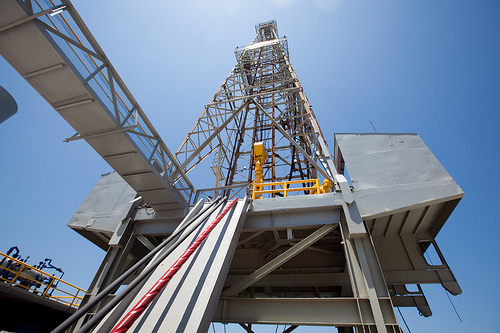

A model offshore rig. (Photo by eschipul.)

The best recent summary of the state of the oil and natural gas industry comes a few paragraphs into this Wall Street Journal article about Shell’s halting, nearly inept attempts to drill in the Arctic before winter.

The project is just one of many multibillion-dollar efforts Shell has under way, so setbacks don’t threaten its overall health. But the problems highlight how oil and gas fields are becoming more difficult to reach.

The Obama administration, the Journal suggests, wanted its approval of Shell’s Arctic drilling permits to demonstrate the president’s commitment to his “all of the above” approach to energy development. Despite oil production hitting a 14-year high during Obama’s tenure, the president is still repeatedly attacked for insufficient commitment to oil exploration. Shell was meant to be a boutonniere the president could wear on the campaign trail to demonstrate his offshore bona fides. If the company fails to drill before the Arctic refreezes for the winter, it’s safe to assume that Obama, not Shell, will bear the blame — though he’s not to blame for the company’s many errors.

The Obama presidency is coinciding with an awkward time of transition for oil and gas (just as with coal). The oil industry is horribly (and appropriately) unpopular while, as the Journal notes, exploration is becoming more risky and difficult.

Take the example of ATP Oil and Gas. ATP wanted to drill on the other side of the country from Shell, in the comparatively calm waters of the Gulf of Mexico. The company locked up funding on April 19, 2010 — the day before the Deepwater Horizon exploded. After the ensuing moratorium on drilling, ATP is now on the brink of bankruptcy. From Forbes:

When I get Paul Bulmahn on the phone rumors are swirling that he’s just days from putting his company, ATP Oil & Gas, into Chapter 11. He can’t confirm it yet, but he wants to make one thing perfectly clear: If it does come to bankruptcy (which it did on August 17) it isn’t his fault. The founder and chairman of publicly traded ATP, Bulmahn wants the world to know that the Obama Administration — and its illegal ban on deepwater drilling in the wake of the BP disaster — is to blame for the implosion of his company. Not him.

The word “illegal” is Bulmahn’s, not the reporter’s. Bulmahn argues that the moratorium is to blame for his company’s woes — though the rest of the article makes it clear that the argument is highly debatable. ATP’s stock began to tank a year and a half before Deepwater, and its massive, risky investments elsewhere broadly undermined the company’s success.

Ravi Kamath, high-yield analyst with Global Hunter Securities, has been bearish on ATP for years and had a sell rating on ATP debt since early 2011, when it was trading at 104 cents on the dollar. It’s fallen to 29 cents now. Kamath says ATP’s problems reach far beyond the moratorium. He keeps a spreadsheet with 105 instances from the past decade where he says ATP has overpromised and then underdelivered. “Bulmahn has said lots of stuff that never happened,” says Kamath. “They have 11 years of bad forecasts.”

Oil and gas extraction, particularly offshore, was always a risk. As the easy sources have been tapped, exploration has become more and more difficult. Shell’s travails and ATP’s failures stem from that increased difficulty as well as failures on the part of the companies and other challenges.

The blame for the problems, though, will almost certainly fall on Barack Obama.