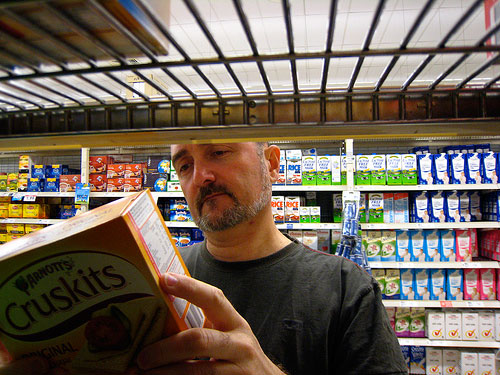

The New York Times reports that food companies are embarked on a “stealth” strategy to hike prices by significantly shrinking packages without changing the price. For example, canned vegetables are down to thirteen from sixteen ounces (one shopper observed that she found an eleven ounce can of corn recently). Sugar is now sometimes sold in four pound bags instead of five.

This is nothing new — food companies have repeatedly responded to weak economies and rising commodity prices in this way — although this is perhaps the first time that some companies are greenwashing their shrinkage. Proctor & Gamble, for one, is trumpeting its new smaller packages (priced about the same as the old, of course) as “‘Future Friendly’ products, which it promotes as using at least 15 percent less energy, water or packaging than the standard ones.”

And don’t forget the health claims! Fewer crackers in a package means fewer calories — you may pay more per cracker, but it’s better for you!

While it’s easy to shake our heads and decry the lousy economy and rising (possibly soon spiking) food prices — as well as the climate effects that may make such increases permanent rather than cyclical, I’m having trouble reconciling all this with another salient fact:

The economy is actually doing great. Gangbusters, in fact. Just not for any of us. Annie Lowery in Slate observes:

According to the Bureau of Economic Analysis, real corporate profits neared an all-time high in the last three months of 2010, with companies raking in an annualized $1.68 trillion in pre-tax operating profits.

Surely, that is bound to translate into new jobs, right? Wrong. It’s translating into stock buybacks and dividend increases, i.e. more money for the investor class. But then, a rising tide will float all boats, won’t it? In fact, all that’s floating are the luxury yachts:

…In the last quarter of 2010, the story was all about Wall Street. Profits actually decreased a bit at nonfinancial firms. But companies like investment banks and insurers saw profits climb to an annualized $426.5 billion. The financial sector now accounts for about 30 percent of the economy’s overall operating profits.

What makes America’s financial firms so profitable, so soon after the housing collapse and financial crisis? At the heart of the matter is a decrease in competition: The recession knocked out Bear Stearns, Lehman Bros., scores of banks, and dozens of other companies, leaving the survivors bigger fish in a less-crowded stream. Additionally, financial firms have enjoyed ample support from Uncle Sam. Since the recession hit, the availability of cheap cash from the Federal Reserve has helped increase banks’ margins, and thus their profits.

So basically, there’s been a massive wealth transfer from the middle class to the ultra-rich — who now should probably be described as the super ultra rich. And what do the rest of us get? Less and less. In our paychecks and at the grocery story. Class warfare, indeed.