Your food doesn’t come from here, but it starts here: an ammonia factory. We burn through more of it per capita than any other country; and our appetite for it can only be sated with massive imports.

Your food doesn’t come from here, but it starts here: an ammonia factory. We burn through more of it per capita than any other country; and our appetite for it can only be sated with massive imports.

No, not oil — I’m talking about nitrogen fertilizer. With only 5 percent of the world population, the U.S. consumes nearly 12 percent of the globe’s annual synthetic nitrogen fertilizer production. And we’re producing less and less of it at home — meaning that, as with petroleum, we’re increasingly dependent on other nations for this key crop nutrient.

In a sense, the answer to the question of where our food comes from is not some vast Iowa cornfield or teeming North Carolina hog factory. It’s places like the Port Lisas Industrial Estate on the Caribbean island nation of Trinidad and Tobago, where 10 natural gas-sucking ammonia plants produce about a quarter of the nitrogen fertilizer used by American farmers.

Nitrogen fertilizer production is tied directly to natural gas, the energy source used in the United States to synthesize nitrogen-rich ammonia from thin air. So you could also imagine our food coming from some vast natural gas deposit in the Gulf of Mexico or off of Trinidad. Nearly as much as grain elevators or supermarkets, off-shore gas rigs count as vital food-system infrastructure.

But as U.S. natural gas prices began rising early this decade, the domestic nitrogen fertilizer industry went into crisis. Producers either scaled up to gain efficiency, moved to countries with cheaper natural gas sources like Trinidad and Tobago, or simply shuttered plants.

The industry has flirted with the idea of switching to gasified coal as the energy source for N fertilizer. “Recent advances in using coal to produce ammonia have increasingly made this technology economically feasible, especially at high natural gas prices,” USDA analyst Wen-yuan Huang wrote in a 2009 paper [PDF]. “Domestic ammonia production based on coal may play a larger role in the U.S. nitrogen supply if economic conditions and environmental considerations are favorable.”

But so far, only one firm, North Dakota-based Dakota Gasification Company, makes a significant amount of nitrogen fertilizer with gasified coal. Another plant, Kansas-based CVR Industries, is making nitrogen fertilizer with yet another fossil-based alternative: gasified petroleum coke. Together, these companies generate about 5 percent of our domestically produced nitrogen. But these exotic inputs don’t seem to be on the verge of pushing out natural gas anytime soon, Janice Berry, a researcher at the Alabama-based fertilizer industry tracker IFDC, told me. “I know of no companies that plan to switch over,” she said. And that’s just as well, because moving to carbon-rich sources like coal and petroleum would only add to N fertilizer’s massive carbon footprint.

Instead, with natural gas prices high, the domestic industry has shrunk. Between 1999 and 2008, domestic nitrogen fertilizer production plunged nearly 40 percent, according to a USDA report [PDF]. But demand for nitrogen — the juice that keeps those big corn crops coming — rose steadily. To fill the gap, we now import more than half of the nitrogen we consume, compared to about 15 percent just a decade ago, the USDA report states.

So where does our nitrogen come from? Given our food system’s reliance on synthetic nitrogen, that’s another way of asking: Where does our food come from?

Domestic squabbles

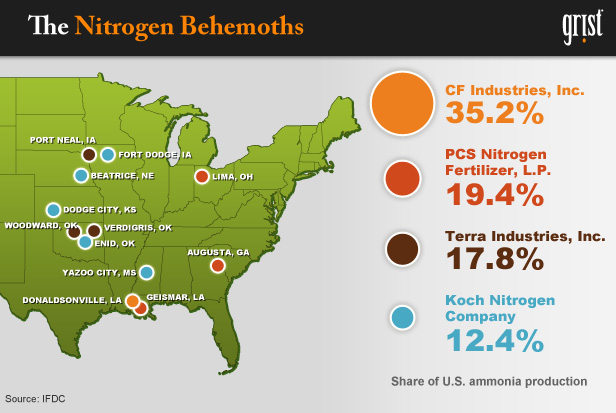

Like most of the agribusiness sector, the North American nitrogen fertilizer industry is tightly consolidated in the hands of a few large companies. A December 2009 report from the fertilizer-industry research group IFDC tells the story. (The proprietary report, called “North American Fertilizer Capacity,” is available for a fee here.) Ammonia (NH3) is the main ingredient in the nitrogen fertilizer farmers spread on fields. Four transnational companies — CF Industries, Koch Nitrogen, PCS Nitrogen Fertilizer, and Terra Industries — generate 72 percent of the ammonia produced in the United States. Another major nitrogen fertilizer product is urea — used both on farm fields and as a cheap protein enhancer in cow feed. For urea, those same four companies control nearly 84.8 percent of the market, IFDC figures show.

As the overall U.S. N fertilizer industry faltered, those companies gobbled up market share. And they concentrated production in areas rich in natural gas — the Mississippi Delta, Oklahoma, and the Texas panhandle. Perhaps not coincidentally — given the petrochemical industry’s political power — these same areas also tend to have weak environmental protection regimes.

And make no mistake: like any petrochemical activity, generating nitrogen from natural gas is a dirty process. To make our fertilizer, ammonia companies not only generate vast amounts of carbon dioxide, they also emit millions of pounds of toxic chemicals each year. Deerfield, Ill.-based CF Industries owns 28 percent of the nitrogen-fertilizer market “in key Corn Belt markets,” according to the company’s website. In Donaldsville, La., the company runs what it calls “North America’s largest” nitrogen-producing facility.

The Donaldsville plant lies in so-called “Cancer Alley,” the petrochemical-intensive zone between Baton Rouge and New Orleans that is notorious for its alleged cancer clusters. Donaldsville is in Ascension Parish. As of 2002, Ascension “ranked among the dirtiest/worst 10 percent of all counties in the U.S. in terms of total environmental releases,” according to the pollution-information site Scorecard. According to Scorecard, the worst polluter in the county was CF Industries. Two other fertilizer firms, Triad Nitrogen and PCS Nitrogen Fertilizers, also cracked the top ten, joining German agrichemical giant BASF and Dutch-owned Shell Chemical, among others. (Of the top ten toxins released in that county, at least four are related to fertilizer production.)

The Donaldsville plant lies in so-called “Cancer Alley,” the petrochemical-intensive zone between Baton Rouge and New Orleans that is notorious for its alleged cancer clusters. Donaldsville is in Ascension Parish. As of 2002, Ascension “ranked among the dirtiest/worst 10 percent of all counties in the U.S. in terms of total environmental releases,” according to the pollution-information site Scorecard. According to Scorecard, the worst polluter in the county was CF Industries. Two other fertilizer firms, Triad Nitrogen and PCS Nitrogen Fertilizers, also cracked the top ten, joining German agrichemical giant BASF and Dutch-owned Shell Chemical, among others. (Of the top ten toxins released in that county, at least four are related to fertilizer production.)

In the EPA’s assessment of the highest-emitting facilities in Louisiana, CF’s Donaldsville fertilizer plant ranked number four. It discharged 7.6 million pounds of chemical waste in 2007, the agency claims.

Nor has CF Industries been particularly diligent about the toxicity levels of the fertilizer-related chemicals it makes. In 2004, Environmental Defense chided [PDF] CF Industries for failing to disclose sufficient hazard information for several fertilizer-related high-production volume (HPV) chemicals it produces.

CF’s few remaining rivals in the North American nitrogen production space have also had environmental slip-ups. Agrium — which dominates Canada’s N fertilizer market and has a strong presence in the U.S. — and Terra Nitrogen both appeared on Environmental Defense’s HPV list. Scorecard counts Terra’s large facility in Claremore, Okla. among the top ten percent of the “dirtiest/worst facilities in the U.S.” In March of this year, the EPA ranked Terra’s plant number five on its top-ten list of facilities with the highest level of chemical releases in Oklahoma, with 2.7 million pounds of chemicals released. Another fertilizer facility, Koch Nitrogen’s plant in Enid, Ok., placed third, with 3.3 million pounds released.

As for Agrium, the EPA has had to rebuke its U.S. nitrogen facilities three times for pollution violations since 2003. The most recent came in 2007, when the agency fined Agrium $750,000 “to settle violations of the New Source Review (NSR) provisions of the Clean Air Act uncovered by EPA.” “This company increased its profits by ignoring environmental laws,” said an EPA spokesperson at the time.

Meanwhile, the three largest players in the North American N market — CF Industries, Terra, and Agrium — appear on the verge of morphing into two companies. They’re locked in an extraordinary three-way proxy fight — Agrium is making a hostile bid to take over CF Industries, which is involved in a hostile bid to take over Terra. Whatever the outcome, our tightly consolidated nitrogen industry looks set to get more consolidated.

Foreign Affairs

While those players duke it out over the remaining profitable U.S. nitrogen facilities, our reliance on imported nitrogen is expanding. Our three largest suppliers are Trinidad and Tobago, Canada, and Russia/Ukraine, which account for 56 percent, 16 percent, and 14 percent of imported N, respectively.

If Trinidad and Tobago — a small island nation of 1.2 million citizens off the coast of Venezuela — supplies more than half our nitrogen imports, that means it provides fully a quarter of the synthetic nitrogen used in U.S. agriculture.

An off-shore natural gas rig: as vital to our food system as grain elevators or supermarkets. Since privatizing in the 1990s, Trinidad and Tobago’s fertilizer industry has come under the control of multinational corporations. Nitrogen production, along with other petrochemical activities, is concentrated at Point Lisas Industrial Estate on Trinidad’s southern coast. Home to nearly 100 companies and occupying over 860 hectares, Point Lisas fuels Trinidad’s economy with taxes generated by the petrochemical industry. There, massive ammonia plants transform a portion of the island nation’s natural gas bounty into fertilizer for our farms. According to the IFDC report, two North American companies, PCS and Canada’s Yarrow, own more than half of the nation’s ammonia production. And PCS makes all of the nation’s urea.

An off-shore natural gas rig: as vital to our food system as grain elevators or supermarkets. Since privatizing in the 1990s, Trinidad and Tobago’s fertilizer industry has come under the control of multinational corporations. Nitrogen production, along with other petrochemical activities, is concentrated at Point Lisas Industrial Estate on Trinidad’s southern coast. Home to nearly 100 companies and occupying over 860 hectares, Point Lisas fuels Trinidad’s economy with taxes generated by the petrochemical industry. There, massive ammonia plants transform a portion of the island nation’s natural gas bounty into fertilizer for our farms. According to the IFDC report, two North American companies, PCS and Canada’s Yarrow, own more than half of the nation’s ammonia production. And PCS makes all of the nation’s urea.

Such multinational corporations enjoy doing business there. “Trinidad and Tobago has earned a reputation as an excellent investment site for international businesses and has one of the highest growth rates and per capita incomes in Latin America,” the CIA Country Handbook gushes. Yet it does less well by its own people. Trinidad and Tobago is essentially a miniature petro-state: its natural resources are being exploited at a vigorous rate, mainly by multinational corporations, with minimal boost to local employment. According to the CIA Handbook, “Oil and gas account for about 40 percent of GDP and 80 percent of exports, but only 5 percent of employment.” Despite the nation’s petrochemical-fueled economy, nearly one in five of its citizens lives in poverty, according to the U.N.

Moreover, environmental controls are notoriously lax; and the nation recently scored just 3.6 points out of 10 in Transparency International’s Corruption Perceptions Index, tying it for 72nd among 180 nations.

Thus in order to maintain America’s agriculture production, we’re sucking natural bounty out of a distant nation and leaving its citizens little to show for it.

The situation is not only morally dubious; it could be literally unsustainable. Natural gas, like oil, is a finite resource. According to a 2005 International Monetary Fund report [PDF], Trinidad’s natural gas reserves “are expected to taper off by 2021.” If that prediction holds true, natural gas prices in Trinidad will spike, and its fertilizer industry, like ours in the 2000s, will wither.

Into Murky Geopolitical Waters

When Trinidad fades as a nitrogen source, where will our soil fertility come from? Let’s look at our other major N suppliers: Canada, Russia, and Ukraine. On the topic of Canada, which currently supplies 15 percent of our imported nitrogen, prominent energy blogger Neal Rauhauser puts it like this:

There will come a day within the next decade where Canadian natural gas production stops, not because there isn’t any gas left in the ground, but because the creation of the wells to get to them require more energy than the pools contain.

That leaves Russia and Ukraine. The first problem here is distance. A significant portion of imported fertilizer’s final cost is shipping. According to USDA analyst Huang, transportation costs account for 22 percent of the cost of ammonia shipped from Trinidad and Tobago, compared to more than 50 percent for product from Russia.

Then there’s the uncomfortable fact that Russia and Ukraine are embroiled in a bitter dispute over natural gas. Russian natural gas exports to Europe pass through Ukraine, and Russia has accused Ukraine of siphoning off product. Twice in the last decade–most recently last winter–Russia slashed natural gas shipment to Ukraine, causing shortages in Europe as seasonal demand for heating gas was at its height. As a result, the International Energy Agency revoked Russia’s status as a natural gas supplier to Europe. Ukraine’s nitrogen fertilizer industry, which relies heavily on Russian natural gas, could have similar problems in the years ahead.

Thus like our addiction to cheap oil, our reliance on cheap nitrogen is leading us into politically unstable places. (Other nations with enough natural gas deposits to keep us in nitrogen for a while include Venezuela, Iran, and Iraq.) In other words, if we’re smart, we’ll soon greatly reduce our dependency on synthetic nitrogen — or at the very least figure out ways to synthesize it that are less resource-intensive.