Climate Politics

All Stories

-

Sustainable funding for sustainable infrastructure

This past Friday, Princeton University's PRIOR Center and New York University's Rudin Center convened a conference on what's next in transportation. The speakers, who included Mort Downey, former Deputy Secretary of Transportation and leader of the Obama transition team for transportation; Tony Shorris, former head of the New York and New Jersey Port Authority; current PA chairman Anthony Coscia; and others, agreed that we are at a crossroads in transportation policy.

On the one hand, there has never been more enthusiasm for new modes of transportation such as high-speed rail and new approaches such as vehicle mileage tolling and congestion pricing. Billions in the stimulus bill and the Obama budget for rail have set off a frenzy of excitement about building high-speed rail in the United States. At the same time, however, the old system of funding infrastructure, the Highway Trust Fund, fed by gas taxes, has never been under greater stress. With a new transportation authorization bill likely to move this year, we stand at a key juncture in U.S. transportation policy.

Transportation reform is vital to building a clean economy. Not surprisingly, therefore, much of the discussion at Princeton focused on the irony of trying to fund the reinvention of transportation out of a five-cents-per gallon gas tax -- at a time when reducing gas consumption has emerged as a national security, economic and environmental priority.

Currently, the Highway Trust Fund, built on nickel-a-gallon gas tax, accounts for the lion's share of infrastructure funding in the United States -- not only for roads, but for mass transit as well. But the fund is essentially depleted (having required a bailout last fall to stay solvent). Additionally, with construction prices higher but gas usage falling, the gas tax now provides only about half the purchasing power needed to sustain our current system, let alone make improvements.

-

Using less fertilizer has no meaningful effect on yield

Speaking of limiting the use of synthetic fertilizer, allow me to throw a little science your way courtesy of Science Daily and the USDA's Argriculural Research Service:

From 1998 to 2008, the researchers evaluated and compared potential management strategies for reducing nitrogen and nitrate nitrogen levels in soil and groundwater.

The first study showed that onions used only about 12 to 15 percent of the fertilizer nitrogen applied to the crop. Much of the remainder stayed in the top six feet of soil. The next year, Halvorson and his colleagues planted corn on the same land and found that it recovered about 24 percent of the fertilizer nitrogen that had been applied to the onion crop.

Following that study, the scientists grew alfalfa on the land for five years, then followed it with a watermelon crop, followed by a corn crop. In the first year that the corn was grown, an unfertilized control plot yielded about 250 bushels of corn.

By comparison, a plot fertilized with 250 pounds of nitrogen per acre yielded about 260 bushels, a small increase that required a significantly higher investment of time and money. Additional corn studies following onion in rotation showed corn was a good residual nitrogen scavenger crop. -

Lieberman-Warner supporter Gregg says Obama climate proposal spends too much on 'special interests'

In 2007, Sen. Judd Gregg (R-N.H.) supported the Lieberman-Warner climate bill. Widely regarded as something of a Frankenstein bill, it directed revenue at every conceivable constituency, based on sometimes tenuous connections to the climate issue. He said his "one reservation" was that more revenue wasn't returned to taxpayers.

Well! Obama just released a budget proposal that would return vastly more of the revenue -- around 82 percent -- to taxpayers. Gregg, who prides himself on being Mr. Moderate Bipartisan, would surely celebrate this development, right?

Nope:

"It's a stalking horse for raising taxes and spending it on special interests." Gregg said of the Obama plan in a telephone interview. "It's a non-starter."

Again, Obama's plan spends far less on "special interests" (Republican code for public investments) than a bill Gregg already supported. The only difference is that Obama's plan is Obama's.

Gregg has talked his way inside the carbon policy tent and now he's trying to burn it down. He's got lots of company.

-

Sea levels to surge at least a metre by 2100, scientists warn at Copenhagen meeting

COPENHAGEN — Months before make-or-break climate negotiations, a conclave of scientists warned Tuesday that the impact of global warming was accelerating beyond a forecast made by U.N. experts two years ago. Sea levels this century may rise several times higher than predictions made in 2007 that form the scientific foundation for policymakers today, the meeting […]

-

A mileage tax may be the best idea that everyone loves to hate

This sort of flew under the radar, but a few weeks ago a federal commission floated the idea of eventually replacing the gas tax with a tax based on the number of miles driven each year. What happened next was odd: progressives, conservatives, and wonks banded together to proclaim a mileage tax to be a stupid idea.

A mileage tax is not a stupid idea. It may prove to be unworkable for technical, political, or even cultural reasons, but at root a mileage tax is both a very good idea and also possibly a necessary one as we undertake a shift away from the internal combustion engine. It's no surprise to see politicians (like Obama) run screaming from this proposal, but why are the pundits piling on?

Before delving into the specific arguments for and against a mileage tax, it's worth noting that the entire country of Holland is doing exactly what commentators have deemed stupid or impossible: starting in 2011, the Netherlands will phase in a vehicle-tracking scheme that applies dynamic pricing to every mile driven. Pricing will vary by vehicle type, time of day, and location, in order to curb both congestion and carbon emissions. The program is designed to be revenue-neutral, and because the government is simultaneously phasing out a steep motor vehicle tax, the plan should end up reducing the burden on low-income drivers. I mention this not to suggest that the U.S. can or should do exactly as Holland does, but just to point out that the concept isn't quite as crazily unworkable as some seem to think.

-

EPA announces plans to regulate coal ash

In response to December’s giant coal ash spill in Kingston, Tenn., the Environmental Protection Agency on Monday announced that it is beginning the process of regulating the waste ponds around the country. The December spill spurred increased attention to coal-waste issues around the country. The 1.1 billion gallons of slurry flooded more than 300 acres […]

-

Marshall Institute misrepresents costs of climate action

With Congress moving forward aggressively to cap global warming pollution, opponents of strong climate legislation are muddying the economics to derail action.

First the good news: Congressional leaders have announced they will move forward with broad energy and climate legislation that will include a cap on global warming pollution -- the single most important step we can take to fight climate change.

The bad news: with Congress on the cusp of action, opponents are once again circulating analyses suggesting that a cap on carbon will hurt the economy and overburden consumers with higher energy costs. The latest making the media rounds comes from the George Marshall Institute.

Like several similar studies we saw during last year's debate over the Climate Security Act, the Marshall Institute analysis consistently misrepresents economic modeling results, painting an inaccurate picture of the estimated costs of climate policy. Here's why:

Cherry picking numbers is a sour approach. The Marshall Institute's study claims to be a meta-analysis, looking at economic studies of the Lieberman Warner bill (S.2191) by MIT, ACCF/NAM, CRA, CDA, EPA, EIA and CATF.1 However, when the Institute makes conclusions about the impact of climate policy on employment and household consumption, it omits the most credible studies from its analysis, namely those by EPA, MIT and EIA.

-

Carbon pricing does not necessarily cause high energy prices

E&E Daily reports ($ub. req'd) today on efforts in the House to try and determine how to minimize the economic pain of CO2 pricing.

They note:

Government studies conclude that for a new U.S. climate law to work, it must stem the demand for carbon-based energy by increasing prices -- not exactly the most politically popular thing to do during an economic crisis that is being compared to the Great Depression.

All the logical failing of our CO2 policy discussion is nested in this paragraph.

For climate law to work, it must put a price on CO2 emissions. But there is no logical reason why that must imply an increase in energy costs, for the simple reason that energy is not CO2.

A price on CO2 emissions, done right, will facilitate a wealth transfer away from CO2-intensive forms of energy, but to assume that this must lead to higher energy costs is to assume that low costs and high carbon go hand in hand. And no matter how many hearings we hold and policies we develop that implicitly or explicitly make this linkage, it ain't there. Coal is freakin' expensive. Efficiency is cheap. Even solar PV is cheap if you ignore the capital costs (just like coal!).

The idea that charging for CO2 will increase energy costs makes as much sense as assuming that charging for mercury will increase tuna costs.

This persistent idea is both inane and dangerous. Inane because it's wrong. Dangerous because it leads to one of two places:

-

Rumor has it Obama will tap Van Jones as his green jobs czar

Word around the blogs is that Van Jones has been tapped to serve as a “green jobs czar” in the Obama administration. We’re still trying to confirm, and we’ll have more soon on this potential new role for someone who’s been a household name here at Grist. [UPDATE: A well-placed source confirms that Jones has […]

-

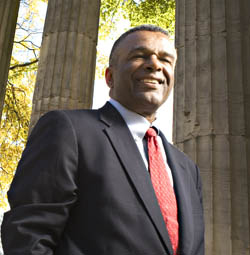

Ron Sims of Seattle plans to green HUD as deputy secretary

Ron Sims. Ron Sims wants to bring a fresh, green perspective to the Department of Housing and Urban Development. Sims — the county executive of King County, Wash., which encompasses the Seattle metropolitan area — is President Obama’s nominee for deputy secretary of the department. “President Obama has … challenged his Cabinet to prepare for […]