A version of this article originally appeared on CleanTechnica.

A version of this article originally appeared on CleanTechnica.

Utilities in the United States are shifting away from coal toward sustainability initiatives, electric vehicles, and clean technology — but uncertainty about pending regulation continues to loom large, and environmental efforts may significantly hike consumer rates.

These findings come from “Strategic Directions in the U.S. Electric Utility Industry,” a survey of more than 500 utility executives conducted by industry consulting firm Black & Veatch (B&V). The annual survey [PDF] is intended to predict how the utility industry will evolve over time.

[Editor’s note: We reported highlights from the survey earlier this week on Grist. Here’s a a deeper look into the report.]

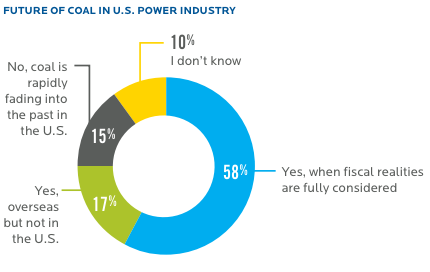

Coal on its way out

Coal‘s fall from favor among utilities, compared to 2011, is the survey’s most significant finding. The percentage of respondents who said they saw a future for coal in the U.S. “when all fiscal realities are fully considered” plummeted from 81.5 percent in 2011 to 58 percent in 2012. An additional 17 percent said coal only had a future overseas, and 15 percent replied coal “is rapidly fading into the past.”

All charts courtesy of Black & Veatch.

Environmental regulation is a key driver in this massive shift. While carbon emissions legislation has consistently ranked as the top environmental concern of utilities in B&V surveys since 2009, rule-making activity by the Environmental Protection Agency (EPA) in 2011 likely added to the negative outlook toward coal. Fifty-four percent said EPA regulations would cause early retirements among coal-fired plants, while 67 percent said the potential classification of coal ash as hazardous waste would have a moderate to significant impact on utility operations.

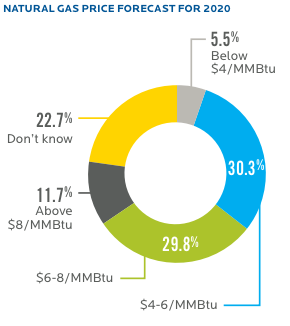

Natural gas dominates, but for how long?

Of course, the impact of America’s shale gas boom on coal’s outlook can’t be ignored. Nearly 80 percent of respondents said natural gas is now economically viable without any subsidies or incentives and “is clearly the preferred technology to replace coal.” However, this situation is expected to change.

More than 81 percent of survey respondents predicted natural gas prices will rise significantly from the current price of about $2 per million British thermal units (MMBtu), with 60 percent predicting natural gas will cost between $4 and $8/MMBtu by 2020. The main drivers for this price increase are environmental concerns from fracking and wastewater, decreasing domestic supplies, and EPA regulations.

More than 81 percent of survey respondents predicted natural gas prices will rise significantly from the current price of about $2 per million British thermal units (MMBtu), with 60 percent predicting natural gas will cost between $4 and $8/MMBtu by 2020. The main drivers for this price increase are environmental concerns from fracking and wastewater, decreasing domestic supplies, and EPA regulations.

But as the price of natural gas rises, coal may rise from the dead, just like in any zombie movie. A recent analysis pegged $2.75 as the price point where utilities convert coal-fired generation to natural gas, which unfortunately means natural gas may not rule for long.

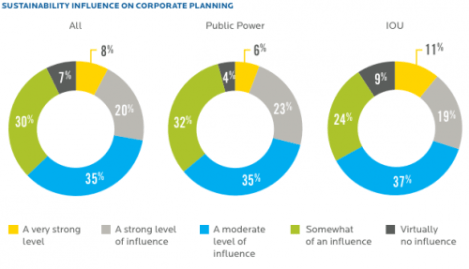

Sustainability grows within business models

Fortunately, the survey reveals sustainability initiatives continue to grow as an important aspect of the utility business model. Twenty-eight percent of all respondents said sustainability considerations have a very strong or strong level of influence on their planning, with another 35 percent saying they have a moderate level of influence.

The importance of sustainability is largely tied to perception among customers, regulators, and analysts. When given a choice, survey respondents ranked local public image, social responsibility image, regulatory relations, and investor perceptions well above actual financial performance or debt issues.

Electric vehicles surging, renewables not so much

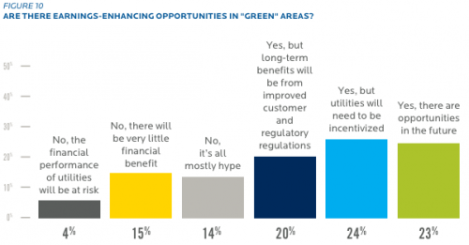

Utility executives are looking beyond theoretical sustainability to actual economic opportunities in clean technology — 67 percent said significant financial opportunity existed for utilities in the green economy. While positive in a broad sense, specific implications of this support vary.

Respondents predicted electric vehicles would surge to 7 percent of their total load by 2025, and 52 percent indicated they would fund actions to accelerate electric vehicle (EV) market penetration. If realized, this expected increase would mean 65 million EVs on the road — quite a jump from today.

Renewables didn’t fare quite as well. While 62 percent of respondents said renewable portfolio targets in their territories were achievable, 90 percent said such rules would lead to higher rates for customers. In addition, 90 percent said they would be integrating renewables into their systems by 2015, but only 38 percent said they would represent more than 10 percent of total generation.

However, solar energy remained a bright spot, ranking as the top renewable technology across all geographic regions, and 42 percent of utilities said they are starting to integrate systems to allow greater distributed generation from renewables.

At least they’re planning for climate change

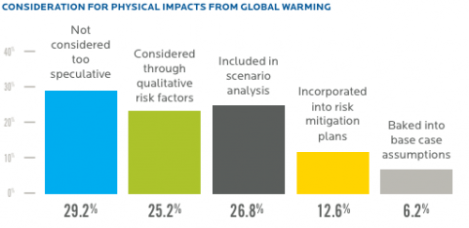

B&V’s 2012 survey may reveal a mixed bag for reducing greenhouse gas emissions, but at least it shows utilities are considering the effects of not cutting them. Roughly 70 percent of utilities are considering the potential physical impacts of global warming in their long-term planning.