Blackout: Coal, Climate and the Last Energy Crisis, Richard HeinbergThere isn’t nearly as much coal left as most people think. “Clean coal” will run down limited reserves even faster. If humanity doesn’t begin massive, sustained investment in renewable power sources immediately, civilization could be at risk before the end of the century. And that’s without considering the impacts of climate change.

Blackout: Coal, Climate and the Last Energy Crisis, Richard HeinbergThere isn’t nearly as much coal left as most people think. “Clean coal” will run down limited reserves even faster. If humanity doesn’t begin massive, sustained investment in renewable power sources immediately, civilization could be at risk before the end of the century. And that’s without considering the impacts of climate change.

Such is the stark conclusion of Richard Heinberg’s Blackout: Coal, Climate and the Last Energy Crisis, which despite its dry tone and technical complexity is one of the scariest f*cking books I’ve ever read.

Right now the U.S. is on the verge of a momentous gamble, as reflected in the ACES bill: betting that long-term emission reductions can be achieved via carbon capture and sequestration (CCS). ACES postpones serious domestic reductions for over a decade on the assumption (hope?) that CCS technology will mature and drop in price enough to enable the indefinite use of coal.

Similarly, at U.N. talks it is fervently hoped that CCS will enable coal to continue driving developing-world economic expansion (as oil declines, coal use has risen). Nothing approaching WWII-scale investment in renewables and efficiency is on the table.

It’s a game-theoretic exercise played for Dantean stakes. If Heinberg is right, policymakers are operating under two fateful, and possibly fatal, illusions.

First, they think the U.S. has a “250-year supply” of coal, and that China, Russia, Australia, and India have similarly inexhaustible supplies. They’re almost certainly wrong.

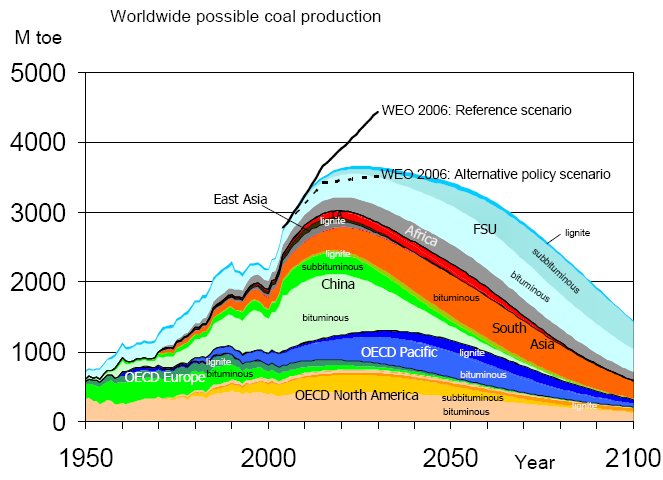

The bulk of Heinberg’s book is a methodical walk through several recent studies on coal reserves. (One of the most shocking facts about coal reserves is how little we know about them — they were scarcely studied in any systematic way before 2005.) If you have time for just one, check out “Coal: Resources and Future Production” [PDF], by Germany’s Energy Watch Group. It’s a page-turner!

A key feature of recent studies is that they abandon the conventional but misleading expression of coal supplies: reserves-to-production ratio, or R/P. Divide total reserves (how much is in the ground) by the current rate of production (how much we’re using) and voilà, a big number — a 250-year supply, even.

But rates of fossil-fuel production are not, indeed cannot physically be, static. The easiest reserves are found first. Over time, as more accessible seams are mined out, what remains is increasingly difficult to obtain and expensive to transport. In every coal field, every country, every region, the energy-return-on-investment (EROI) rises, peaks, and declines. Post-peak, it takes more and more energy to reach the coal and get it where it needs to go. The crucial issue is not how much coal is left in the ground but where we are on the curve, and more to the point, when we cross into negative EROI, the crucial line after which it takes more work to get coal out of the ground than coal returns in energy.

Obviously that line is a moving target. It depends on commodity prices, technology, the cost of transport, and any number of other dynamic variables. Nonetheless, it’s possible to sketch a basic bell curve for EROI (a “Hubbert linearization,” in dorkspeak) for coal production. That’s what the Energy Watch Group (EWG) and others have recently done, and as it turns out, the news ain’t pretty.

(This will all sound very, very familiar to the peak-oil crowd. Turns out coal is a finite fossil fuel too!)

According to the EWG, global coal production will, best-case scenario, peak and begin declining about 20 years from now. Yikes.

The second fateful illusion: that carbon capture and sequestration can enable the continued expansion of coal use.

Industry insiders admit that CCS technology will not be developed, and costs reduced enough to prompt widespread adoption, until 2035 at best. By then, if CCS becomes a primary climate strategy and EWG-style analysis is correct, humanity will be in the grips of four interrelated costs and risks associated with coal. Quoting Heinberg:

• the need for substantial investment in new CCS technology;

• higher coal prices and shortages due to depletion;

• higher electricity generating costs due to the use of IGCC and CCS; and

• lower electricity generation efficiencies due to the use of CCS, requiring more coal to produce an equivalent amount of electricity.

So at a time when supplies are declining, while commodity and transportation costs are rising, we’ll need much more coal to get the same amount of electricity from a more expensive generation technology. Surely you see the wisdom of the strategy.

Another issue that doesn’t get the press it deserves is the investment necessary to produce the infrastructure for widespread CCS. It’s mind-boggling. Ultimately humanity would be burying more than twice the amount of CO2 that it digs up in coal, more than eight times the amount of yearly volume handled by the global crude oil industry (according to Vaclav Smil). Building the new-gen plants, running more railroad cars to bring the increased coal supplies necessary to run them, building and burying all the CO2 pipelines, maintaining CO2 burial fields … it all requires not only an enormous amount of money but an enormous investment of energy, and fossil energy is a finite commodity.

Heinberg’s conclusion: it’s renewables or nothing.

Imagine the remaining reserves of oil and coal as a savings account. There’s a lot in the bank, but pretty soon income is going to decline and savings are going to get drawn down. The question before us is: how fast should we draw down our fossil savings, and what should we spend them on?

Spending on CCS poses a fateful opportunity cost. If scaling up renewables and efficiency (R&E) is difficult today, it will be doubly so when savings have been drained pursuing CCS infrastructure. According to the scenarios developed by Heinberg and the Post Carbon Institute, massive CCS investment would at best delay an energy crash by a decade or two. I’m dubious of these kinds of scenario exercises, but it’s inarguable that after all that fossil energy is spent on CCS, it can’t be retrieved. There’s no do-over. If it doesn’t work out, the energy needed to build out R&E infrastructure will only be more expensive.

One subject on which Heinberg strikes me as unduly pessimistic is the potential for R&E. He and the Post Carbon Institute think the best-case scenario is a massive, controlled, humane reduction in human population alongside a transition to a much lower-energy, localized form of life. For my part, I incline bright green. Worldchanging‘s Alex Steffen put it well in a recent tweet: “To be bright green is to know that a sane respect for planetary limits imposes no meaningful limits on humanity’s potential, at all.” It is possible to flourish sustainably.

But that’s an argument for another time. At minimum, a sustainable future requires the best possible understanding of available coal reserves and their likely cost. If “clean coal” turns out to be a phantom, chasing it will not only waste time, it may foreclose the only decent options we have left.