The first thing you should know about Exxon’s 2013 “Outlook For Energy” report, the latest in an annual series that makes predictions about energy use to 2040, is that climate change is mentioned twice. In both cases, the expression is followed by the word “policies.”

So, with that big grain of salt, an oil tanker-sized grain of salt, what does Exxon portend for energy use on our little, warming planet? The toplines:

- “Efficiency will continue to play a key role in solving our energy challenges.” Energy use by developed nations will stay flat.

- “Energy demand in developing nations [those not in the Organisation for Economic Co-operation and Development, or OECD] will rise 65 percent by 2040 compared to 2010, reflecting growing prosperity and expanding economies.” This increase will mean a 35 percent rise in energy demand globally.

- “With this growth comes a greater demand for electricity.” This increased demand for electricity will account for half of the overall increase in demand for energy.

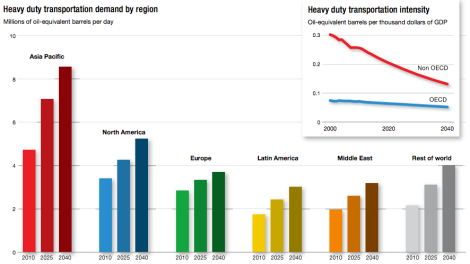

- “Growth in transportation sector demand will be led by expanding commercial activity as our economies grow.” Exxon will keep making money off cars and shipping …

- “Technology is enabling the safe development of once hard-to-produce energy resources, significantly expanding available supplies to meet the world’s changing energy needs.” … and fracking.

- “Evolving demand and supply patterns will open the door for increased global trade opportunities.” North America will start exporting oil.

I mean, that’s pretty grim, if predictable. As living standards increase, so does energy use. And even if the largest energy users — read, greenhouse gas emitters — level off (which is questionable), growth elsewhere in the world more than makes up for it. So by 2040, the world, warmer thanks to what we’ve already emitted, will keep adding to greenhouse gas pollution as it adapts to shifts in climate — and 2 billion more people.

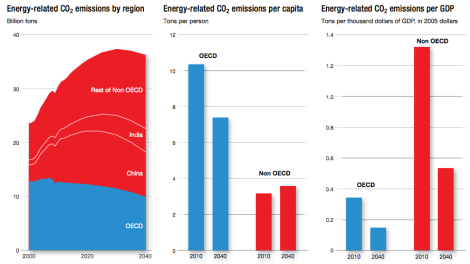

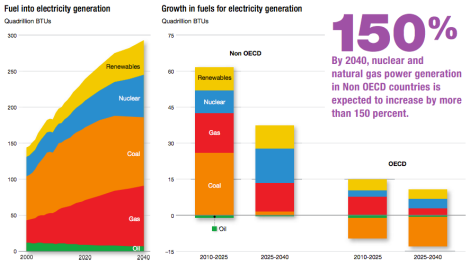

The problem is summarized in these graphs:

OECD CO2 emissions drop; non-OECD emissions rise. That’s that. Thanks for visiting our planet, hope you enjoyed your stay.

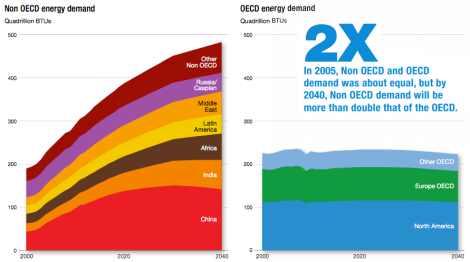

In fact, by 2040 demand for energy in non-OECD countries will be twice that of OECD countries …

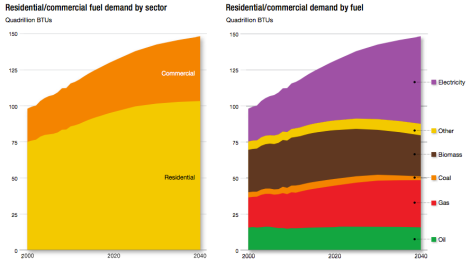

… largely due to residential electricity use.

Generation of that electricity will come mainly from coal until 2025. Renewables will be a slowly growing part of the mix.

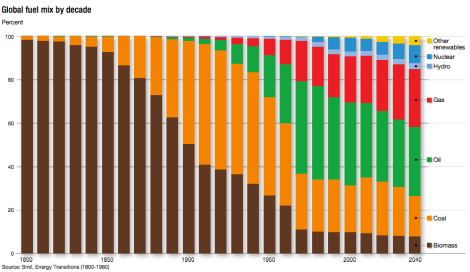

This is a pretty remarkable look at fuel use over time. Even in 2040, more than 80 percent of fuel consumption will be from non-renewable sources, Exxon believes.

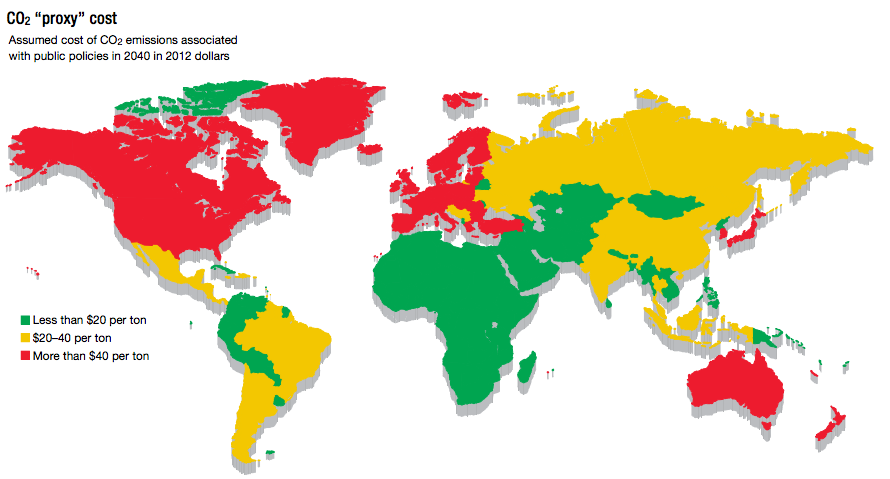

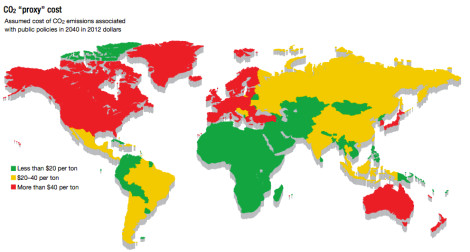

Exxon does consider the effects of a carbon tax or other carbon price (though it insisted this morning that it isn’t seeking one). It expects such taxes will be in place in various countries by 2040 (note the subtle red/yellow/green coloration).

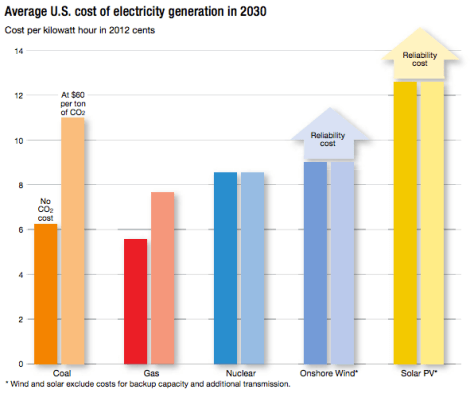

It also estimates how fuel prices will be affected as a result. With a tax in place, coal will be more expensive than anything but solar, according to Exxon — though that doesn’t include the “reliability cost” of renewable sources.

Here’s what Exxon cares about the most: oil use.

For Exxon, sunny days are here to stay. Which is bad news, because the heat from that sun is increasingly being trapped in our atmosphere by greenhouse gases, slowly but surely upending life as we know it.

And there’s your real prediction for 2040.