Climate Politics

All Stories

-

McCain wants a climate policy that benefits the rich

I see John McCain is upset by the fact that Obama wants to auction 100% of cap-and-trade permits. He wants the vast bulk of the permits to be given away to businesses. There are lots of complicated, obscure issues around carbon policy, but this is not one of them. Let’s be very very clear about […]

-

Quit arguing with douchebags that everyone hates, part two

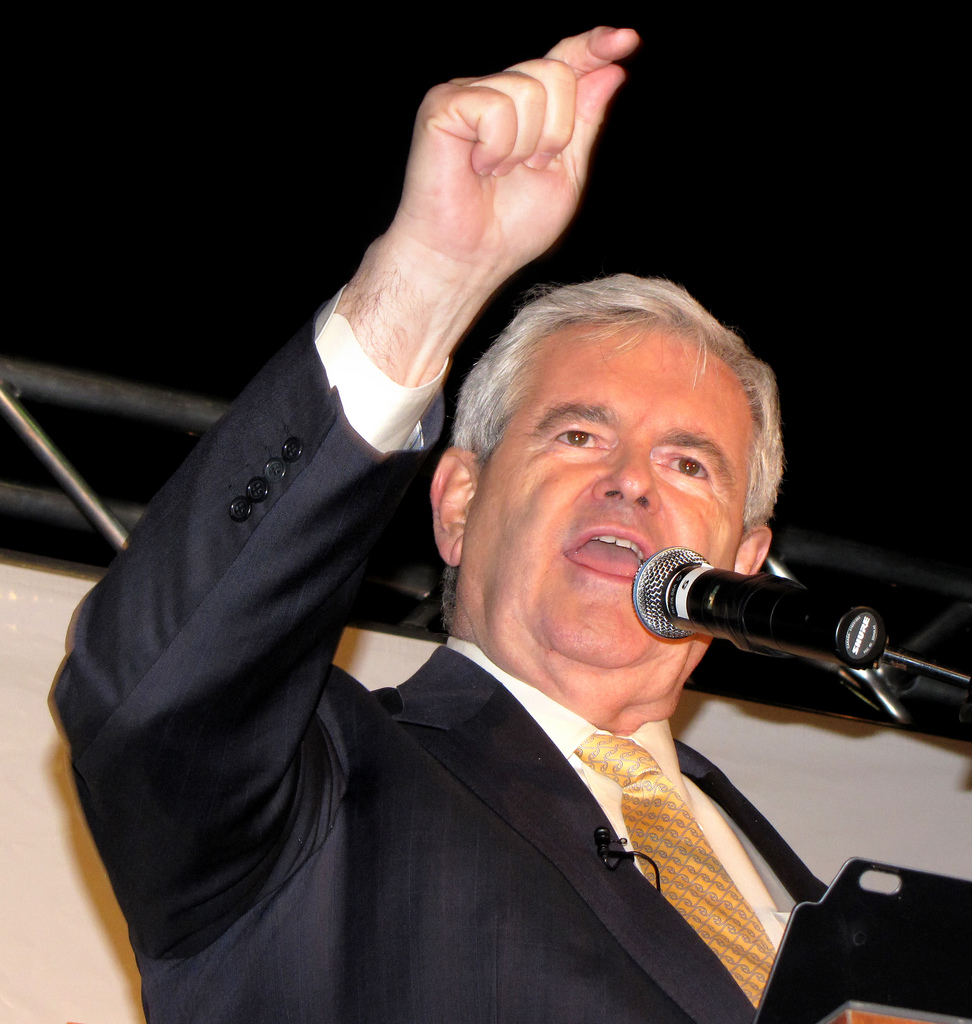

Following up a bit on my previous post, let’s make some more specific points. Point number one: Newt Gingrich is a douchebag and everyone hates him. Few figures in American politics (beyond Dick Cheney) are as discredited and unpopular as the bilious windbag Newt, whose renewed prominence as an “intellectual” on the right side of […]

-

Quit arguing with douchebags that everyone hates

Catching up with email and blog posts I missed while on vacation for a few weeks has been instructive. It appears to me, from this fresh perspective, that progressive bloggers, journalists, and activists are wasting a lot of their time. To understand why, we need to be clear on the current landscape. Right now, Republicans […]

-

Gore and Gingrich bump heads at House climate hearing

Debate on the House climate bill got heated on Friday as Al Gore and Newt Gingrich — two lightning-rod political figures — testified before the Energy and Commerce Committee. Gingrich came crying foul that Congress is poised to begin regulating Jacuzzis, while Gore – you guessed it! –testified to the urgent need to pass an […]

-

Tennessee rep accuses Gore of trying to profit from climate bill

One of the more, uh, interesting moments from Friday’s climate hearings in the House was this exchange between Al Gore and Rep. Marsha Blackburn (R-Tenn.), who suggested that Gore would profit from a cap-and-trade bill. Here’s the video, via TPM, and a transcription follows: Blackburn: I think it’s really important that no suspicion or shadow […]

-

Interest groups pile on with suggested changes to House climate bill

The third day of climate hearings in the House made it clear that even representatives and interest groups that nominally support the principles of the Markey-Waxman bill have a laundry list of changes they’d like to see made to the bill before they’ll back it. Thursday’s hearings brought 26 new witnesses before the Energy and […]

-

Finding consensus on climate policy

Originally posted at the Breakthrough Institute. For advocates of immediate and strong climate and clean energy legislation, there’s one man we should all be paying close attention to: Senator Sherrod Brown (D-Ohio). Senator Brown is one of several Democratic Senators from America’s “Heartland” states that form the critical swing block of legislators that will need […]

-

Progressive coalition spends $250,000 on ads for a green energy bill

A coalition of labor, environmental, and progressive groups is putting up a quarter of a million dollars for a TV ad campaign promoting national clean-energy and climate legislation. The ad (watch it below), which will air on national cable and prime-time network TV for at least the next week, calls on Congress to pass an […]

-

Obama’s Clean Energy Service Corps will train people for green jobs–eventually

He’s ready — put him to work.President Barack Obama created a new Clean Energy Service Corps on Tuesday as part of a landmark national service bill he signed into law. That could be good news for young Americans wanting to get a foot in the door of the clean energy industry — but they’ll have […]

-

Rep. Shimkus says climate bill is worse than two wars and terrorist attack

Via ThinkProgress, here’s video of Rep. John Shimkus (R-Ill.) claiming at Wednesday’s House hearing that the Waxman-Markey climate bill is “largest assault on democracy and freedom in this country that I’ve ever experienced. I’ve lived through some tough times in Congress — impeachment, two wars, terrorist attacks. I fear this more than all of the […]