Cross-posted from ThinkProgress Green.

Tax breaks and subsidies for energy companies have gotten so extreme that dozens of top companies have made billions in profits while having negative taxes — actually receiving taxpayer welfare instead of paying anything to the federal treasury. An analysis by Citizens for Tax Justice and the Institute on Taxation and Economic Policy found dozens of companies that had a negative tax balance [PDF] between 2008 and 2010, while making billions in profits. Because of tax breaks and questionable tax dodging, these companies reported higher post-tax profits than pretax profits, often actually getting checks from the Internal Revenue Service.

Tax breaks and subsidies for energy companies have gotten so extreme that dozens of top companies have made billions in profits while having negative taxes — actually receiving taxpayer welfare instead of paying anything to the federal treasury. An analysis by Citizens for Tax Justice and the Institute on Taxation and Economic Policy found dozens of companies that had a negative tax balance [PDF] between 2008 and 2010, while making billions in profits. Because of tax breaks and questionable tax dodging, these companies reported higher post-tax profits than pretax profits, often actually getting checks from the Internal Revenue Service.

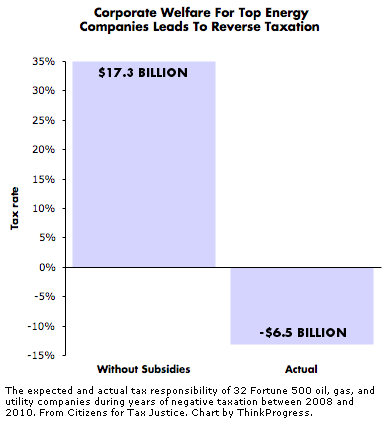

During these years of negative taxation, 32 companies in the fossil-fuel industry — from Exxon Mobil and Peabody Energy to ConEd and PG&E — transformed a tax responsibility of $17.3 billion on $49.4 billion in pretax profits into tax benefits of $6.5 billion, a $24 billion windfall.

The official corporate tax rate in the United States is 35 percent, but subsidies and dodges make that figure meaningless. The overall tax rate for top utility companies from 2008 to 2010 was 3.7 percent [PDF], the report found. Companies in the oil, gas, and pipelines sector paid 15.7 percent. The report’s authors comment:

It seems rather odd, not to mention highly wasteful, that the industries with the largest subsidies (driven in part by their large share of total profits) are ones that would seem to need them least.

Regulated utilities, for example, make investment decisions in concert with their regulators based on the needs of the communities they serve. Oil and gas companies are so profitable that even President George W. Bush said they did not need tax breaks.

D.C.-area utility Pepco had the highest negative tax rate of the 280 companies surveyed in the report, with negative taxes of $508 billion on $882 pretax profits, a whopping negative 57 percent effective tax rate. Pepco chairman, president, and CEO Joe Rigby made $3.6 million in 2010.

The 99% is subsidizing welfare for the 1%. First the corporations profit from the utility bills and gas prices that take a disproportionate chunk of working families’ budgets, then they get another cut from a corporate-friendly tax code. The lion’s share of the profits are kept for the benefit of overpaid executives and superwealthy shareholders. Furthermore, these corporations are profiting from the extraction and burning of fossil fuels, giving them the triple subsidy of the long-term costs of pollution being paid primarily by children and the elderly.

The companies that paid no tax for at least one year between 2008 and 2010 are the utilities Ameren, American Electric Power, CenterPoint Energy, CMS Energy, Consolidated Edison, DTE Energy, Duke Energy, Entergy, FirstEnergy, Integrys Energy Group, NextEra Energy, NiSource, Pepco, PG&E, PPL, Progress Energy, Sempra Energy, Wisconsin Energy and Xcel Energy; and the fossil-fuel extraction and services companies Apache, Atmos Energy, Chesapeake Energy, El Paso, Exxon Mobil, FMC Technologies, Halliburton, Holly, Marathon Oil, Occidental Petroleum, Peabody Energy, and Scana.