Berkeley is Fox News’ nightmare. The city’s political spectrum runs from center left to left of Lenin. Malcolm X not only has an elementary school named after him but his birthday is a public holiday. The best pizza in town comes from a workers’ collective (veggie only) located across the street from Alice Waters’ Chez Panisse — she who would smash the agricultural-industrial state. And did I mention Breast Freedom Day at People’s Park?

A lot more solar panels like these could be installed across California if more cities adopt Berkeley’s model for financing installation.City of BerkeleyBut this hotbed of East Bay Bolshevism has also become a wellspring of municipal eco-capitalism that’s serving as a model for less leftist locales. As you may have heard, Berkeley will finance a solar array for any home or business that wants one, tacking on a surcharge to the owner’s property tax bill for 20 years to recoup the cost. If you sell your house, the assessment rolls over to the new owner.

A lot more solar panels like these could be installed across California if more cities adopt Berkeley’s model for financing installation.City of BerkeleyBut this hotbed of East Bay Bolshevism has also become a wellspring of municipal eco-capitalism that’s serving as a model for less leftist locales. As you may have heard, Berkeley will finance a solar array for any home or business that wants one, tacking on a surcharge to the owner’s property tax bill for 20 years to recoup the cost. If you sell your house, the assessment rolls over to the new owner.

In one fell swoop, the city removed the chief roadblock to going solar — steep upfront costs that can run $20,000 or more for a rooftop system. When the Berkeley FIRST (Financing Initiative for Renewable and Solar Technology) website went live it took all of nine minutes for the 40 slots in the pilot program to be sold out.

But the story behind that story is how this experiment in state-sponsored solar spurred the founding of an innovative green financial startup. A startup that in turn has developed a business model to nationalize the Berkeley blueprint with the aim of creating a multi billion-dollar market for “green municipal bonds” to finance the decarbonization of the country.

It all started a couple years ago when Cisco DeVries and his wife decided to try to halve their personal carbon emissions. (Berkeley voters had just passed a ballot initiative calling for the city to reduce greenhouse gas emissions 80 percent by 2035.) DeVries, then chief of staff to Berkeley’s mayor, looked into solar, but the cost was prohibitive and the return on investment decades out given Berkeley’s mild climate (most of us just don’t use that much electricity in our early 20th century homes).

At the time DeVries happened to be working on creating a special tax district for a neighborhood that wanted to put unsightly overhead utility wires underground. The city would sell a municipal bond and uses the proceeds to pay for the work, adding a surcharge to the homeowners’ property tax bills.

“I thought if we’re doing this for underground utility districts, why can’t we do it for solar,” says DeVries, a thirty-something veteran of the Clinton energy department.

In short order, the Berkeley City Council approved the solar scheme. That was the easy part. “It was pretty clear that it was complicated, that even Berkeley was struggling to put all the pieces together, to figure out how to finance things,” says DeVries.

So he left his city gig and joined veteran financier Stephen Compagni Portis to start Renewable Funding last year to develop a solar enrollment and financing system – a “platform” to you geeks — that could be rolled out outline to any city that wanted to adopt the Berkeley model.

“All the cities were saying, ‘Good grief it’s going to cost a fortune,’ to develop an application processing system,” says DeVries at his office in downtown Oakland.

So Renewable Funding built an Internet platform that lets homeowners sign up for a solar system in a matter of minutes through their city government’s website.

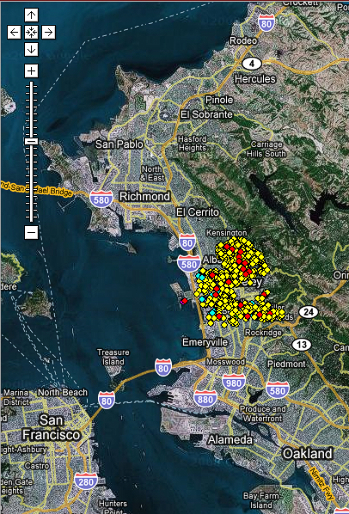

A map on the City of Berkeley’s website charts the progress of solar panel installation.City of Berkeley“The hardest piece was the bonds,” DeVries says.

A map on the City of Berkeley’s website charts the progress of solar panel installation.City of Berkeley“The hardest piece was the bonds,” DeVries says.

If a city wants to install a new sewer system or put utility poles underground, it issues one bond that carries a set interest rate. But that wouldn’t work when you have thousands of individual homeowners signing up for rooftop solar arrays over a period of years with their property serving as collateral for the bond. The homeowner wants to know what the interest rate will be when they sign up and a bond buyer wants to know what property is securing the bond.

Renewable Funding’s solution: A new species of security it calls a “micro bond.”

“We buy a tiny little bond every time a property owner” installs a solar array through the program, says DeVries. Say your Berkeley-financed solar system costs $20,000 installed. Renewable Funding buys a bond from the city worth $20,000 and writes you a check to pay the solar installer.

The company, which uses its own capital and bank credit lines to buy the bonds, will pool all these micro bonds to create a security that carries a blended interest rate. “It’s like we buy one big bond but in tiny pieces,” DeVries says. “Over time we actually have what looks to be much more like a bond you’d see in the market. But we’ve done the work of taking the interest-rate risk. We’re dealing with the money flow so there is on-demand financing available for every property as it needs it.”

“I believe that this model is transformative,” he adds.

Here’s why: The muni bond market is how big public works projects get financed. Tapping that multi billion-dollar market to pay for solar, energy efficiency and other low-carbon projects will spur demand for solar panels, home retrofits and other products and services, lowering their cost over time while creating green jobs. A recent University of California, Berkeley, study estimated that municipal solar financing is a potential $280 billion market.

“It’s really important to develop a long-term market for these bonds,” DeVries says. “There’s really never been this kind of green, fixed income municipal bond before. If you look at the socially responsible investing world, they really haven’t had many bonds to buy. Here’s a bond that is 100 percent green.”

It’s early days and Berkeley so far has only issued about $1.5 million in bonds through the solar pilot program. The market’s appetite for green micro bonds remains untested. Though Renewable Funding has yet to sell any bonds on the market, DeVries says the company has “firm offers to buy as many as we’ll ever have.” Buyers likely will be socially responsible investing funds as well as infrastructure banks. Renewable Funding makes its money from administrative fees and from a premium it charges on the bonds it finances.

The Berkeley experiment is quickly going mainstream. Last year the California legislature passed a bill — AB 811 — that lets any city or county do a Berkeley-style program as well as provides for a statewide solar financing scheme. Renewable Energy was chosen to develop and administer a program that could be deployed across California. The company also is creating a solar financing system for Boulder County, Colorado, and 10 states are considering implementing similar programs. A stimulus package provision to allow such programs to qualify for a 30 percent tax credit — for which Renewable Funding lobbied hard – has also helped spark interest.

The economic collapse has made obtaining financing for the solar program harder and more expensive but it doesn’t seem to have dampened demand. A pile of message slips from municipal administrators sits on DeVries’ desk, and he says 69 California cities and counties have expressed interest in joining a statewide solar financing program.

Also on DeVries’ desk is a book titled “It Came From Berkeley: How Berkeley Changed the World.” Along those lines, he sees the program’s solar focus as “the gateway drug to energy efficiency.” Both the Berkeley program and AB 811 allow municipal financing of solar thermal — i.e. residential heat and hot water systems — as well as home retrofits.

“Ultimately we see this market as 90 percent energy efficiency,” says DeVries. “The state has a goal of 13 million residential properties by 2020.”

And that means a big market in micro bonds.