As John Oliver memorably said about net neutrality, “if you want to do something evil, wrap it inside something boring.” The same could be said of a recent ruling by the D.C. Circuit Court of Appeals.

The short version: In 2009, the Federal Energy Regulatory Commission (FERC) wrote an important rule meant to boost “demand response” and reduce the need for expensive, fossil-fuel-generated electricity in parts of the U.S. Whiny power generators sued over the new rule, and in May of this year, a three-judge panel of the D.C. Circuit quashed it. FERC appealed to put the case before the entire 11-member court. Late last month, that appeal was denied. The issue is important enough that FERC is likely to petition the Supreme Court to take the case — and if it doesn’t, environmental groups might. If SCOTUS declines, and the ruling stays on the books, it would mean more dirty power on the grid and higher electricity prices for consumers. That’s bad.

FERC orders. Three-judge panels. Demand response. These are not words that stir the soul. But behind all the wonky jargon is an episode that carries important lessons about clean energy and the American judiciary. SO YOU’LL READ ABOUT THIS BORING CASE AND YOU’LL LIKE IT. Ahem.

There are three bits of background you need to understand to grasp what went down. The first is about demand response, the second is about wholesale power markets, and the third is about a radical judge. Each is more exciting than the last! Bear with me.

Demand response

OK, what is demand response? The idea is, during times of high electricity use and grid congestion, you can pay people (or businesses) a little to reduce their consumption. If you get enough people to agree to this and develop a way to coordinate their reductions, you can reliably produce negawatts, i.e., canceled electricity demand. The companies that organize a bunch of people to do this are called aggregators.

Now, negawatts are pretty great, generally speaking. The cleanest electricity is the electricity that never has to be generated. But reliable, responsive negawatts are even better, especially for the electricity grid. They can reduce demand precisely during those periods when it usually spikes (usually in the afternoon, especially on hot summer days, or in the evening when people are arriving home from work, cooking dinner, starting the laundry). Power for those daily peaks in demand is supplied by “peaker plants,” usually natural gas turbines, which produce the most expensive power on the market. By reducing the size of those spikes — “peak shaving,” in the lingo — demand response can take pressure off the grid and hold down the overall price of power.

So just about everyone — the earth, the grid, utilities, ratepayers — benefits from having more demand response available. With Order 745, FERC tried to make more available, by integrating it into wholesale power markets. So we have to take a quick detour through how those markets work.

RTOs

Electricity grids, at least in the roughly half of America that has semi-deregulated electricity markets, are run by Regional Transmission Organizations (RTOs), which typically cover several states. Here are North America’s RTOs:

RTOs, yo.

Created by FERC in 1999, RTOs are charged with regulating wholesale electricity markets. In these markets, generators offer power and utilities buy it, mark it up enough to make a profit, and deliver it to ratepayers via the local distribution grids they run. RTOs make sure that the reliability of the transmission grid is maintained and that wholesale power prices are “just and reasonable,” so consumers don’t get screwed. Think of it like a giant bazaar: power generators hawking their wares, utilities sniffing around for the best price, RTOs patrolling to make sure things run smoothly and nobody cheats.

There are many more details (so many), but they are boring and you mostly don’t need to know them. There are only two additional facts to keep in mind.

One: Wholesale prices for power change hour by hour and area by area, depending on weather, available generators, grid congestion, and any number of other factors. The price for wholesale power at a particular place, at a particular time, is called the Locational Marginal Price, or LMP. (She’s LMP, she’s LMP, she’s in my head.)

Two: Federal jurisdiction extends to wholesale power markets only. Retail electricity markets are under the jurisdiction of states, with their public utility commissions. Once electrons are purchased by utilities and leave the transmission grid to enter the distribution grid, regulatory responsibility jumps from FERC to state PUCs. If you think that sounds like a ridiculous way to to run a national electricity system, you are correct. But that’s a subject for another post.

So, how did FERC try to mix the chocolate of demand response with the peanut butter of wholesale electricity markets? I’m glad you asked.

FERC orders, booyah!

In 2009, under the able chairmanship of Jon Wellinghoff, FERC issued orders 719 and 745, which went on to Change Everything. Or at least change wholesale markets.

Order 719 instructed RTOs to treat negawatts like megawatts — that is, to treat bids from demand-response aggregators the same way they treat bids from power generators. Order 745 established compensation for demand response at LMP, i.e., the price of wholesale power at the time and place it is offered.

Importantly, demand response was eligible for wholesale markets (and LMP compensation) only when it was cost-effective and helpful in balancing supply and demand.

FERC orders are never going to be exciting, per se, but this was a big deal. In a stroke, it structured a market in which demand reduction could compete on a level playing field with power generation — in which not using power could be as valuable as power itself. Wellinghoff rightly views it as a key part of his legacy.

Of course the folks selling power don’t much like the idea of competing with (often cheaper) demand-side solutions, so the rule became a target. And with that, we turn our attention for a moment to the D.C. Circuit Court.

Court nukes 745

In May, a three-judge panel of the D.C. Circuit Court of Appeals vacated Order 745 — completely nuked it.

The pretext for the ruling is that, by structuring compensation for retail ratepayers (the ones reducing their demand for demand-response aggregators), FERC is meddling in retail electrical markets, where it has no jurisdiction. The ruling also found that setting the price of demand response at LMP was done “arbitrarily and capriciously,” without adequate justification.

The counter-argument, well-expressed in the dissent written by Judge Harry T. Edwards (starts on page 17 of the ruling, and is actually pretty good reading), is that Order 745 only addresses demand-response resources that affect wholesale power prices, which are in FERC’s jurisdiction. If available demand-response resources are not fairly compensated, then wholesale power prices are no longer “just and reasonable” — they are higher than necessary. Thus FERC’s involvement.

Ultimately, Edwards concludes, the Federal Power Act (which created FERC) does not speak clearly on exactly where to locate the metaphysical line between wholesale and retail. In such a situation, it’s probably best for judges not to do it either. “The task for this court,” he says, “is not to divine from first principles whether a demand response resource subject to Order 745 is best considered a matter of wholesale or retail electricity regulation.”

Instead, in the absence of any clear statutory language to the contrary, the court ought to defer to FERC’s judgment. (Edwards later objects to “inject[ing] quasi-philosophy” into the ruling: “what is the sound of one hand clapping? What is the true nature of a sale that was never made? of megawatts never consumed?” I’m telling you, it’s a good read.)

Edwards sums up:

The unfortunate consequence [of the majority judgment] is that a promising rule of national significance — promulgated by the agency that has been authorized by Congress to address the matters in issue — is laid aside on grounds that I think are inconsistent with the statute, at odds with applicable precedent, and impossible to square with our limited scope of review.

Why would a federal court insert itself so aggressively into an ambiguous matter of rulemaking, when settled practice and established law generally leave such matters to regulatory agencies?

Funny you should ask.

Bad Bad Leroy Janice Rogers Brown

The D.C. Circuit has been drifting rightward for years, but even in that grim context, this FERC case rolled snake eyes. The three-judge panel hearing the case consisted of Edwards, the Carter appointee who wrote the dissent, Laurence Silberman, a conservative Reagan appointee, and the author of the ruling, Justice Janice Rogers Brown.

You may remember Brown from her heated confirmation fight. Democrats filibustered her in 2003. In 2004-05, Senate Republicans threatened the “nuclear option,” which would have reformed Senate rules to make judicial nominations unfilibusterable. The so-called Gang of 14 struck a “compromise” (to wit, Democrats surrendered and agreed not to filibuster any more judicial nominations) and George W. Bush renominated Brown in 2005, when she was confirmed.

Even by the degraded standards of today’s politics, Brown is a far-right ideologue. She has compared government programs to slavery (“We no longer find slavery abhorrent. We embrace it. We demand more.”), condemned the “collectivist impulse — whether you call it socialism or communism or altruism,” and called the U.S. a “debased, debauched culture which finds moral depravity entertaining and virtue contemptible.”

She has also called for a return to what’s called “Lochnerism,” based on the 1905 Supreme Court case Lochner v. New York. Lochner launched an era of conservative activism on the court, which inhibited or struck down child labor laws, minimum wage laws, banking regulations, and any other imposition on the holy integrity of private property. Lochnerism is an incredibly radical view, or used to be, before the right succeeded in mainstreaming so much radicalism.

Take a look at this 2005 analysis of Brown’s record by conservative legal analyst Stuart Taylor Jr. “Almost all modern constitutional scholars have rejected Lochnerism,” he writes, “as ‘the quintessence of judicial usurpation of power,’ in [conservative justice Robert] Bork’s words.” Its remaining adherents cluster “toward the right fringe of the legal-political spectrum.” Her past comments, he says, “show Brown to be a passionate advocate of a radical, anti-regulatory vision of judicially enforced property rights far more absolute than can be squared with the Supreme Court precedents with which judges are supposed to comply.”

Given that background, Brown’s rulings on the D.C. Circuit Court have been pretty much what you’d expect. (Read this Dahlia Lithwick column about the “starkly political and ideological tone” of one of Rogers’ most remarkable opinions.)

And her ruling in the FERC case is just what you’d expect. She is implacably hostile to federal authority, eager to defend federalism and states’ rights, and has clumsily imposed that ideology on an ambiguous regulatory issue. It’s called “judicial activism” and it’s something conservatives claim to oppose, at least when liberal judges do it.

Remarkably, none of the stories and blog posts I read about this case — not one — mentioned Brown’s record of reactionary radicalism. They just say “the court ruled.” It’s a great example of how reactionary ideology insinuates itself ever further into American life while technocratic liberal elites refuse to acknowledge it.

What’s next?

Demand response is coming, one way or another. Utilities can’t ignore its benefits. In 2009, FERC did a comprehensive study of the national potential for demand response and found that, in the best-case scenario …

… the 2019 peak load could be reduced by as much as 150 GW, compared to the Business-as-Usual scenario. To provide some perspective, a typical peaking power plant is about 75 megawatts, so this reduction would be equivalent to the output of about 2,000 such power plants.

That’s the ideal, of course, with idealized assumptions: best practices spread to every state, advanced metering deployed, dynamic pricing instituted, every household participating, etc. But even the most conservative scenario FERC modeled reduces the 2019 peak by 82 GW, the equivalent of more than 1,000 peaker plants. That’s a lot of the most expensive power canceled out, a huge savings for utilities and ratepayers alike, not to mention many tons of carbon emissions prevented.

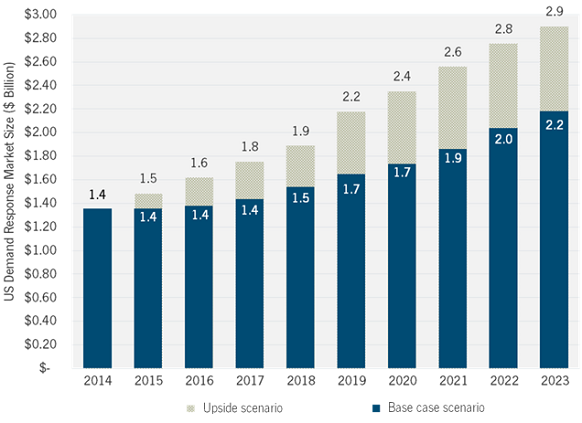

But this ruling could be a serious stumbling block. In a brief before the court, the Maryland Public Service Commission said: “To separate demand response from market participation will increase prices, confuse operations, and make planning unnecessarily complex.” Wellinghoff calls the ruling “devastating.” An analysis by GTM research found that it could cost the demand-response industry $4.4 billion in revenue over the next 10 years (“upside scenario” means Order 745 is reinstated):

Customers will suffer too. An analysis by Navigant found that if all demand-response resources were removed, prices in the PJM capacity market (which covers several east-coast states) would jump three-fold, resulting in substantially higher prices for consumers.

Even as the case is being appealed, there are still ways to move forward. See this excellent post from lawyer Scott Hempling on ways that FERC, utilities, and consumers can support demand response even in light of the ruling.

Meanwhile, it would be great if Obama, liberals, and everyone else concerned with the integrity of social democracy got a little more alarmed about the rightward trajectory of the U.S. judiciary. This is something the conservative movement has been focusing on for decades, and it’s paying grim dividends.

Climate hawks should be alarmed too: “This month a three-judge panel of the D.C. Circuit Court of Appeals agreed to hear a challenge to the Environmental Protection Agency’s new climate rules under the Clean Air Act.” Anybody feel confident about that one?