British Columbia

-

Regional climate policy is still moving forward in the Northwest

Over the last couple of weeks, there’s been a lot of hand-wringing about the state of climate policy in the Northwest. Washington’s citizen-backed renewable energy standard is in jeopardy and neither Oregon nor Washington appears close to implementing the Western Climate Initiative. Even British Columbia’s pioneering carbon tax is taking fire. Freak out! Everybody panic! […]

-

More on B.C.’s carbon tax shift

On February 19, one of my colleagues at Sightline applauded British Columbia's new carbon tax shift. I've now had time to digest the plan. It's even better than we said, and the province could tweak it to make it better still.

This policy is the purest instance of a tax shift that I've ever seen. It's an exceptionally faithful implementation of tax shifting -- a policy innovation Sightline has been promoting since 1994 and especially since our 1998 book. (A small brag: Gordon Campbell read the book that year and told me he was going to shift taxes in his second term as premier. I didn't hold my breath, but now he has delivered.) The carbon tax shift (as opposed to the larger government budget it's wrapped in) is almost entirely untarnished by handouts to special interests. It is built on four principles:

-

A quick survey of carbon taxes outside of Cascadia

British Columbia's bombshell announcement of a carbon tax shift last month made me want some context. Here's a rundown of other carbon taxes elsewhere in the world. As I noted, none of them is as consistent and comprehensive as B.C.'s, though some do have higher tax rates. In most cases, these levies came in tax shifts that reduced payroll taxes, business taxes, or other energy taxes. B.C.'s starts at $10.10 per metric ton of CO2 equivalent and rises in steps to $30.30 in 2012.

At least nine jurisdictions elsewhere in the world claim to have carbon taxes. (Good starting places for learning about them are the Carbon Tax Center and these dated but informative U.S. EPA sites.)

-

Biodiesel company convinces B.C. restaurants to switch oils

Came across this piece about a biodiesel company in British Columbia that’s convincing restaurants to switch to a lighter, healthier cooking oil so it can buy the oil and turn it into biodiesel. And partly I’m just excited because the program, called Restaurant Green Zone, is finding the biggest success in Chilliwack! And that’s fun […]

-

California continues to innovate on the climate front, but still gets smoked by perky B.C.

A national carbon tax in the U.S. appears increasingly unlikely, but all sorts of interesting experiments in emissions pricing are underway regionally.

First: the California Assembly this week votes on the California Clean Car Discount Act, a "feebate" system that imposes a direct charge on sales of gas guzzlers and uses the funds to reward buyers of fuel sippers. The way it works it pretty simple. If you buy a Chevy Tahoe, you'll have to pony up a $2,500 fee, which will then go straight to all the folks buying Honda Civics. Fees and rebates are determined on a sliding scale based on the fuel efficiency of the vehicle in question.

Although not quite a carbon tax, the system does establish clear price signals for energy efficiency, and such feebate systems are an improvement over CAFE. Unfortunately, some members of the assembly are still sitting on the fence:

-

Notable quotable

“I think this is a landmark decision in North America as far as government addressing global warming. The B.C. government has decided to use one of the most powerful incentives at its disposal to reduce pollution.” — Ian Bruce of the Suzuki Foundation, on the carbon tax just implemented by the provincial government of British […]

-

Cars are more expensive than you think

Everyone knows that cars are expensive, right? Still, it may come as a surprise to find out just how much money we spend getting from place to place.

The cost of the car itself -- typically the second biggest purchase many families make in their lives -- is just the start. When you start adding in the cost of gasoline, and car insurance, and maintenance and repairs, and parking, and taxes to build new roads and maintain old ones, and license fees, and the medical costs of traffic accidents ... boy, I could go on all day ... suffice it to say, the zeros start adding up.

-

And why we pay too little for well travelled food

Speaking of eating locally, I've neglected to keep you apprised of the latest developments of our heroes to the North, Alisa Smith and J.B. MacKinnon, who are living on a hundred-mile diet.

In part four, Alisa and J.B. write about the hidden costs of food, China's agro ambitions, and Vancouver's bright spots.

In part five, our dynamic duo heads oustide of their comfort zone to northern British Columbia, where they discover that following the hundred-mile diet isn't as hard as they thought it would be.

-

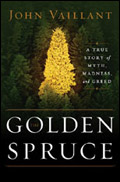

Forest meets felon in John Vaillant’s The Golden Spruce

The old riddle goes: If a tree falls in a forest and no one’s there to hear it, does it make a sound? The new one might go: If a tree falls in a forest and no one’s there to hear it, is it worth writing a book about? The Golden Spruce by John Vaillant, […]