Today, the price of oil fell under $53 a barrel, the cheapest crude since the 2009 recession. Petroleum’s price plummet over the last six months (explained by Vox) means cheaper gasoline prices, a short-term win for cash-strapped American drivers but a potential setback for the climate. Heck, inexpensive gas has even summoned the climate-wrecking SUV from its too-shallow grave.

On the bright green side, a glut of bargain-basement oil could potentially slow production, especially at super-dirty sources like tight oil from the Bakken shale formation of North Dakota. Such “unconventional petroleum” is expensive to extract and then refine. The longer oil prices remain low the harder it is for the fossil fuel industry to turn a profit on oil from shale rock.

So, will 2015 be the year the U.S. fossil fuel industry finally hits the brakes on the shale boom?

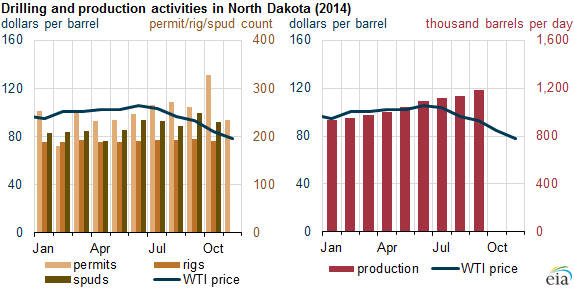

Unfortunately, the U.S. Energy Information Administration doesn’t think so. Data through September 2014 show that oil production in North Dakota continued to increase even as it commanded lower and lower prices. And by tracking new drilling permits, movement of drilling rigs, and “spuds,” the ground-breaking processes for new wells — none of which have fallen during the price drop — the state’s Department of Mineral Resources gives reason to believe that increasing volumes of Dakota crude will flow from the shale fields in the new year, worldwide glut be damned.

Data: North Dakota Dept. of Mineral Resources, Bloomberg U.S. EIA

Throughout the oil price collapse, North Dakota has consistently issued more than 20 new permits per day to energy companies hell-bent on screwing the earth sideways with high-tech horizontal drilling techniques. More than 11,000 holes already perforate the Bakken field, with 40,000 miles of well bores bringing fracked oil to the pinpricked surface of the growth-spurting state.

As long as the U.S. keeps pumping prodigious amounts of crude oil into the global energy economy, it’s likely that Saudi Arabia will continue to drive prices down by flooding the market from their vast reserves of easy-to-extract oil. Cheap oil means more oil burned — and less motivation to switch to cleaner energy sources. Bad news for the climate.

Eventually, Dakota drilling could slow, as low prices ruin the economics of digging for new shale oil. But by then we’ll all be on road trips, our tanks filled with $1.50-a-gallon gas.