On Tuesday, the president once again proposed ending subsidies to the oil industry. As we’ve said before, this is a great idea, and should be supported in full.

That said, although we haven’t seen details, it’s quite unlikely that the administration is proposing to eliminate all these subsidies. First, there is an important difference from the unmet pledges of the last several years.

Obama is apparently no longer talking about eliminating “fossil fuel” subsidies, preferring instead to focus only on “oil” subsidies.

So eliminating subsidies to coal and natural gas would seem to be off the table. What’s more, the president has redefined “clean energy” to include natural gas and “clean” coal. More on this soon.

This shift puts Obama’s rhetoric (at least) out of step with the G20′s — which is ironic because that process was created by the president. But then again, not that much is happening there anyway.

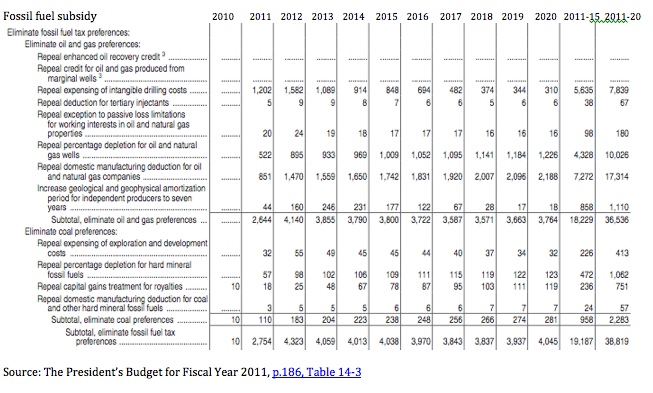

Looking at last year’s budget submission and the president’s submission to the G20 process can supply some likely insight into what the administration has in mind. Here’s the page from last year’s budget with the subsidy removal line items:

This budget request, which was basically ignored by Congress, would have eliminated $36.5 billion in oil and gas subsidies and $2.3 billion in coal subsidies over the next 10 years. If you’re interested to get details on the line items, you should read the U.S. submission to the G20 subsidy removal process [PDF], which goes through each of these lines in detail.

There are several other prominent subsidies that the administration has never talked about eliminating, but should. These include:

- The Foreign Tax Credit on foreign energy operations that are really disguised royalties. This was estimated to be worth $15.3 billion from 2002-2008 in a recent Environmental Law Institute study.

- Subsidies to international financial institutions and export credit agencies. Export of fossil-fuel related goods and services via Ex-Im Bank, the Overseas Private Investment Corporation, and U.S. commitments to multi-lateral lending institutions such as the World Bank vary annually but total at least $4 billion annually. (Note these are only totals for U.S. contributions.). The administration can and should end much of this unilaterally. Congress should oppose any more funding for these institutions unless they stop lending for fossil fuel projects that are not solely devoted to improving energy access to the poor.

- Oil defense. This includes costs to build, run, and finance oil stockpiles in the U.S. Strategic Petroleum Reserve; and defense of key oil infrastructure, including pipelines and oil shipping lanes. Does not include the cost of the Iraq war. Estimated to be more than $10 billion annually.

All of these are subsidies to the oil industry, it’s just likely that eliminating these isn’t what the president has in mind. But we’ll see.