This is the first in a series on how we can build an energy future based on our best science and no longer critically dependent upon exhaustible and polluting fossil fuels.

Too often, discussions of our future energy system simply reflect the current array of political forces in Washington or the novelty-hungry attention of the media and not the long-term viability of technologies and proposed solutions. As the price of oil is the most pressing issue from a short-term perspective, I am starting this series of policy briefs with how the energy used in transport on land can be transferred from liquid fossil fuels to cleanly generated electricity; in the second part I will address how we can create the conditions for powering the grid in the post-fossil fuel era.

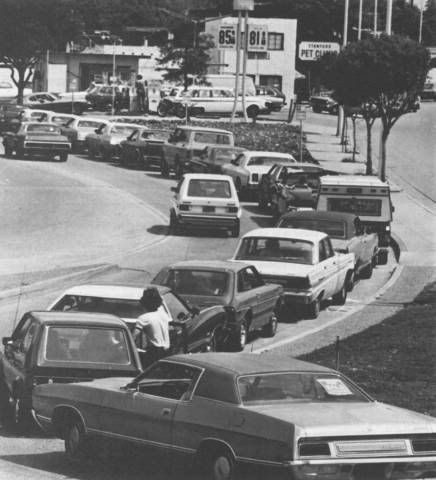

Oil supply: speculation and long-term trends

We can all now agree that it has been the ultimate in shortsightedness to continue building a society founded upon burning ever increasing amounts of easily exhaustible resources. Not only is it highly visible, petroleum at the pump, but, behind the scenes, the vital energy for agriculture and freight transport that now depend upon the output of oil wells, mostly located abroad. In the U.S. in particular, we have had a 25 year hiatus in facing this reality through political, cultural, and corporate resistance to change, which means that Americans are starting the race far behind the starting line. In addition, as it turns out, the burning of these fossil resources alters the global climate and creates local pollution and health problems. There are other ills and challenges in our world but currently fossil fuel addiction is one of the most pressing but also, fortunately, soluble problems.

Talk of a speculative bubble in the oil markets is a distraction from the fundamental reality of a widening gap between increasing transport energy demand and static or dwindling supply of liquid hydrocarbons. Those who put their faith in speculation as the driver of punitively high oil prices come from two divergent camps. Some are wedded to the energy status quo by a conservative, jaded view of energy alternatives and function as defenders of the fossil fuel energy industry establishment (the business commentator Larry Kudlow comes to mind). A more surprising group are populists and left-leaning analysts who always use the formula “qui bono” (who benefits) to locate the responsible parties for any social ill. These critics of oil companies and oil sheiks continue to promote the illusion of an endlessly abundant and forgiving Nature, which is despoiled not by our combined global thirst for energy but solely by a thin layer of greedy profiteers, who can be punished or pushed aside thereby making the problem go away. We can safely expect oil to continue to climb in price even if we are now currently in a period where emotions have driven prices higher than actual supplies would warrant as some continue to profit from the price run-up.

Beyond speculation, suggestions that we can drill and refine our way out of the inevitable decline of oil that we have known for a long time to be in finite supply anyway, function as populist pandering or as short-term profit-maximizing calculus by parts of the oil industry. Members of the latter group, in a profits-over-ethics mode, would like us to continue to depend on oil as long as it is profitable for oil producers, which will be the case until a fundamental break with petroleum use in transportation is organized; obviously scarcer but more expensive oil will continue to be a cash cow unless a new post-oil transport system has been built. There is fundamental conflict between backward-looking portions of the petroleum industry and the general health of our economy and environment, a conflict which must be decisively resolved by policymakers and the voting and buying public in favor of new, cleaner energy sources in the next few years.

On the other hand, realistically, oil production and supply will need to remain a concern for a few more decades, yielding a very delicate but extremely important political challenge. On the political side, Republican presidential candidate John McCain has relied on common wishes that more domestic oil production through offshore drilling will somehow eliminate or significantly soften the inevitable price spiral upward. Such drilling will only have an impact 10 years hence at a point when worldwide demand will have still further outstripped supply and prices will be in a comparative sense stratospheric. Not quite drawing a clear political front on this issue, Barack Obama has lately been attempting to accommodate the popular appeal of offshore drilling by suggesting that new drilling would support energy alternatives.

Natural gas with its lower carbon dioxide emissions per unit energy is occasionally touted as an “alternative” fuel but it too can easily be exhausted; in fact, production in natural gas wells tapers off very rapidly as compared to its solid and liquid fossil brethren, making price spikes and shortages all the more likely in a turn to natural gas. The stock-picker Jim Cramer praises natural gas as an investment and T. Boone Pickens, in his new heavily marketed energy plan, trumpets it as an automotive fuel, as we are sure to use more of this dwindling lower-carbon resource, but it is not a sustainable alternative to oil. Relying on natural gas as a climate or energy solution is the modern definition of a Faustian bargain: highly profitable for some, but costly for most economic sectors, our society as a whole, and our atmosphere.

Differentiating short-term and long-term solutions

The impulse to jump on the natural gas or intensified oil exploration bandwagon will distract policymakers by confusing short-term and longer-term solutions. Fluctuations in supply of these hydrocarbons may create a temporary plateau in prices, but no enduring relief. In the short-term, within the next two or three years, steps can be taken to ameliorate what may be, in the energy and transport areas, a grim period. It is here that I part company with some of the doom-and-gloom predictions about economic collapse that originate from some Peak Oil enthusiasts. While I agree with some of the more pessimistic predictions about oil and natural gas supply and pricing, there are short-term, rapidly deployable solutions at least for passenger travel and some freight that will soften the blow.

Effective short-term solutions include:

- Fiscal support for intensified operations by existing public transport — Federal and state governments will need to help local and regional transit agencies to increase their schedules to serve more riders without raising ticket prices substantially.

- Development of internet — and cellphone — based ride-sharing businesses and services. Local development of van-pooling services also enabled by internet and cellphone networks.

- Development of transport centers or nodes for public transit and ride-sharing with municipal and regional oversight to increase efficiency and security.

- Opening of lanes of local streets to lower speed vehicles including neighborhood electric vehicles, scooters, and bicycles.

- Designating space or facilities in buses and trains for small freight hand trucks and bicycles.

- Development of transport demand study tools using the internet to fine-tune and coordinate transport policy and new transportation businesses.

These solutions will not provide the same level of spur-of-the-moment convenience as we might find in the recently past era of cheap fossil fuels and widespread personal vehicle ownership. The transport of medium and larger quantities of freight will also require more capital intensive, longer-term solutions. Nor will these short-term solutions provide the same utility of future innovations in electric vehicles and an EV public and quick-charging infrastructure. Some, used to traveling in their own personal space, will not avail themselves of these stopgap options until they feel more economic pain through still higher gas prices.

Next: Five fundamental options to move into a post-oil, post-natural gas, energy world, and one imperative.