As governments worldwide begin imposing fees on pollution to try to protect the climate, a debate over dueling approaches — one that has long been restricted to conferences and academia — is becoming prominent in Washington state.

Washington voters will decide in November whether to introduce a carbon tax on fossil fuels and electricity from coal and natural gas, with the goal of slowing global warming while reducing taxes on sales and manufacturing and keeping total tax revenue flat overall.

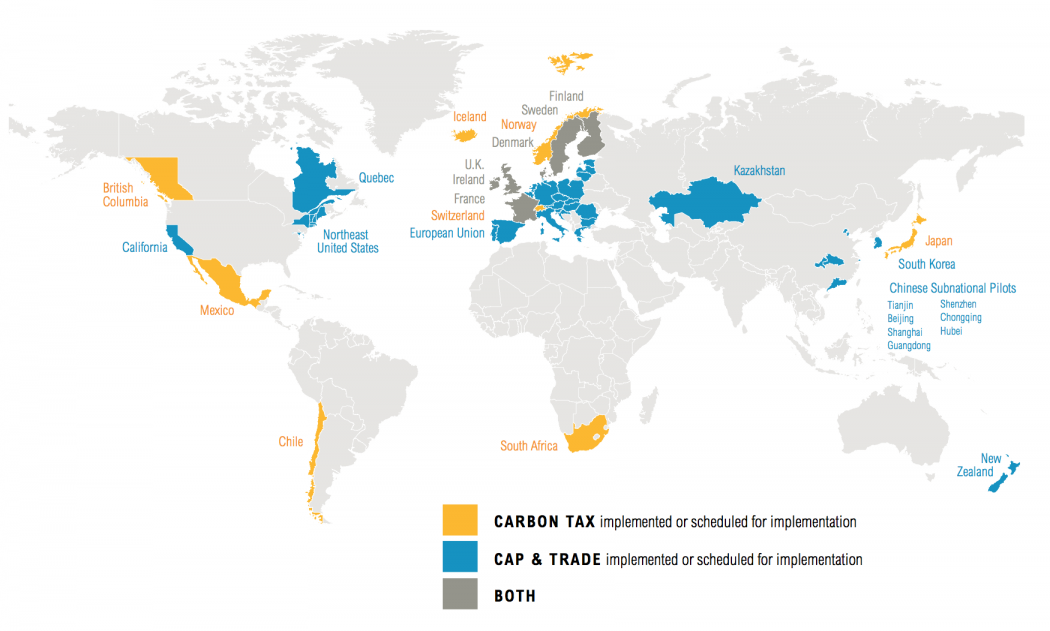

If Initiative 732 passes, the Evergreen State would buck a national trend in which other states have been adopting a different system for carbon pricing — that of cap-and-trade, in which pollution levels are capped and allowances to release pollution are sold and traded.

“Some folks on our executive committee and in our grassroots base have a strong preference for a carbon tax,” said Yoram Bauman, an economist and comic involved with Carbon Washington, a group that drafted the initiative and gathered signatures.

Carbon pricing is popular among economists and climate experts because it can account for some of the hidden costs of climate change by taxing fossil fuels, which raises prices and reduces demand. That helps solar, wind, and other climate-protecting alternatives compete on price.

Worldwide, carbon pricing is being adopted rapidly as countries and states work to slow global warming. China plans to roll out a nationwide program next year, joining the European Union, Kazakhstan, California, and other governments in putting a price on carbon.

The World Bank and International Monetary Fund were campaigning in support of carbon pricing ahead of the signing last week of the United Nations’ climate treaty, which was finalized in Paris in December.

Some experts prefer a carbon tax over cap-and-trade, arguing that it’s more efficient and less complicated. Others prefer cap-and-trade, arguing that the approach provides governments with greater control over the amount of pollution that’s released each year.

Bauman said a carbon tax is “simple and transparent,” and he pointed out that neighboring British Columbia already has a carbon tax in place. “The choice of a carbon tax for I-732 came from some issues that are pretty specific to Washington State.”

Carbon pricing programs worldwide in 2015.World Resources Institute

The debate has spilled into the Democratic primary race, with Bernie Sanders pushing for a carbon tax. During a 2007 race, Hillary Clinton said she opposed a carbon tax — but only because she favored cap-and-trade.

The ballot initiative is the latest effort to establish a system in Washington that prices carbon pollution. Cap-and-trade legislation by Gov. Jay Inslee was rejected last year by lawmakers, and his administration is now trying to cap carbon pollution using regulatory powers.

“The differences between carbon taxes and cap-and-trade programs are dwarfed by the similarities between them,” said Noah Kaufman, a climate economist at the nonprofit World Resources Institute. “A lot of the differences that you hear talked about are not really fundamental differences between the policies, but what to do with the revenue.”

The Washington ballot measure was crafted to be revenue neutral for the state, helping to curb pollution while reducing other taxes. A government analysis indicated those cuts could substantially reduce state revenue overall, though backers of the proposal disagree with the finding. Major winners would be low-income families, which would receive $1,500 tax rebates.

The Centralia Power Plant in Washington burns coal.Kid Clutch

Carbon Washington is facing opposition to its ballot initiatives from corporations that use and produce energy.

“We don’t think a price on carbon is necessary,” said Brandon Houskeeper, who oversees government affairs at the Association of Washington Businesses. “We think it’s the wrong approach.”

The planned revenue neutrality of the measure has also sparked opposition from groups that are fighting for a system that sets aside funds for environmental initiatives.

California, European nations, and some other governments earmark large chunks of revenues from cap-and-trade programs to be spent on efforts to promote clean energy and reduce pollution impacts in poor communities.

Washington’s carbon tax ballot initiative “doesn’t have a huge united coalition behind it,” said Kristin Eberhard, a researcher who tracks carbon pricing for the Sightline Institute, a think tank based in Seattle.

Climate Solutions, a nonprofit in the Pacific Northwest, says it can’t support but won’t oppose I-732, preferring to continue to push for adoption of an alternative carbon pricing program — one that would provide funding for environmental initiatives in Washington.

“We need a more comprehensive solution,” said Vlad Gutman, director of Climate Solutions’ Washington office. “We need to drive investments to clean energy.”