Over the weekend, The New York Times launched a series considering how state and local incentives to private business benefit the localities that bestow them. The bottom line seems to be: not much. Incentives frequently fail to prevent companies from relocating or going out of business, and often cost huge amounts of money while returning very little value to the public.

Reading the report, we couldn’t help but wonder how those incentives — a combination of tax breaks, zoning changes, and contributions — broke down by industry. (Full disclosure: We have a bit of a chip on our shoulders about fossil fuels.) The report offers a teaser hint:

Far and away the most incentive money is spent on manufacturing, about $25.5 billion a year, followed by agriculture. The oil, gas and mining industries come in third, and the film business fourth. Technology is not far behind, as companies like Twitter and Facebook increasingly seek tax breaks and many localities bet on the industry’s long-term viability.

Third place is instructive, but not nearly enough. Happily, the Times also included a searchable database of incentives by company name. So we searched it.

First, a note on methodology. Here’s what the database contains:

The New York Times spent 10 months investigating business incentives awarded by hundreds of cities, counties and states. Since there is no nationwide accounting of these incentives, The Times put together a database and found that local governments give up $80.3 billion in incentives each year [stemming from] 1,874 [different] programs.

We searched the database for company names we associated with either the fossil fuel or renewable energy sectors, and threw in the following words for good measure: coal, oil, gas, ethanol, wind, solar. Some expected names didn’t appear (Solyndra; remember, this isn’t federal money); some appeared often but were too broad in scope to be included in our analysis of energy subsidies (Halliburton).

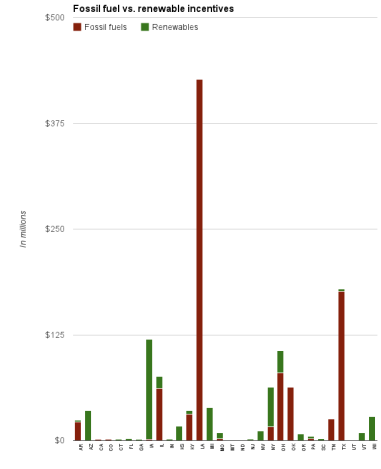

Now, the findings:

- Of the 103 incentives we identified, fossil fuel companies received $2.5 billion compared to renewables’ $382 million — or more than six times as much.

- Of the total for renewables, $118 million went from the state of Iowa to ethanol companies. Iowa also gave $1.2 million to Plymouth Oil.

- The most generous state was Pennsylvania, but only due to the $1.6 billion it offered to Shell (something we covered here).

- Excluding Pennsylvania’s largesse, the most generous state was Louisiana, which offered $426 million — all to fossil fuel companies.

- If we’d included Halliburton, it would have added only about $15 million to the total.

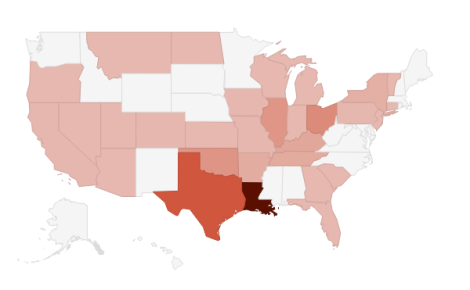

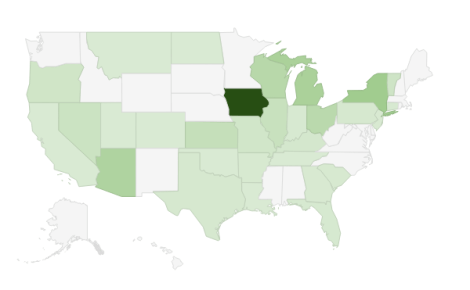

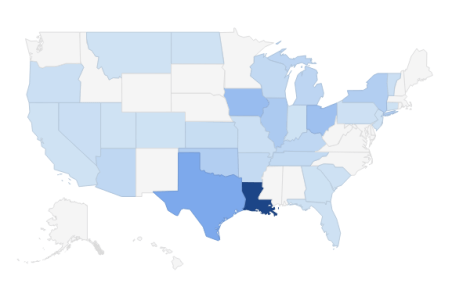

A chart and some maps. In each map, the darker the color, the more money went to incentives. (Note: We excluded the Pennsylvania/Shell incentive from these because it dwarfed the other data.)

Fossil fuel incentives, by state

Renewable incentives, by state

All energy incentives, by state

Here’s the spreadsheet we used to make these calculations. See something we missed? Leave it in the comments.