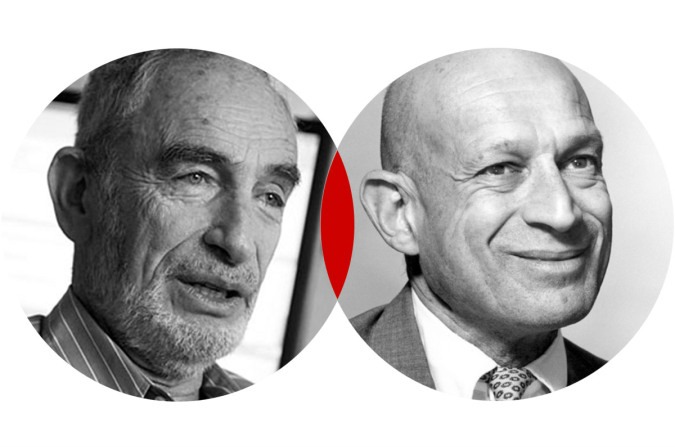

L.A. Cicero / University of MarylandPaul Ehrlich and Julian Simon.

In 1980, the biologist Paul Ehrlich and the economist Julian Simon made a famous decade-long bet. Ehrlich had written a bestseller titled The Population Bomb and become a celebrated advocate of population control to prevent global famine and disaster. Simon, an up-and-coming market-oriented business professor, believed that we don’t need to fear the depletion of global resources, since human ingenuity will keep finding new ways to find, fabricate, or redefine them.

After the two began butting heads in public, Simon challenged Ehrlich to a $1,000 wager: Ehrlich could pick any mix of raw materials; if the inflation-adjusted price rose in 10 years, Ehrlich would win; if it fell, Simon would win.

Ehrlich bit. He consulted some friends and assembled a portfolio of chromium, copper, nickel, tin, and tungsten that was supposed to represent some key finite resources whose prices might reflect the impact of population pressures.

Ten years later, he sent Simon a check — no doubt gritting his teeth as he sealed the envelope.

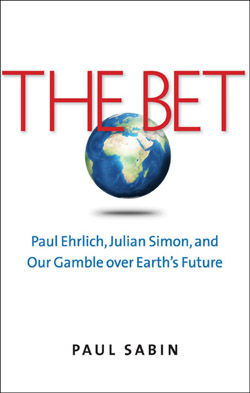

The Simon-Ehrlich wager tapped into an intellectual debate about growth and limits that stretches as far back as the 18th-century thinker Thomas Malthus and that continues, despite the conclusion of the bet itself, to this day. In his new book The Bet: Paul Ehrlich, Julian Simon, and Our Gamble over Earth’s Future, Yale historian Paul Sabin retells this story in the context of the rise of environmentalism in the U.S., the changing fortunes of green ideas in an age dominated by free market thinking, and the urgent alarms sounded by climate scientists. It’s a deft and thorough account of a debate that continues to split the American public and its leaders.

We talked with Sabin recently by phone.

Q. How’d you come to write this book?

A. I was interested in the rise of the environmental movement in the 1970s. I was trying to understand its relationship to some of the broader political conflicts in the nation. And I figured that enough time had passed that we could look back and assess the major successes and some of the limitations of the earlier environmental politics. I was also looking for a topic that would challenge me and had some strong and engaging characters — a good story.

A. I was interested in the rise of the environmental movement in the 1970s. I was trying to understand its relationship to some of the broader political conflicts in the nation. And I figured that enough time had passed that we could look back and assess the major successes and some of the limitations of the earlier environmental politics. I was also looking for a topic that would challenge me and had some strong and engaging characters — a good story.

Spoiler alert, but I think everyone knows that the economist Julian Simon won their bet. That raises interesting questions: Why did he win? What does it mean? How should we think about the clash of issues between these men?

Q. So, like everyone who’s heard of the bet, I always saw it as a kind of archetypal conflict. But the first thing that jumped out at me from your book is that the bet itself is kind of a red herring. It’s just a bet on commodity prices, which, as you point out, are volatile, and make a peculiar stand-in for the real issues that both of these men cared about. Is that true? How significant was this bet?

A. All the bet itself proves is that metal prices, these five metals, on average, went down in the 1980s. It doesn’t prove something larger, but it has larger lessons. It suggests that there’s not a linear relationship between population growth and resource scarcity — because population did in fact grow by some 800 million people during that decade.

More generally, I think it’s suggestive of the way in which human welfare, though it is tied to the state of the environment, is not in a direct linear relationship to ecosystems. The world we live in is more malleable.

At the same time it doesn’t prove that climate change isn’t a problem, or that we don’t need environmental regulation. It doesn’t tell us what to do about our policy choices.

Q. At one point you quote Ehrlich saying, “Julian Simon is like the guy who jumps off the Empire State Building and says how great things are going as he passes the 10th floor.” Which seems like a restatement of the Black Swan idea, that history is discontinuous — past trends don’t always predict future events.

A. Right. One way to think about what’s going to happen in the future is to look at the past, and think things might happen in the same way. But if you study the past closely, you can see that things don’t always keep happening the same way over and over again!

So the title of the book, The Bet, is about the wager, but it’s really about the larger bet that we’re all still making about the future. I think that bet hasn’t been settled and maybe never will be, but it’s one that we continue to lay our markers on.

Q. You chronicle how, over time, the positions and the rhetoric both Ehrlich and Simon used got more extreme and polarized. But don’t outrageous predictions sometimes serve a purpose? I think in the technology world of how Intel’s engineers labored over the years to make sure that Moore’s Law, predicting exponential leaps in the power of microchips, would come true. Do we need extreme predictions to goad us to action? Do we need doomsayers just to get some moderate political fixes to happen?

A. Ehrlich would say he was making these predictions in order that they not come true. I think he thinks of himself as in some ways an optimistic person. He still thinks it’s worth making the pessimistic predictions because there’s still time for change. He’s making warnings to try to cause action.

There may be some truth to that. Painting extreme pictures of the future can lead people to think, yeah, that would be really bad, we don’t want that outcome. But there are also negative aspects: It can be discrediting over a long period of time, if you never acknowledge that what was said before never came true. Or it can be misleading if everyone starts to believe that this is the way it is. You make decisions and policies that aren’t grounded in the way things have actually unfolded.

Q. You lay out the divide between Ehrlich and Simon as one between biology and economics, and you ask whether the deeper conflict might really be over ethics. But I kept thinking, is a lot of this psychology and neuroscience? Is the conflict between these guys just about temperament, about how you’re wired, the pessimist versus the optimist?

A. There’s something to that. We tend to be predisposed to messages that conform with our general attitude toward the world. If it’s our sense that the world is unjust or unfair or endangered, then we’d be more receptive to the idea that it’s threatened by something, or that we need to take action. On the flip side, if you think the world is just, the world is fair, there’s a God that’s looking out for us, then maybe nature is in balance and problems may not really exist.

With Ehrlich and Simon there may have been a component of that, but they really were men of ideas, and they were forcefully representing two contrasting ways of thinking about the world that go back to Malthus and his peers arguing with each other about population growth and scarcity of resources.

We don’t know the answer. It’s a long-running argument, and will continue.

Q. If we live long enough we’ll see a little more of it unfold.

A. We certainly will. And that’s what’s interesting for me about this story: There are truths on both sides. The planet is both hardy and fragile at the same time, and so is human society, and you can see that playing out here.

Q. I was really surprised the extent to which both of these guys perceived themselves as outcasts, renegades, unheeded prophets. I thought of them both as very successful people. With Simon, also, although he represents the optimistic side of the bet, it turns out he was also dealing with depression.

A. It is fascinating, the human dimension. I have to wonder to what extent Simon’s determination to be optimistic might have had some relationship to his struggles to overcome depression, and his success in doing that. There’s a determined optimism to his views — maybe it’s connected to that, it’s hard to know.

I did interview Ehrlich a couple of times, and he felt that after a life of tremendous accomplishments and influence, he had failed to change the direction that humanity was still on, this path to disaster, in his view. Both men wrote books in the ’90s, and the titles were symbolic of how they felt about the other side: Simon wrote a book called Hoodwinking the Nation, and Ehrlich had one called Betrayal of Science and Reason. They both had this sense of, I’m still losing!

Q. That reflects the larger politics. Today, progressives and environmentalists feel they keep losing ground and getting stymied, but conservatives are full of a sense that America is going the wrong way and the state is taking everything over. No one feels they’re winning.

A. Right, and I think that’s actually in some ways accurate. We’ve had a stalemate since Reagan. Reagan came in with the idea that there was going to be an aggressive effort to review the regulations of the 1970s, there was going to be regulatory relief. But ultimately that turned out to be fairly limited. By the end of his first term, James Watt was out, Anne Gorsuch was out, they brought back the moderates to be caretakers at the EPA and get back on track. There have been some new laws, like the Clean Air Act of 1990, but we’ve had a real stalemate of sorts for decades.

Which is really a problem. It means we’re still working within a framework that was designed decades ago and we can’t really improve the laws — in ways that would probably make sense — from either side very well. We’re unable to respond to new threats, like the climate problem.

Q. I guess Simon would say that doesn’t matter. The political system can only or mostly do harm, and as long as our science and business can develop useful solutions to problems, we’ll be OK. But to me it looks like, if we’re stalemated, that means there are some actual barriers in the way of human ingenuity solving our problems.

A. That is the case for problems that are not responsive to market forces. So in the area of energy and energy abundance, I think we’re seeing a tremendous period of abundance. Earlier fears that we’re going to run out of various forms of energy are now seeming less of a concern. That’s a response to prices, market innovation, the discovery of new resources, new techniques for extracting them, all of that. Where that’s less of a possibility is in the area of externalities, which are not readily responsive to market pressures. That’s why problems like climate change or ozone depletion are not obviously solvable without some kind of government action to bring them within the scope of market forces.

It’s hard to speculate on what someone like Simon would say as the science changes around a problem like climate change. He was clearly skeptical of environmental science and what he perceived as its biases, but at the same time he considered himself a very data-driven person who was responsive to facts. That was his mantra, his organizing principle.

I have to think that he would ultimately be responsive to the accumulation of facts and knowledge around climate change and global warming as well. And you can certainly see that among some conservatives who in the past decade or so have changed their views.

One of the things that’s interesting about Simon’s ideas is that he did not say there were no problems in the world. He just had confidence in human abilities to respond to problems. The first element of responding to a problem is recognizing that it exists. We’re a little stuck right now in the public debate on climate, with people actively refusing to believe that there is a problem.

Q. The Bet is admirably and almost religiously evenhanded in its approach. It concludes that each of these men’s views was necessary yet incomplete. But I couldn’t help wondering where you come down. In your gut, which of these guys do you think is right? Did you lean even a tiny bit in one direction? Do you feel deep down more like an Ehrlichite or, how would you say it, a Simonian?

A. If you look at the world around us over the last 30-40 years, seeing the tremendous innovations and the pace of change, it’s remarkable, and that leads me to have hope for the future, and to think about the amazing possibilities of human innovation. At the same time, I recognize that a lot of what Ehrlich has lamented is happening, in terms of the transformation of our ecosystems, of our planet. That there are a lot of big changes happening, and I have a great concern about climate change.

I favor aggressive action there, so I guess that puts me on the side of the environmentalists. I feel that the balance is really in thinking about risk, and where the risks lie. And there are risks on both sides. This is a frustration I have with the environmental community sometimes — the somewhat cavalier way of talking about the risks of making big changes to our whole world energy system. But at the same time I think the risk is much greater in the threat of global warming and the destabilizing aspects of it, and it’s crazy not to be taking action to ameliorate it.

Q. You studied these two men for years. If you were picking one of them to spend, say, a week with, which would it be?

A. I never got to meet Simon, so it’s hard for me to know. I’ve heard that he was smart and entertaining. And that’s also true about Paul Ehrlich — he has a great sense of humor and a very sharp mind. So I guess I’ll have to go with the one who’s still alive, and the possibility of a weeklong hiking trip.

Q. Or you could say Simon, precisely because you never got to meet him — if we could magically make that opportunity available.

A. That would be great — I was sorry not to get the chance to talk with him. Both of them are in their own ways charismatic and sharp and incisive in their thinking.