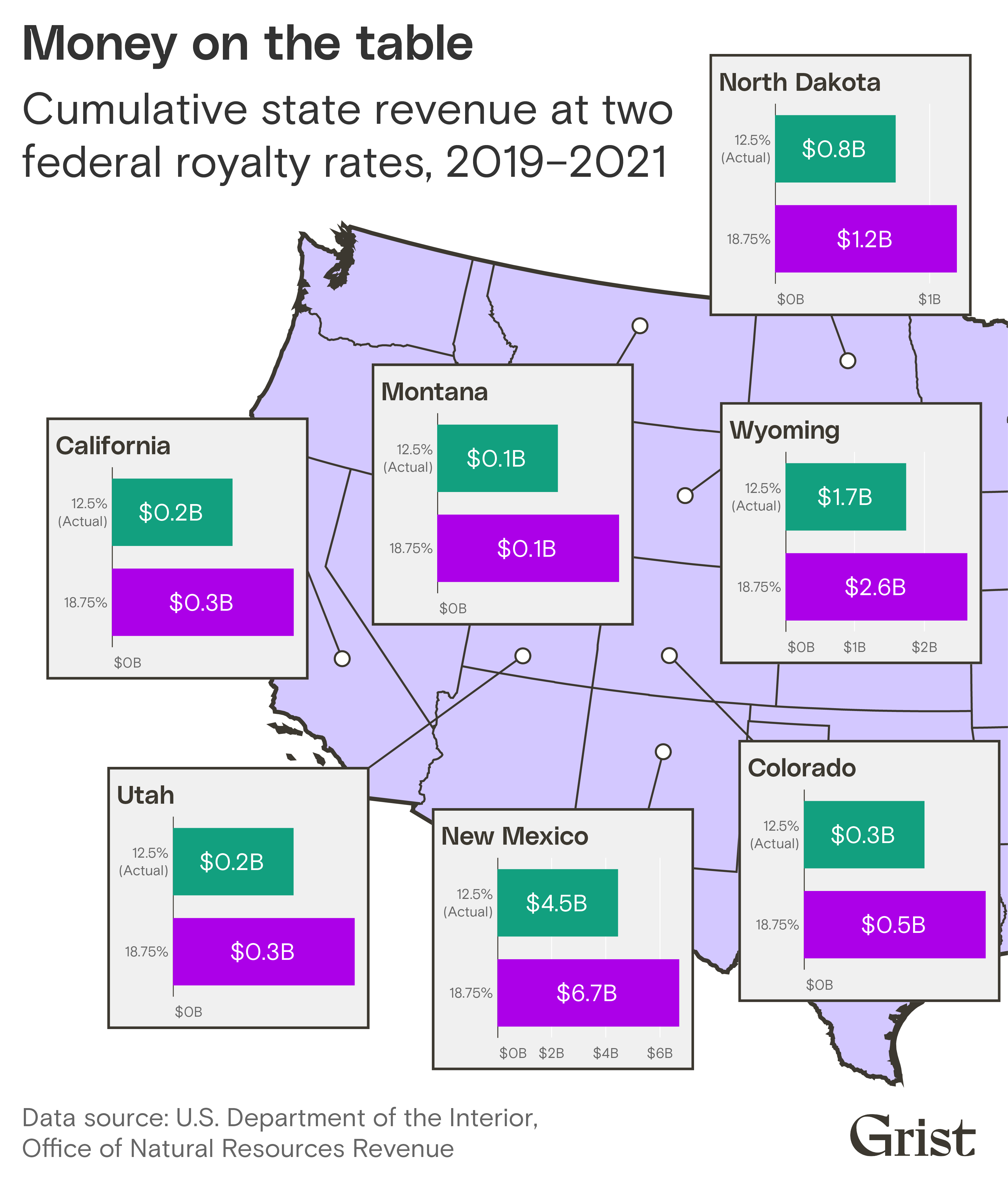

Increasing the federal rate could be a boon for state governments, which receive half of the royalty revenue the federal government takes in for leases in their borders and often rely on it to fund schools, public health programs, and critical infrastructure. That’s the message of a new report from the nonprofit watchdog organization Accountable.US, which calculated just how much states are being shortchanged by the outdated federal royalty rate. It found that in 2019, Western states could have taken in additional $1.58 billion if the royalty rate had been 20 percent instead of 12.5. The worst affected state, New Mexico, missed out on $804 million in potential revenue in 2019, or about 13 percent of its budget that year.

Grist extended Accountable.US’s analysis to see how much states would have earned under the potential increase to 18.75 percent, and found that Western states could still have received as much as $1.3 billion in 2019 with this royalty rate.

Accountable.US energy and environment director Jordan Schreiber, who conducted the analysis, points out that the top leaseholders are large, publicly traded companies that can afford the increase. The number one federal leaseholder, holding 1,819 leases spanning more than 700,000 acres, is Exxon Mobil.* Schreiber found that in 2019, Exxon Mobil paid $307 million in federal royalties while bringing in $256 billion in revenue. She said that if the federal royalty rate had been 25 percent — what Texas charges on state lands — it would have reduced Exxon’s revenue by only 0.1 percent that year. She ran the same analysis for eight other major leaseholders and found that none would have lost more than 3 percent of their total revenue in 2019.

“These companies are posting record profits, increasing dividends to shareholders, and buying back more shares — all while taking advantage of the American people,” Schreiber said in an email. She also dug into the track records of the 20 largest leaseholders and found that 12 of them have a history of underpaying royalties to both the federal government and private landowners. “Beyond the fact that Big Oil does not need taxpayer subsidies, it does not deserve them either because it abuses a system that is already very much tilted in its favor,” Schreiber said.

The notice that was accidentally uploaded to the Interior Department website hinted at other changes to the leasing program, in addition to increasing the royalty rate, like “avoiding lands with low potential for oil and gas development” and “focusing leasing near existing development.” Such changes could begin to downsize the program while preserving royalty revenues. A spokesperson for the Interior Department told E&E News that the language was not final.

While increasing the federal royalty rate could help fill state coffers for underfunded public services in the near future, the U.S. will eventually need to wind down oil and gas drilling to achieve Biden’s goal of net-zero emissions by mid-century. That means states need to prepare for a future where this source of revenue declines.

Mark Haggerty and Nicole Gentile of the nonprofit Center for American Progress have proposed that the government end royalty revenue sharing with states and replace it with an endowment system that provides states with more reliable funding. They also urge oil and gas-dependent states to look for ways to raise revenues from renewables, conservation, and recreation to replace dwindling revenues from oil and gas.

“Decoupling community needs from fossil fuel revenue will pave the way for advancing climate and conservation goals,” they write.

*Correction: An earlier version of this story misstated the number of acres that Exxon’s leases span.