As if Hollywood isn’t fracked up enough already.

The New York Times Click on graphics in this post to embiggen.

The latest target of the unconventional oil craze is California, specifically the Monterey Shale in southern California (see map). Will California become the next North Dakota? Let us ponder.

Oil in California is nothing new — it’s the third highest oil-producing state in the U.S. (after Texas and North Dakota, which recently displaced Alaska for the No. 2 spot). The Monterey area has been drilled for years, profitably, though production has been steadily declining since its peak in the mid ’80s.

However, as you’ve no doubt read in recent breathless media accounts, drilling technology has advanced. Two techniques have been combined: hydro-fracturing, whereby fluids (a mix of water, sand, and chemicals) are injected into drill holes to break open tight rock formations, allowing liquid fuels to seep out; and horizontal drilling, whereby drills can travel laterally from drill sites, sometimes miles, allowing a single drill site to cover vastly more area. This is the “fracking” you’ve heard so much about. It puts all kinds of previously inaccessible fossil fuels within reach, albeit expensively. (Oil seems stuck near $100 a barrel, though; with prices that high, all kinds of crazy schemes are economic.)

The Monterey Shale hasn’t been fracked much, at least not with horizontal drilling, but oil companies have got their beady little eyes on it. The typical news report, like this one in The New York Times, pegs the oil resource in the Monterey Shale at just over 15 billion barrels of oil, more than four times the tight oil in the storied Bakken Shale in North Dakota and more than two-thirds of all the tight oil in the country.

(Vocab note: “shale oil” or “tight oil” refers to oil stuck in shale rock formations; “oil shale,” a kind of rock containing kerogen, which can be refined into oil, is a whole different thing — a grosser, even less economic thing.)

A new study from University of Southern California says that fracking all that tight oil could boost the state’s economy by 14 percent. Even for a purportedly green state, that’s a tough offer to refuse. Sure enough, Gov. Jerry Brown (D) has been making positive noises about it, saying he’s open to it as long as there are proper regulations.

National enviro groups have not put up much resistance so far. They’re busy with Keystone or EPA or the like. But local protestors could use some help. This seems to me like one to fight. Here, in no particular order, are 10 reasons why.

1. This isn’t natural gas we’re talking about, which can displace coal and reduce carbon emissions. This is oil. And it’s heavy, carbon-intensive oil. The California Air Resources Board (CARB) studies the characteristics of each source of oil — extraction and transportation — and assigns it a score, the higher being worse for the climate. California oil scores badly:

Most oil sources worldwide have scores between 5 and 13, under the system used by California Air Resources Board.

[California’s] Midway-Sunset oil scores 21.18. Crude from nearby Coalinga scores 25.36. The San Ardo field, whose bobbing pump jacks push up against Highway 101 between King City and San Luis Obispo, scores 28.82.

And the [Canadian] tar sands?

One synthetic oil from the tar sands — Albian Heavy Synthetic — scores 21.02. Another, Suncor Synthetic A, rates 24.49. Syncrude Sweet comes in at 21.87.

California’s oil is as dirty as Canadian tar sands! And with fracking comes increased energy intensity and hundreds more wells. So yeah, this stuff is unambiguously bad from a climate perspective. Depending on how much of that 15 billion barrels gets dug up and burned, it will mean billions and billions of tons of new carbon dioxide in the atmosphere, maybe even as much as will be piped through the Keystone XL pipeline.

2. Speaking of the oil being dirty: California recently implemented a “low-carbon fuel standard” requiring producers to decrease the carbon intensity of the fuels they sell in the state. The dirty sludge pulled out of the Monterey Shale is almost certainly not going to meet that standard. That means it can’t be burned in-state. They’ll have to export it.

So California gets the damage to land, air, and water, oil companies get the profit, and other states get the oil. Sweet deal!

3. That 15 billion barrels of oil in Monterey? It is, to put it charitably, speculative.

My editor is convinced that a full discussion of this point is unbearably boring and will drive away this post’s few readers. So I’ve moved the full discussion down to the bottom. Here’s the takeaway:

The amount of technically recoverable oil is determined by multiplying the total amount of oil that USGS estimates is under the Monterey Shale by the “recovery factor,” which is the percentage of the oil that can be recovered with today’s technology. The USGS estimate is based on mathematical models, not data, and is extremely speculative. The recovery factor that’s being used for Monterey is probably optimistic — it’s more than double that of other tight oil plays like the Bakken Shale. Long story short, 15 billion barrels is probably a) wrong and b) high.

For a full discussion of this fascinating matter, scroll down to the bottom of the post.

(I should pause here to say that most of what I know on these subjects I learned from energy analyst Chris Nelder, whose work you should be reading religiously. To better understand unconventional fuels like tight oil, start here and here.)

4. Colorado and North Dakota have fairly “flat beds,” i.e., stacked horizontal layers of rock. California has a messy bed (I owe the analogy to RL Miller), which is to say its layers have been cranked, tossed, folded, and otherwise mangled by frequent earthquakes. California is, you’ll recall, full of fault lines.

That may help explain why, despite the optimistic numbers above, the Monterey Shale has thus far proved something of a disappointment. A story in World Oil (paywalled) notes that disappointing results from Monterey have forced operators to “revisit their geological drawing boards.” The Energy Information Administration estimated that Monterey would produce 550 million barrels per well, but “operators today are reporting typical flowrates averaging only around 350 to 400” barrels per day. At 400 barrels a day, it would take a well 3,767 years to hit 550 million barrels. Perhaps the EIA was a bit optimistic?

This is from an AP report last year:

… drillers haven’t been able to get the Monterey Shale to produce oil at high rates. [Alliance Bernstein analyst Bob] Brackett suggests that there are a few characteristics of the geology that could make the field more difficult to develop. There are lots of natural faults in the rock, which means drillers can’t easily control the flow of oil through faults they create. Also, the rock is not under enormous pressure, so there is less force pushing the oil to the surface. And the oil may be relatively thick and sticky, which slows its flow.

If the Monterey had performed as well as the Bakken field in North Dakota or the Eagle Ford in Texas, it would be delivering an additional 300,000 barrels of oil per day by now, Brackett says. Instead, production in California is flat.

“We don’t expect a ‘Bakken Boom’ to strike the San Joaquin Valley,” Brackett wrote. “We expect California production to grow only modestly.”

A story in the magazine of the American Association of Petroleum Geologists was blunt in reaction to the EIA’s optimistic numbers: “Sounds good, until you realize there is no truly successful Monterey resource play to date.”

The promise of fracking in California is based on hope, not data. The danger is a debt-driven explosion of wells (and the chemicals they bring), followed by a bust as production proves disappointing.

5. Water is always a problem in California, a state that lurches from drought to drought and suffers constant bickering between cities, farmers, fishers, and everyone else over the dwindling resource. According to industry figures [PDF], every fracking well uses between 80,000 and 300,000 gallons of water. (That probably means they use way more than that in reality.)

In addition, as Food & Water Watch says in this informative issue brief, “Increasing demand for fresh water, leaking toxic waste pits, well-cementing failures and injection of chemicals underground all post serious short- and long-term water risk.”

Is this how Californians want to use their dwindling water? To expedite the export of dirty oil?

6. Speaking of water, fracking produces a shit-ton of wastewater. It can’t be disposed of in rivers or on the ground (though it very often leaks, accidentally, into both), so instead it’s typically injected far underground, creating the risk of “induced seismicity,” i.e., earthquakes. The link between injection and seismicity in areas with known faults is pretty well-documented at this point. Here’s a paper on it [PDF] in the journal of the American Geophysical Union. There’s also a great article about it in the latest issue of Mother Jones; it isn’t officially online yet, but it looks like you can get a bootleg copy here.

Less is known about injecting into areas with unknown faults, which are all over California. As far as I can tell, there’s been no research at all on deep injection in California specifically. The Mother Jones piece makes pretty clear that the industry is trying to squelch any discussion of this, but don’t worry, they pledge to “avoid known faults.” What could go wrong? (The 1994 Northridge quake, which killed 50 people, originated in an unknown fault. Just saying.)

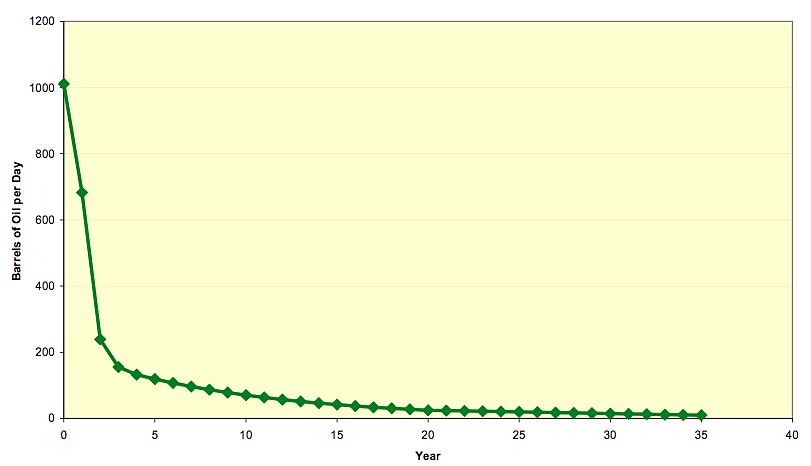

7. Most people don’t get this, but getting at tight oil requires a lot of wells, because production at each well falls off pretty quickly. There’s not much data from Monterey yet, because there aren’t a lot of horizontal fracking wells yet, but data from other tight oil plays shows that the depletion rate is high, on the order of 80 or 90 percent the first year. Here’s the production profile of a typical well in the Bakken play:

Other tight oil plays have turned up similar results.

Oil companies are not particularly eager for people to know this. When petroleum geologist and researcher Arthur Berman looked at actual well data, it turned out oil and gas companies had systematically overstated shale well productivity:

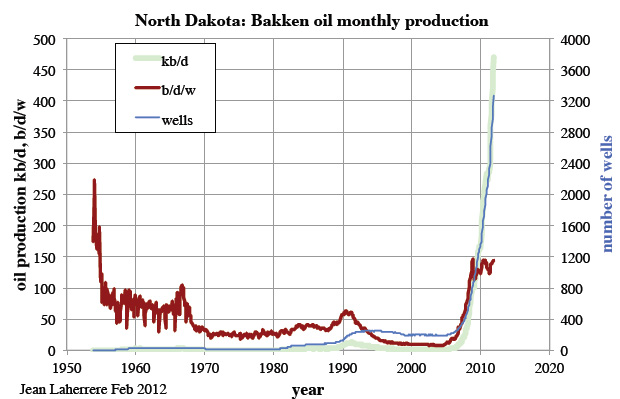

With wells falling off quickly, and most early fracking funded by debt, producers are under huge pressure to keep digging new wells. Here’s what that looks like, in a graph put together by French petroleum engineer Jean Laherrère, taken from yet another Nelder post:

(For reference: kb/d is thousands of barrels per day; b/d/w is barrels per day per well.)

Nelder writes of this graph:

It tells the real story of tight oil production beautifully. Each well produces a mere 150 barrels or so per day on average, and like shale gas wells, their output declines rapidly after initial production. As [Foreign Policy‘s Steve] LeVine learned from a Bakken executive, the decline rate can be over 90 percent in the first year, then gradually tapers off. After seven or eight years, wells will have produced over 60 percent of their recoverable reserves. Therefore, you have to keep drilling like hell just to maintain production, and drill even more to increase it. … But at around $7 million per well, these wells are not cheap.

Given the steep decline rates of typical fracking wells, making the thick, hard-to-reach Monterey Shale oil pay off like oil companies want it to pay off — like they’re promising California officials it will pay off — means constantly drilling a swarm of new wells.

Meanwhile, four of California’s top 10 agricultural counties are in frack-targeted areas, which is why agricultural groups are starting to ally with greens against it. Then there are the threatened wells in the Baldwin Hills oil field near Culver City, where oil drilling has already had devastating effects on (largely poor) residents. The local impacts from these wells are no joke, and there are going to be a lot of them.

8. Can Californians trust their government to properly regulate fracking? (That’s what a lot of the borderline somnolent green groups seem to think.) The fracking that has gone on in the state so far seem to have flown completely under the radar of state regulators. Get this, from the L.A. Times:

This new interest in fracking plainly caught California regulators off guard. In January 2011, [state Sen. Fran] Pavley wrote to the state division of oil, gas and geothermal resources, or DOGGR (pronounced “dogger”), asking for information [PDF] about the number and location of fracked wells in the state, the amount of water employed, the permitting process and what was known about the risk to groundwater.

The agency responded with a detailed four-page letter, the gist of which was: “We don’t know nothin’.” Its actual words were: “The Division is unable to identify where and how often hydraulic fracturing occurs within the state.” It also said that “the Division has not yet developed regulations to address this activity.”

So, DOGGR doesn’t know where the fracking is, or how much there is, and it hasn’t bothered to develop any regulations to address it. But now, the agency insists it’s changing. It’s on top of things. This DOGGR. So … yeah. No worries, Californians. You’re in good hands!

9. That USC study about the economic effects of fracking I mentioned up top? DeSmogBlog did a little sniffing around and found oily fingerprints all over it. It was funded by, written by, and reviewed by people with longstanding ties to the industry. California officials might do well to take it with several grains of salt.

10. It is morally wrong to sacrifice the interests of poor people and future generations for the benefit of fossil fuel executives and shareholders. Kinda seems like this one should go without saying, but …

I guess that’s enough for now. If activists rally against California oil fracking, they’ll get the same lectures from VSPs that the Keystone campaign gets: “This one bit of supply won’t make any difference to climate change; as long as demand exists, they’ll get it out somehow; you’re distracting from the carbon tax pony.” But whatever. It’s time for states and oil producers to get the message that moving heaven and earth to reach the world’s filthiest fossil fuels is no longer socially acceptable.

Every junkie needs an intervention.

——

* So, as promised, for you hardcore nerds, more on why the 15 billion number is almost certainly wrong, and most likely high:

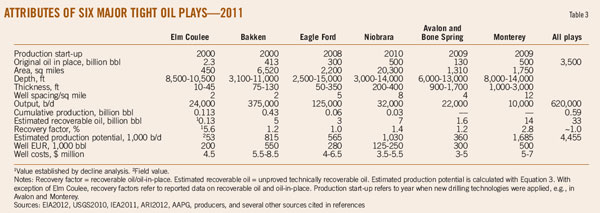

Here’s a handy chart that I’m going to steal from this piece in Oil & Gas Journal, because it’s behind a paywall:

First, we’re looking in the “Monterey” column, over on the right. Note that it estimates 500 billion barrels of original oil in place (OOIP), which represents the sum total of the oil in the ground. This not based on well data — remember, it hasn’t been fracked much — but on mathematical simulations. Such simulations offer a range of possibilities with different probabilities; it’s likely 500 billion was the mid-point probability. Suffice to say, that’s a highly speculative number.

Next, we’re looking at the “recovery factor” (RF), which is the percentage of the total oil that can technically be recovered — not economically recovered, but recovered with today’s technology, irrespective of price. This chart estimates 2.8 percent, which seems optimistic. The Elm Coulee play in Montana is a “sweet spot,” with comparatively shallow, easy to reach oil; the more common RF for big shale plays is between 1 and 2 percent. The Monterey play faces determined environmental opposition and some unfavorable geography. Once they get in and start drilling, the RF could well fall. It too is speculative.

Anyway, multiply the OOIP by the RF and you get the “estimated ultimately recoverable” (EUR) oil — the amount we might conceivably be able to get out.

OOIP x RF = EUR! Fun.

So in the case of Monterey, 500 billion barrels times 2.8 percent equals 14 billion barrels. That’s the estimate of technically recoverable oil. (The EIA pegs EUR at 15.4 billion barrels, which is what gets used in all the news stories. Not sure why this data set and the EIA differ by a bit — probably a different OOIP or RF estimate — but it’s not that important.)

That’s two speculative numbers multiplied. What if the RF turns out to be 1.4 percent, like in the Niobrara Shale? Well then there’s half as much recoverable oil in Monterey: 7 billion barrels. Fifteen billion barrels would satisfy U.S. oil demand for just over two years; 7 billion would satisfy it for a year or so.

Regardless: the 15 billion barrels figure that gets tossed around confidently by journalists is just this side of a guess, and probably a guess on the high side.