On Wednesday, Minnesota became the first state to allow utilities a new method of contracting with distributed solar producers, called the market-based “value of solar.” If adopted by utilities, it will fundamentally change the relationship between solar-producing customers and their electric utility.

Following Minnesota’s Value of Solar Process? Here are a few resources:

- Part 1 and Part 2 and Part 3 and Part 4 of ILSR’s series of posts on the process

- The MN Department of Commerce final comments and draft value of solar methodology (January 2014)

- My comments to the Department of Commerce on value components to include (PDF and slideshow)

- Live tweets and context with Twitter hashtag #MNVOST

- The Department’s value of solar stakeholder resource page

- The enabling law (see Sec. 10 and following) – HF 729

Until now, producing on-site energy from a solar panel has been treated much like any other activity reducing electricity use. Energy produced from solar is subtracted from the amount of energy used each month, and the customer pays for the net amount of energy consumed. This “net metering” policy has guided the growth of distributed solar power in the United States to an astonishing 13 gigawatts GW by the end of 2013.

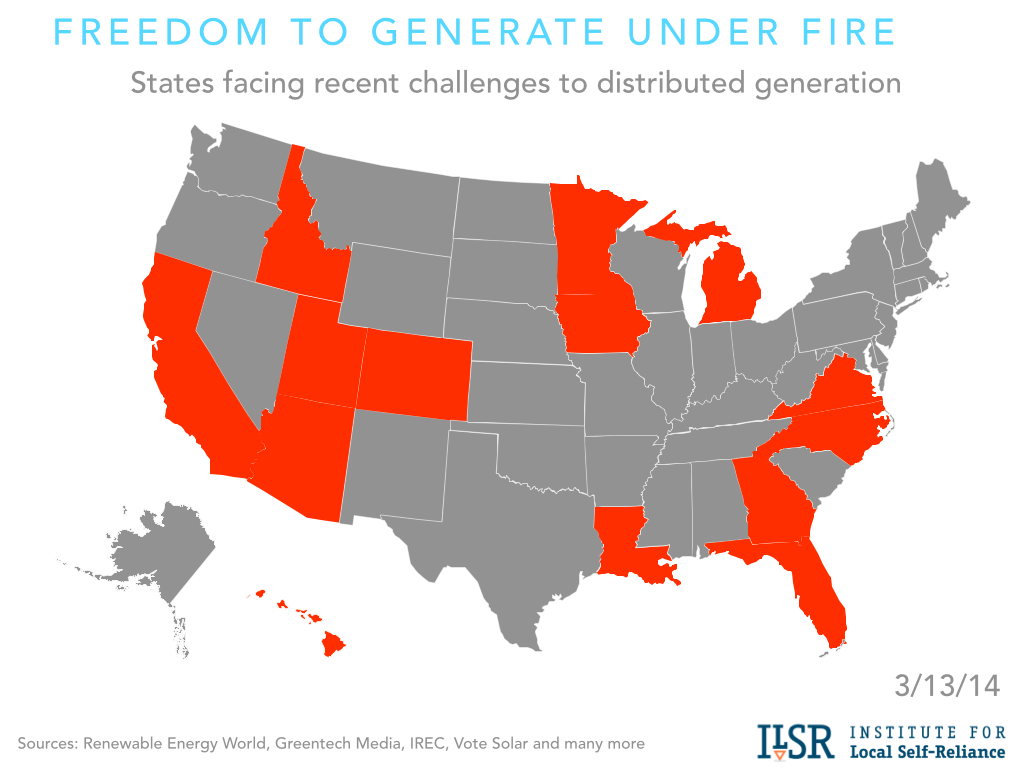

But net metering has been the focal point for the utility war on the democratization of the grid, a phenomenon made possible by enormous reductions in the cost of on-site power generation from solar. The following map illustrates the many states where utilities have sought to undermine policies and/or incentives supporting distributed renewable energy generation.

The transformation of the grid has utilities crying foul (or fowl) because lots of customers using net metering reduces their balance sheet revenue. However, increasing evidence suggests that the overall economic benefits to the utility’s electric grid may outweigh the loss of revenue.

Value of solar creates a market price for distributed solar energy in an effort to answer the utility’s cry. And Minnesota’s rigorous formula suggests that in crying “foul,” utilities may have been crying “wolf.” That’s because the initial estimates of the market value of solar peg it at more than the retail electricity price. In other words, utilities have been getting a sweet deal on solar power.

Will Value of Solar Work?

Will the value of solar market price be sufficient to maintain growth in distributed solar generation?

Yes, according to preliminary calculations.

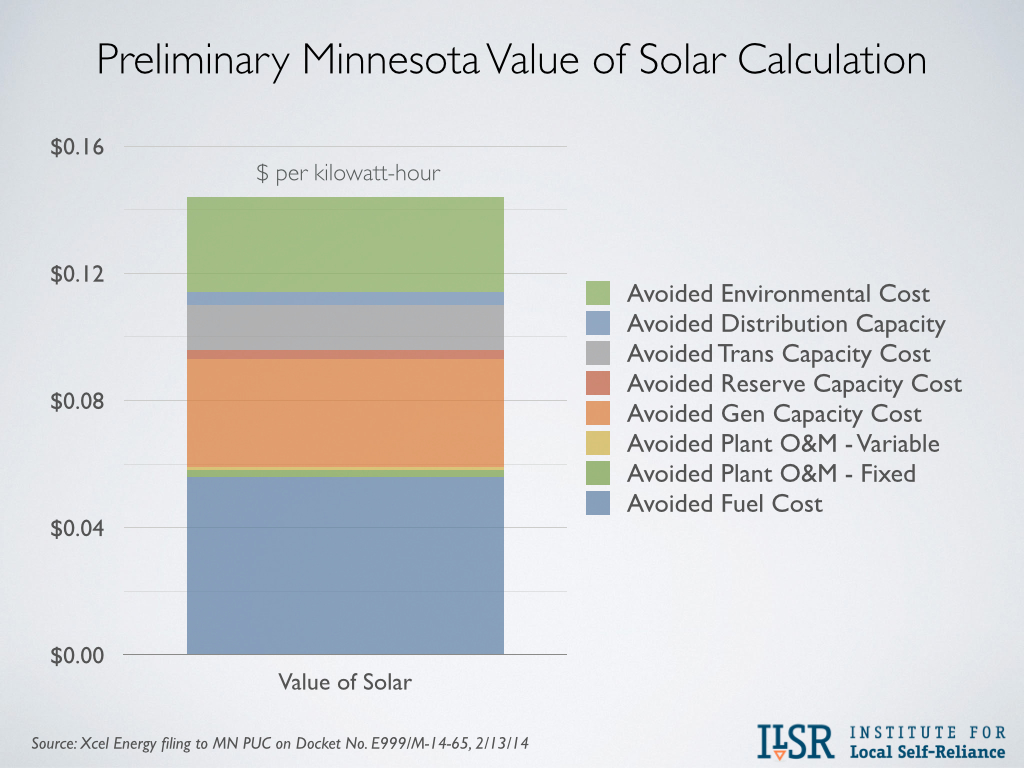

Xcel Energy, the state’s largest electric utility, shared estimations for the value of solar in its comments (to reduce the value) to the Public Utilities Commission in mid-February. Their calculations follow:

The solar market price includes eight separate factors, but the largest four account for the lion’s share of the value: 25 years of avoided natural gas purchases, avoided new power plant purchases, avoided transmission capacity, and avoided environmental costs.

The value of avoided fuel cost recognizes that utilities cannot buy natural gas on long-term contracts the way they can buy fixed-price solar energy, and it internalizes the risk of fuel variability that utilities have previously laid on ratepayers.

The avoided power plant generation capacity value recognizes that sufficient solar capacity allows utilities to defer peak energy investments (like Xcel’s recently requested 3 natural gas peaking power plants that an administrative law judge discarded in favor of distributed solar).

Avoided transmission capacity costs rewards solar for on-site energy production, saving on the cost of infrastructure and energy losses associated with long-range imports.

The environmental value may be the most precedent setting, because it means that when buying solar power under Minnesota’s value of solar tariff, a utility is for the first time paying for the environmental harm it had previously been socializing onto everyone else. This value is based on the federal “social cost of carbon” as well as non-carbon externality values adopted by the Minnesota Public Utilities Commission.

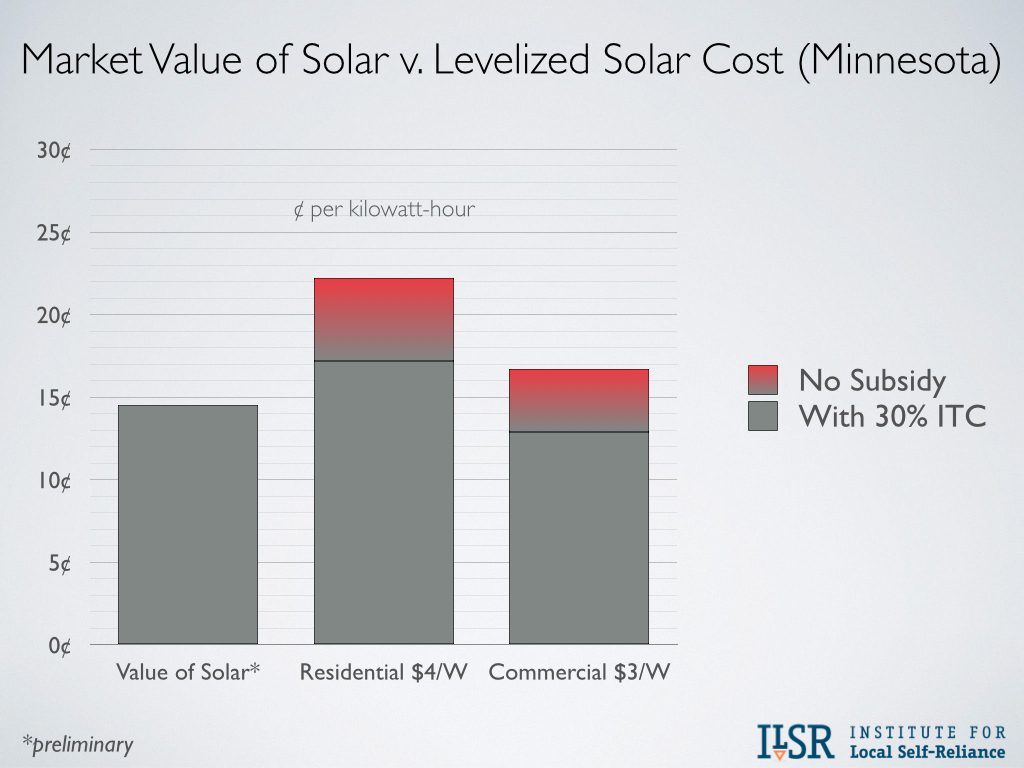

All told, the preliminary market value of solar estimate by Xcel Energy (14.5¢ per kilowatt-hour) for Minnesota comes fairly close to the levelized cost of energy from solar projects in Minnesota using the federal 30% Investment Tax Credit (ITC). Residential projects installed at $4/Watt will cost 17.2¢ per kWh over 25 years (and be eligible for state incentives). Commercial projects installed at $3/Watt will cost 12.9¢ per kWh over 25 years.

Will Utilities Adopt Value of Solar?

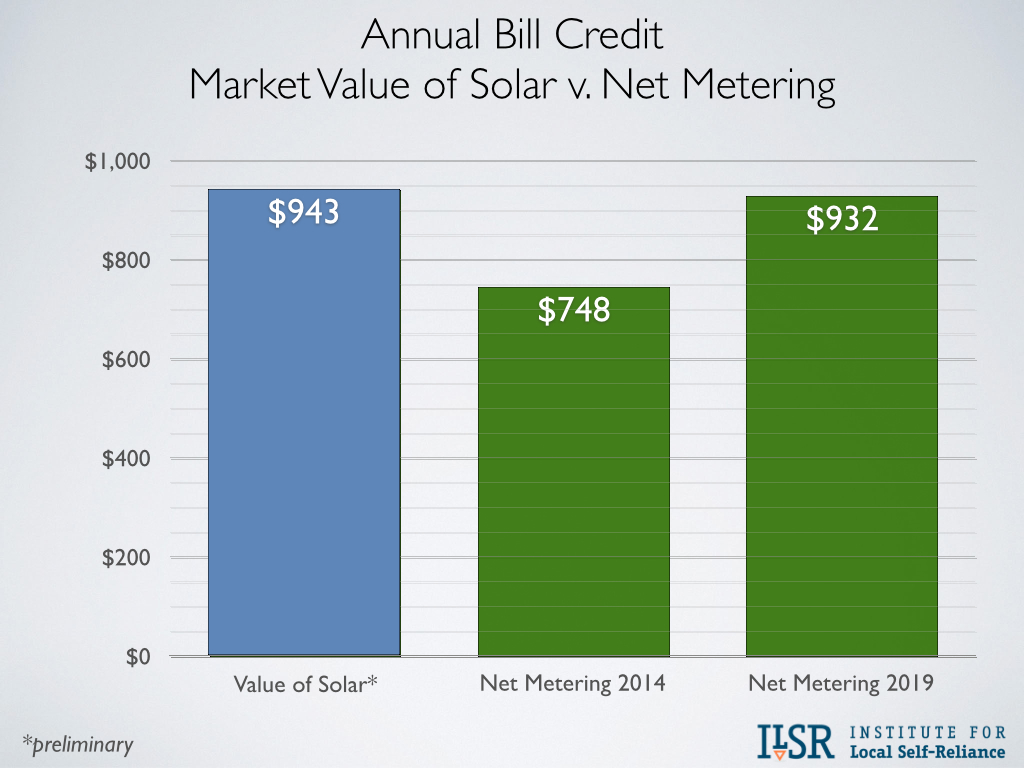

The crucial remaining issue is whether Minnesota utilities will adopt value of solar in place of net metering. The adopted methodology may require utilities to (in the short run) pay more for solar electricity than they do under net metering. The following chart shows that a representative residential customer with a 5 kW solar array would net an extra $200 bill credit this year with the value of solar than they would using net metering.

Within five years, however – based on recent utility rate inflation of 4-5% per year – the premium falls to just $12. And over the life of the value of solar contract – 25 years – the net present value (5% discount rate) of utility payments for solar production is $3,000 less under value of solar than under net metering.

Not only that, utilities lock in the market value of solar when the signed a 25-year contract, not bad for a business rocked by volatile fuel prices.

Who Wins?

In theory, everyone is a winner if utilities adopt Minnesota’s market value of solar. In the near term, solar energy producers will get a better price than they have under net metering. In the long term, the cost of solar will fall (perhaps significantly) below the market value (accelerating the development of solar energy), and the 25-year, fixed price contract will help small-scale producers secure financing.

Utilities should also come out ahead. Over the 25-year life of solar projects, they will pay less for solar energy than under net metering. Furthermore, greater amounts of solar on the grid will (over time) erode the market price for solar energy since much of its value is based on low (zero) fuel costs and environmental advantage over fossil fuel generation.

The market value of solar should also be a victory for ratepayers. First, it’s transparent and without subsidy. In fact, it removes hidden subsidies for polluting fossil fuel generation. Ratepayers also get to purchase this renewable resource based on its value to the grid and not an awkward and obscure retail price proxy.

Is the market value of solar the best thing to come out of Minnesota in 2014? If nothing else, it beats the polar vortex.