Our discussion of carbon offsets has been rather hand-wavey — lots of intuitions and moral judgments and gut feelings flying around. This obviously offended the gods of wonkitude, who have now seen fit to deliver unto us a report on the voluntary carbon credit market, containing some sweet, sweet numbers and graphs.

The report was done by market analyst types at New Carbon Finance (in London) and Ecosystem Marketplace (in D.C.), and is based partly on "a wide ranging survey with responses from over 70 organizations involved all stages of the supply chain from developers, aggregators, developers and retailers, and covering five continents."

Here’s the executive summary (PDF) and the full report (PDF).

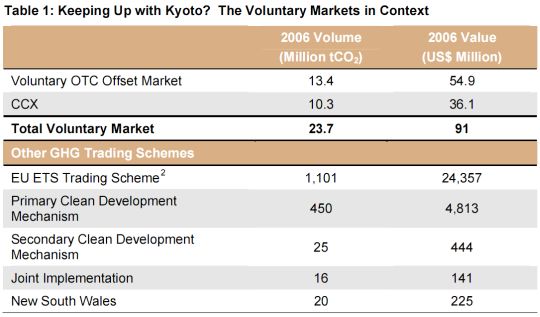

Turns out the voluntary carbon credit market — which consists of the Chicago Climate Exchange plus the “over the counter” (OTC) offset market we’ve been discussing — accounted for about $91 million in 2006. And it’s getting bigger rapidly: based on survey responses, the volume of credits traded in the voluntary market by June 2007 may well have exceeded the entire volume traded in 2006.

Between 2005 and 2006, the OTC market grew by 200%. Here’s how the voluntary markets stack up against gov’t regulated trading markets:

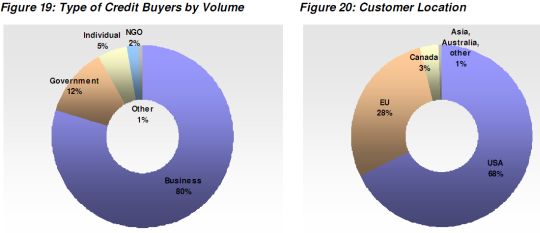

The biggest purchasers are businesses (80%). Individuals account for only 5% (which makes all our overwrought discussion of whether individuals are buying offsets rather than changing behavior much ado over very little). Most buyers are in the U.S. Here’s the breakdown:

According to suppliers, the businesses that purchase credits are not, contrary to what you might expect, hedging against future carbon regulation. Rather, the most common motivations were corporate social responsibility (CSR) and a desire to "walk the talk" on environmental stewardship. In other words, most businesses buying voluntary credits seem to have their hearts in basically the right place. Not that their motivations really matter one whit.

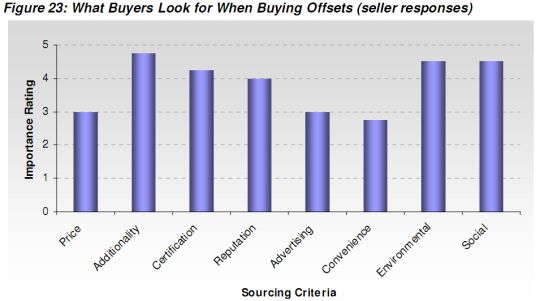

What are credit buyers looking for? Again contrary to what you might think, it’s not just price — in fact, quality- and environment-related factors were primary. To wit:

Relative to gov’t carbon markets, voluntary markets source more from forestry and smaller "micro" projects. Here’s where the credits are coming from in the voluntary market:

- Forestry: 36%

- Renewables: 33%

- Industrial gas: 20%

- Energy efficiency: 5%

- Methane capture: 3%

- Mixed/other: 3%

(By contrast, just 1% of CDM credits are from forestry projects. I’ll paste a larger chunk about forestry down at the bottom, for those into that sort of thing.)

The volume-weighted average price of carbon in the voluntary market is $4.1 per tonne of CO2e, but that’s from a range of $0.45 all the way up to $45. As you’d expect, the more expensive credits were for "projects with strong quality and verifiability attributes, such as landfill methane and coal mine methane, as well as the more publicly visible forestry projects and long term sustainable development projects, such as energy efficiency and off-grid renewable energy.”

This is an excellent summary of the promise and perils of the voluntary carbon market:

The flexibility of the voluntary markets is both a source of strength and a weakness. One of the reasons the market has very low transaction costs is that it does not require proof of quality in the same way as the regulated markets. For instance, in the OTC markets there are no widely accepted standards, processes for certification and verification, or requirements to list credits on established registries. This lowers transaction costs, but it also makes it a “buyer-beware” market where getting a handle on the quality of credits being bought can be difficult for customers.

But this is changing. The quality of offsets is – and will likely continue to be – the most important issue for both buyers and sellers in this market. In our survey, buyers indicated that the quality of offsets was more important to them than price, and sellers all agreed that addressing issues of quality would ultimately determine how (and how fast) this market continues to grow. According to suppliers, the issues that determine quality of offsets in this market include: additionality (would the reductions have happened anyway with or without the offset purchases), third party certification and verification, standards, and avoidance of double-counting and double-selling (i.e. registries).

As part of the consolidation in the market that began to take shape in 2006, various groups (from non-profits and industry associations, to offset providers and government agencies) continue work aimed at creating rigorous standards and processes as a way of ensuring confidence and quality in the market. In 2006 and early 2007, the issue of quality in the voluntary market became very visible in the form of media stories and articles questioning the validity of offsets being sold. This backlash was (at least partly) the result of the increased growth and visibility of the market, but it also helped to fuel increasing efforts on the part of those interested in the industry to strengthen quality and create standards. These efforts are explained and documented in this report.

There’s more where this came from — lots more, particularly some good stuff about efforts to improve standards and verification — in the full report.

—-

For those who track this issue — i.e., Joe “no trees” Romm — here’s an interesting excerpt about forestry credits:

The predominance of forestry credits in voluntary carbon markets is not surprising. While forestry sequestration projects are widely accepted under the New South Wales Greenhouse Gas Abatement Scheme, these credits must be from local projects. In other words, outside of Australia, the Kyoto and voluntary markets are the only two outlets for forest-related sequestration credits. Compared to Kyoto markets, it’s clear that the voluntary carbon markets play a critical role in financing sequestration projects. In 2006, less than 1% of CDM credits were sourced via approved forestry or the broader Kyoto category defined as Land Use, Land Use Change and Forestry (LULUCF) methodologies. As of early 2007, seven different afforestation/reforestation methodologies had been 35 accepted by the CDM board. However only one LULUCF project (compared to about 500 non-LULUCF projects) has actually been registered by the CDM and is being issued with CERs. Moreover, the EU ETS, the largest potential market for carbon offsets currently does not accept LULUCF credits of any kind.

In contrast, on the voluntary side, LULUCF projects may not only face lower financing and bureaucratic hurdles, but may also be valued more highly for providing more benefits to communities, to biodiversity, and to other values which voluntary buyers care about. They may, in other words, be more “charismatic.” While not all forestry projects can boast high sustainable development co-benefits, and several projects have been criticized for negative social or environmental impacts, many projects (especially native forestry projects) do in fact result in ancillary social and environmental benefits beyond sequestration. Moreover, LULUCF credits may be appealing because they are simple to understand: Most consumers have an intuitive understanding of the role trees play in the carbon cycle. The same cannot be said for exotic chemical gases such as HFC and N O. 23 2 Erin Meezan of Interface explained that her company chose forestry credits from major tree planting projects to offset their in-house emissions because, “Trees is one area of carbon sequestration that everyone understands, even little kids understand it… people get it.”

Due to concerns about permanence (i.e. carbon stored in trees may be released into the atmosphere if the forests burn down or are felled by disease) and further investments in abatement technologies, the percentage of forestry credits provided to the market has decreased rapidly, especially in the EU, and especially in the retail sector. Conversely, forestry carbon projects have historically played an important role in the US voluntary carbon markets. For example, the first protocol approved for offsets by the California Climate Action Registry was the forestry protocol. In the voluntary OTC market, about 66% of these forestry based credits originated from US projects. Whether a backlash against forestry carbon of European proportions will some day emerge in the US still remains to be seen. So far, forestry projects have been highly valued in the US voluntary markets, and their future role will largely be dictated by how the main criticisms of carbon forestry (additionality, measurement, and permanence) are dealt with. One interesting development is that some organizations have proposed innovative approaches (namely insurance schemes) for addressing the permanence problems associated with forestry carbon.