The natural gas industry may be eviscerating King Coal, but it’s still having a rough time.

Over the weekend, The New York Times looked at the increasingly small profit margins for natural gas extractors (read: frackers).

[W]hile the gas rush has benefited most Americans [Ed. — Um, the argument being cheaper energy costs], it’s been a money loser so far for many of the gas exploration companies and their tens of thousands of investors.

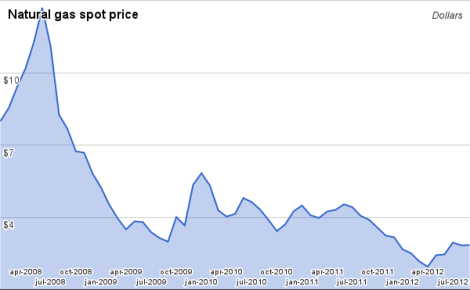

The drillers punched so many holes and extracted so much gas through hydraulic fracturing that they have driven the price of natural gas to near-record lows. And because of the intricate financial deals and leasing arrangements that many of them struck during the boom, they were unable to pull their foot off the accelerator fast enough to avoid a crash in the price of natural gas, which is down more than 60 percent since the summer of 2008.

Although the bankers made a lot of money from the deal making and a handful of energy companies made fortunes by exiting at the market’s peak, most of the industry has been bloodied — forced to sell assets, take huge write-offs and shift as many drill rigs as possible from gas exploration to oil, whose price has held up much better.

EIA.govClick to embiggen.

Yes, while every conservative pundit is busy railing against the tribulations of the solar industry, the natural gas boom is yielding comments like this:

“He is like the bartender serving drinks for people who can’t handle it,” said Fadel Gheit, a managing director at Oppenheimer & Company, about [banker Ralph Eads III, who has rounded up funding for new natural-gas operations]. “And the whole gas industry has gotten a rude awakening, a hangover, with gas prices plummeting. The investment bankers were happy to help with a smile and get their cut.”

I assume that Gheit cribbed the language for that quote from a 2008 rant against mortgage resellers. Even our old friend T. Boone Pickens is worried about overproduction.

“Quit drilling,” T. Boone Pickens, the Texas oilman, barked to his fellow board members at Exco Resources, a small, independent drilling company based in Dallas that, like Chesapeake, had made a big bet in the Haynesville [shale area in Louisiana and Texas]. “Shut her down.” … There was only one problem: under the contracts that Exco signed, it couldn’t stop drilling. …

Mr. Pickens was furious. “We are stupid to drill these wells,” he said in a recent interview.

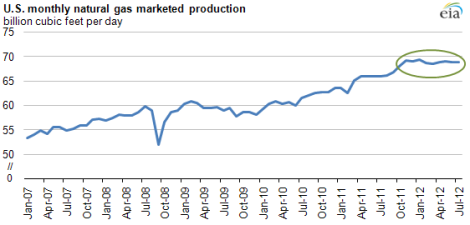

Given the economics at play, production has unsurprisingly leveled off — but volume is still at an all-time high.

EIA.govClick to embiggen.

Says the U.S. Energy Information Administration:

U.S. marketed natural gas production has flattened since late 2011, mainly in response to lower natural gas prices. Nevertheless, volumes remain at historically high levels. From January through July 2012, marketed natural gas production set a record high for the first seven months of any year, averaging 68.9 billion cubic feet per day (Bcf/d), up nearly 4 Bcf/d, or 5.9%, from the same period a year earlier.

(SmartPlanet has a much deeper look at this leveling.)

At the end of the day, volume, not production, is the problem. Until the market demands more of that produced volume, prices will stay fairly low, meaning that fracking companies will continue to be pinched.

I’m sure they have your sympathy.