In a new report on U.S. CLEAN (Clean Local Energy Accessible Now) programs, I provide a comparison of solar CLEAN Contract (feed-in tariff) rates across the United States.

Comparing published rates is not particularly helpful, however, because contract lengths vary (from 15 to 25 years) and the solar resource also varies widely. For international comparisons (e.g. Germany), it’s also necessary to account for the currency exchange rate and the federal tax incentives that are routinely factored in to U.S. solar CLEAN prices.

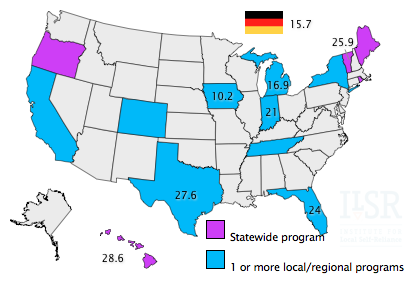

Here’s a look at the methodology for normalizing the CLEAN rates for comparison, and two maps illustrating those prices. The maps illustrate how Germany’s mature solar market means they pay much less for solar than U.S. CLEAN programs, especially when accounting for the federal taxpayer subsidy of local CLEAN programs.

First, here are the published solar CLEAN prices for all U.S. programs that support residential solar, including Germany’s program. Contract prices are paid per kilowatt-hour (kWh) for the specified contract term.

Residential Solar CLEAN Rates (Germany and U.S.)

| Location | Price per kWh | Contract Term |

| Germany | 19.5 euro cents | 20 years |

| Vermont | 27.1 cents | 25 years |

| Hawaii | 27.4 cents | 20 years |

| Gainesville | 24 cents | 20 years |

| Consumers Energy | 26 cents | 15 years |

| NIPSCO | 30 cents | 15 years |

The first step is to convert all prices to U.S. dollars. I use an exchange rate of 1.3 USD to euros.

Residential Solar CLEAN Rates (Germany and U.S.; USD)

| Location | Price per kWh | Contract Term |

| Germany | 25.4 cents | 20 years |

| Vermont | 27.1 cents | 25 years |

| Hawaii | 27.4 cents | 20 years |

| Gainesville | 24 cents | 20 years |

| Consumers Energy | 26 cents | 15 years |

| NIPSCO | 30 cents | 15 years |

The next step is to normalize all contracts to 20 years. So we adjust prices down on shorter contracts and up on longer contracts to get an equivalent 20-year price (in net present value).

Residential Solar CLEAN Rates (Germany and U.S.; USD, normalized to 20 years)

| Location | Price per kWh | Contract Term |

| Germany | 25.4 cents | 20 years |

| Vermont | 31.7 cents | 20 years |

| Hawaii | 27.4 cents | 20 years |

| Gainesville | 24 cents | 20 years |

| Consumers Energy | 20.9 cents | 20 years |

| NIPSCO | 24.1 cents | 20 years |

Next we account for the variability in sunshine, normalizing to the solar insolation in Gainesville, FL (5.3 average annual kWh per sq. meter per day). Jurisdictions with weak sunshine relative to Gainesville will have their prices drop (because they can pay much less per kWh) and places with better sunshine will have their prices increase. Germany sees the greatest adjustment, because the solar resource quality there (in Munich) is just 3.28, compared to 5.3 in Gainesville.

Residential Solar CLEAN Rates (Germany and U.S.; USD, normalized to 20 years, Gainesville insolation)

| Location | Price per kWh | Contract Term |

| Germany | 15.7 cents | 20 years |

| Vermont | 25.9 cents | 20 years |

| Hawaii | 28.6 cents | 20 years |

| Gainesville | 24 cents | 20 years |

| Consumers Energy | 16.9 cents | 20 years |

| NIPSCO | 21 cents | 20 years |

At this point, we’ve removed all of the disparities between U.S. solar CLEAN programs and can see that some programs (e.g. Hawaii) pay 40% more for solar than the lowest cost U.S. CLEAN (Consumers Energy).

Residential Solar CLEAN Rates (Germany and U.S.; USD, normalized to 20 years, Gainesville insolation)

But participants in the U.S. programs are likely, if not expected, to take advantage of the 30% federal tax credit for installing solar. In Germany, on the other hand, there are no other financial incentives. So an accurate comparison to Germany would inflate U.S. solar prices by 30%. This apples-to-apples comparison shows that the Germans are paying 50% less for residential solar than comparable U.S. programs.

Residential Solar CLEAN Rates (Germany and U.S.; USD, normalized to 20 years, Gainesville insolation, no federal tax credit)

| Location | Price per kWh | Contract Term |

| Germany | 15.7 cents | 20 years |

| Vermont | 37 cents | 20 years |

| Hawaii | 40.9 cents | 20 years |

| Gainesville | 34.3 cents | 20 years |

| Consumers Energy | 24.1 cents | 20 years |

| NIPSCO | 30 cents | 20 years |

The implications of this are remarkable. Solar PV modules and arrays are sold on a world market, so hardware is unlikely to account for the price difference. Rather, the maturity of the German market has significantly reduced the installation and balance of system costs for small-scale solar.

That’s actually a very hopeful sign for the U.S., as these jurisdictions are using CLEAN Contracts to accelerate the growth of their solar market and capture those same cost savings. Our report provides more detail on these U.S. CLEAN programs, including some lessons learned that may help them mimic the success of Germany’s solar feed-in tariff.

This post originally appeared on ILSR’s Energy Self-Reliant States blog.