The Department of Energy has agreed to loan a Nevada startup $2 billion to support its production of critical battery materials, a staggering sum that illustrates the Biden administration’s determination to domesticate the electric vehicle supply chain.

Redwood Materials will use the money for construction of the first factory in the nation to produce anode copper foil and cathode active materials, two essential components in EV batteries. The company, founded by former Tesla executive JB Straubel, says it will manufacture enough of them to support the production of 1 million electric vehicles per year by 2025. According to the Department of Energy, that would reduce the country’s gasoline consumption by more than 395 million gallons annually and cut carbon dioxide emissions by more than 3.5 million tons. It also would ease automakers’ reliance on battery components made overseas.

“It accomplishes the goals of less reliance on critical minerals from Asia, brings manufacturing and the supply chain to the US, and produces components for electric vehicles, which ultimately reduces greenhouse gas emissions,” Bob Marcum, chief operating officer of the DOE Loan Programs Office, told Grist on Friday. “It’s a very important project and something that we’re very excited about.”

The loan, which the Energy Department agreed to in a conditional commitment announced Thursday, will come from the Advanced Technology Vehicles Manufacturing Loan Program, which supports manufacturing projects that improve vehicle fuel efficiency.

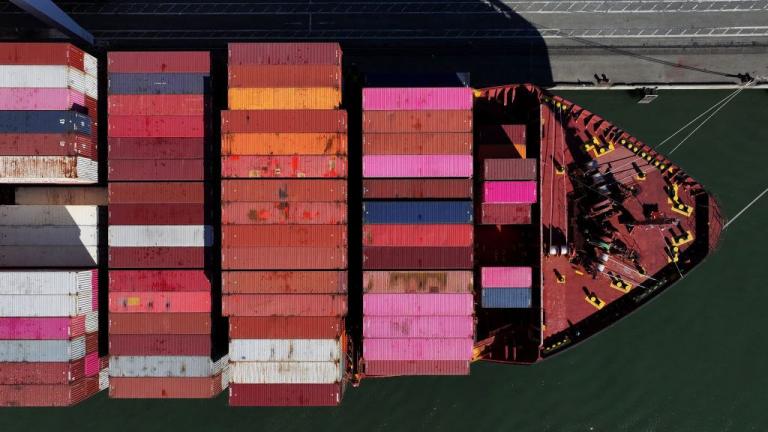

The Biden administration wants electric vehicles to comprise half of all new car sales 2030. The essential components of electric vehicle batteries are produced almost exclusively in Asia. “We have some catching up to do,” Energy Secretary Jennifer Granholm said at an event at Redwood Materials’ Nevada facility on Thursday. “China has dominated every step of the supply chain.” That poses supply chain security risks, drives up the cost of batteries, and creates greenhouse gas emissions in transporting materials around the world.

“Once we realized how systemically important this technology had become to our entire transportation system and our grid, all eyes started sharpening on how to build independence,” said Nathan Iyer, senior associate at the clean energy nonprofit RMI.

The Bipartisan Infrastructure Law, CHIPS & Science Act, and Inflation Reduction Act direct more than $135 billion to the country’s electric vehicle transition, including toward critical minerals sourcing and processing as well as battery manufacturing.

“They targeted essentially every single part of the manufacturing process,” said Iyer. “What the US is doing is unique, strategic and aggressive.”

Redwood Materials was founded in 2017 by JB Straubel, the co-founder and former CTO of Tesla. While working on Tesla’s massive Nevada Gigafactory, he realized the U.S. would soon confront a dire challenge sourcing the supplies needed to support the EV transition. “Even eight years ago, it was clear this would be a really big bottleneck for the entire industry as it scaled,” he said at the event on Thursday.

Redwood Materials will produce the two most important components of an electric vehicle battery: the anode, which contributes to the battery’s charging performance, and the cathode, which contains the battery’s critical metals. Together, they make up almost 80 percent of a battery’s cost. Domesticating their production not only provides a more secure supply stream for the materials, it lowers the cost of battery production, which can make electric vehicles more affordable for consumers.

Last month, Redwood Materials began producing anode copper foil at its Nevada facility, the first time the component has been commercially produced in the U.S. It expects to begin testing on its cathode products later this year.

Once complete, the Nevada facility will employ about 1,600 full-time workers.

The company is bringing circularity to the battery supply chain. The metals in EV batteries are almost infinitely recyclable, and Redwood Materials has begun recycling them and collecting scrap from factories, lithium-ion batteries from e-bikes, consumer electronics and other sources for use in its anode and cathode components.

While there are not yet enough electric vehicle batteries in circulation to use materials exclusively from recycled sources, the infrastructure Redwood Materials is creating now could eventually support almost completely closed-loop battery manufacturing.

“They’re a little ahead of the recycled material inputs,” said Iyer, “but if they’re successful this will be the cornerstone of the circular economy.”

Eighty battery manufacturing or supply chain companies have announced that they are either reshoring or opening in the United States in the last two years, according to Secretary Granholm. “This is happening because there is now an industrial strategy to make this stuff in America,” she said. “China might be starting to worry.”