Despite spending massively to position itself as “clean,” the natural gas industry has a serious pollution problem it doesn’t want getting more public and regulatory attention.

Not only is the industry’s climate disruption footprint potentially heavierthan coal, the hydraulic fracturing (“fracking”) practice the current gas boom depends on is contaminating our water supplies. The industry wants you to trust that when it drills toxic chemicals through our water supplies, injects them beneath our water supplies, and dumps them on top of our water supplies, everything will be fine.

Except that it isn’t.

The U.S. Environmental Protection Agency recently linked fracking with “high levels of chemicals found in ground water in the small town of Pavilion, Wyoming,” while this peer-reviewed study found “evidence for methane contamination of shallow drinking water systems.” The study also found that “[d]espite precautions by industry, contamination may sometimes occur through corroded well casings, spilled fracturing fluid at a drilling site, leaked wastewater, or, more controversially, the direct movement of methane or water upwards from deep underground.”

We’re not talking about small amounts of waste water, either: “During the first month of drilling and production alone, a single well can produce a million or more gallons of waste water that can contain pollutants in concentrations far exceeding those considered safe for drinking water and for release into the environment.”

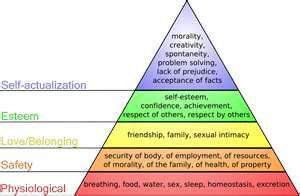

If you don’t remember it from school, drinkable water is at the bottom of Maslow’s Hierarchy of Needs.

Drinking water isn’t just critical to life. Ruining readily available supplies of it is a cost, and a big one.

So it’s natural to expect that a credible study on the “economics” of the gas industry would have to account for the costs of permanently ruined drinking water supplies…unless, of course, gas industry lobbyists paid to produce it.

Take the recent IHS Global Insight study commissioned by America’s Natural Gas Alliance (“ANGA,” with members such as Anadarko, Apache, El Paso, and Cabot Oil & Gas). The study has an expectedly dry title to build credibility: “The Economic and Employment Contributions of Shale Gas in the United States.” And, it has claims just waiting for politicians to use, such as “shale gas production supported more than 600,000 jobs in 2010, a number that is projected to grow to nearly 870,000 million by 2015, while contributing more than $118 billion in GDP.”

But, when we read the study, we noticed there isn’t a mention of the costs of permanent drinking water contamination. When we contacted IHG repeatedly to ask about the omission, we got this answer from IHS Global Insight’s John Larson:

The study was not intended to be a cost/benefit analysis. The study represents IHS Global Insight’s expertise as an economic modeling firm. It contributes rigorous and independent research on the economic contribution of the shale gas industry as well as the economic benefits (on the macro economy and selected industries) of the lower gas prices that are a result of developing shale gas resources. It was designed to contribute this important piece of critical information to the broader set of issues already in the public forum to better facilitate the national dialogue. [emphasis added]

We pressed the point by asking if they had any thoughts on the costs of shale gas production. No response.

Perhaps that’s because there isn’t a credible response to give. To date, the gas industry’s response to concerns about drinking water contamination has ranged from flat denial to asserting that the pollution is “naturally occurring.” Its remedy has been to provide big drinking water tanks (“buffaloes”) to people whose water has been ruined.

But as it contaminates more drinking water, won’t becoming a permanent bottled water utility to tens of thousands of Americans become a financial drag for an industry that many suspect is already in the midst of a bubble? As this article in The Oil Drum put it: “The true structural cost of shale gas production is higher than present prices can support,” with “most wells…not commercial at current gas prices” (under $4 per thousand cubic feet, compared to a required $8-$9 per thousand cubic feet “ to break even on full-cycle prices”).

The point is that calculating pollution’s costs might not be some back-of-the-envelope exercise, but it often favors clean energy over dirty.

Perhaps the ANGA lobbyists and Mr. Larson convinced themselves that by including the word “benefits” in the title, they could leave enormous costs out of the “critical information” they say they produced, and still be taken seriously. But when an industry’s costs to the country are potentially massive and permanent, that’s not a serious way to present itself.

The better, family-friendly word for that type of effort is, “propaganda.”