Photo: NREL/Iberdrola RenewablesAs Paul Krugman’s New York Times Magazine cover story on environmental economics, “Building the Green Economy,” was ricocheting around the enviro blogosphere last week, the American Wind Energy Association released its annual report [PDF] on the state of the wind industry.

Photo: NREL/Iberdrola RenewablesAs Paul Krugman’s New York Times Magazine cover story on environmental economics, “Building the Green Economy,” was ricocheting around the enviro blogosphere last week, the American Wind Energy Association released its annual report [PDF] on the state of the wind industry.

It was an interesting juxtaposition — Krugman’s deep dive into the macroeconomics of an aggressive cap-and-trade or carbon-tax policy to limit greenhouse-gas emissions alongside a report from the frontlines where the green economy is actually under construction.

What’s striking is that the wind farm–building boom continued through the depths of the Great Recession in 2009, with a record 10,010 megawatts of new capacity added last year in the United States. In fact, wind energy accounted for 39 percent all new electricity generation that came online in 2009.

Sure, the renewable energy tax incentives in the Obama stimulus package and various state renewable-energy requirements certainly helped prime the pump. But even absent a national cap on greenhouse-gas emissions, the strength of the wind industry indicates the decarbonization of the economy is already underway, if haltingly.

According to AWEA, 90 percent of new power generation built over the past five years has come from renewables and natural gas. In other words, you are not likely to see many, if any, new coal-fired power plants built in the coming years. California regulators have prohibited big investor-owned utilities from signing long-term contracts for electricity generated by coal plants in places like Utah and Arizona, while the Golden State’s biggest coal-consuming utility, the Los Angeles Department of Water and Power, has pledged to wean itself from that particular fossil fuel.

And if carbon caps don’t do in other coal-fired power plant projects, their voracious appetite for water may well halt expansion in the desert Southwest. The U.S. Department of Energy estimates that a coal-fired power plant equipped with carbon capture and storage could consume twice as much water as a conventional power plant.

Kristin Mayes, chair of the Arizona Corporation Commission, the state’s utility regulator, told me last year that all power-plant projects are being closely scrutinized for their water use. “If one of our utilities wanted to build a new coal plant, we would be talking very much about water issues as well as cap-and-trade,” she said.

Wind-turbine farms, of course, use no water in electricity production. AWEA estimates that by displacing fossil-fuel power, wind farms saved 15 billion gallons of water in 2009.

Where the wind do blow

The knock against wind is that despite the huge increases in capacity that have made the U.S. the world’s biggest wind power — with more than 35,000 megawatts installed — all those turbines still satisfy less than 2 percent of the nation’s demand for electricity.

True enough, but the picture changes if you take a state-by-state look. Iowa, for instance, relies on wind farms to generate 14.2 percent of its electricity, according to the wind industry report. Wind power supplies 9.4 percent of Minnesota’s electricity, 8.1 percent of North Dakota’s, and 6.4 percent of Oregon’s.

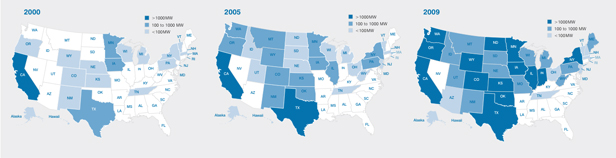

In the report, there’s a series of color-coded maps of wind-farm installations in the United States between 2000 and 2009. Those states with significant numbers of turbines are colored in shades of blue, those with few or none are white. At the beginning of the decade, broad swaths of the country were blank slates, with California the only dark blue state along with a handful of light blue states.

Maps: AWEA

Maps: AWEA

By decade’s end, most of the West and wind-swept Great Plains states as well as parts of the Northeast were a sea of blue of varying hues. Only the wind-poor Southeast and a handful of other states remained as white spots on the map.

So, is the wind boom only benefiting the blue states?

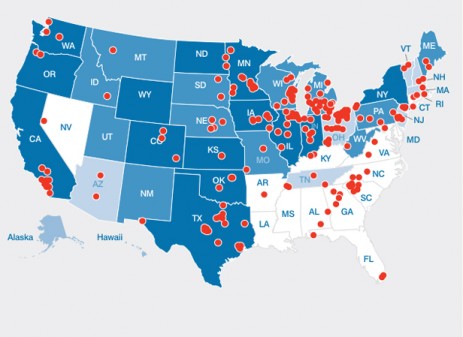

Not at all. Turn to a map of wind-related manufacturing and the red states are a pincushion of red dots from Arkansas to Georgia to Virginia, each dot indicating a factory.

Map: AWEA“Currently, over 200 facilities across the U.S. supply to the wind industry, and this figure does not capture the many additional facilities at the sub-supplier level,” the report states. “Wind manufacturing facilities can be found in every region of the United States, and include major new wind-dedicated facilities and established businesses that have diversified into the wind-energy industry.”

Map: AWEA“Currently, over 200 facilities across the U.S. supply to the wind industry, and this figure does not capture the many additional facilities at the sub-supplier level,” the report states. “Wind manufacturing facilities can be found in every region of the United States, and include major new wind-dedicated facilities and established businesses that have diversified into the wind-energy industry.”

Since 2005, the number of turbine makers doing business in the U.S. has tripled from five to 15. The wind industry currently employs 85,000 people, according to the report, a figure that remained flat in 2009 after growing rapidly in previous years. Texas remains the place to get a wind job, with more than 10,000 people employed in the industry.

A cap-and-trade market would certainly boost the fortunes of the wind industry, but emissions trading probably can’t solve one of the biggest obstacles to further expansion — the lack of transmission to connect far-flung wind farms to population centers.

“The inadequacy of the nation’s electric grid is a major impediment to the continued growth of the wind industry,” the report noted. “Many wind projects that have connected to the grid are forced to curtail a significant amount of their output or are facing low or even negative electric prices because there is inadequate transmission to carry their full output.”

There’s an astounding 300,000 megawatts worth of planned projects seeking connection to the grid, only a fraction of which is likely to get built due to transmission constraints, according to the report.

Constructing that transmission will be akin to building the interstate highway system of the past century, and will involve juggling a slew of competing local, state, and federal interests — a task the market alone is unlikely to facilitate and finance.

“These are daunting tasks,” the report concluded. “But the progress made in 2009 suggests an industry that is at the cusp of new growth, and new opportunity.”