Chelsy Robison huddled in an empty building on the Paradise Park mobile home campground in Perry, Florida, on the evening of September 26, listening as 140 miles-per-hour winds tore through the state’s Big Bend region. Robison, recovering from hernia surgery; her boyfriend, Steve; and their dog, Judah, had abandoned their violently shaking trailer just a few hours earlier, fearing it would not survive the storm.

The next morning, as the worst of the winds died down, they emerged to find that Hurricane Helene had left behind a world of damage: Fragments of one neighbor’s walls littered the grass, roof panels had been ripped clean off a communal building, and a trailer just a few dozen feet from her own had been flipped entirely upside down. In the distance, a sea of downed power lines and felled trees covered the mobile home park’s 8 acres. Her trailer sat amid the calamitous scene, miraculously unscathed.

Robison was relieved. She had lost everything the year before when Hurricane Idalia, another Category 4, bore down on Taylor County and caused a tree to crash through her manufactured home. That’s how she ended up at Paradise Park in the first place, living in a temporary trailer issued to her by the Federal Emergency Management Agency. “It’s just a little bit of damage. It ain’t too much. It ain’t like Idalia,” said Robison, which crushed her trailer “like a can.” “We just living, man. I just hope ain’t nothing else gonna come through here.”

Not even two weeks later, Florida’s Big Bend communities are now preparing for Hurricane Milton, a rapidly intensifying system forecasted to bring life-threatening storm surge and winds later this week to many of the same areas devastated by Helene.

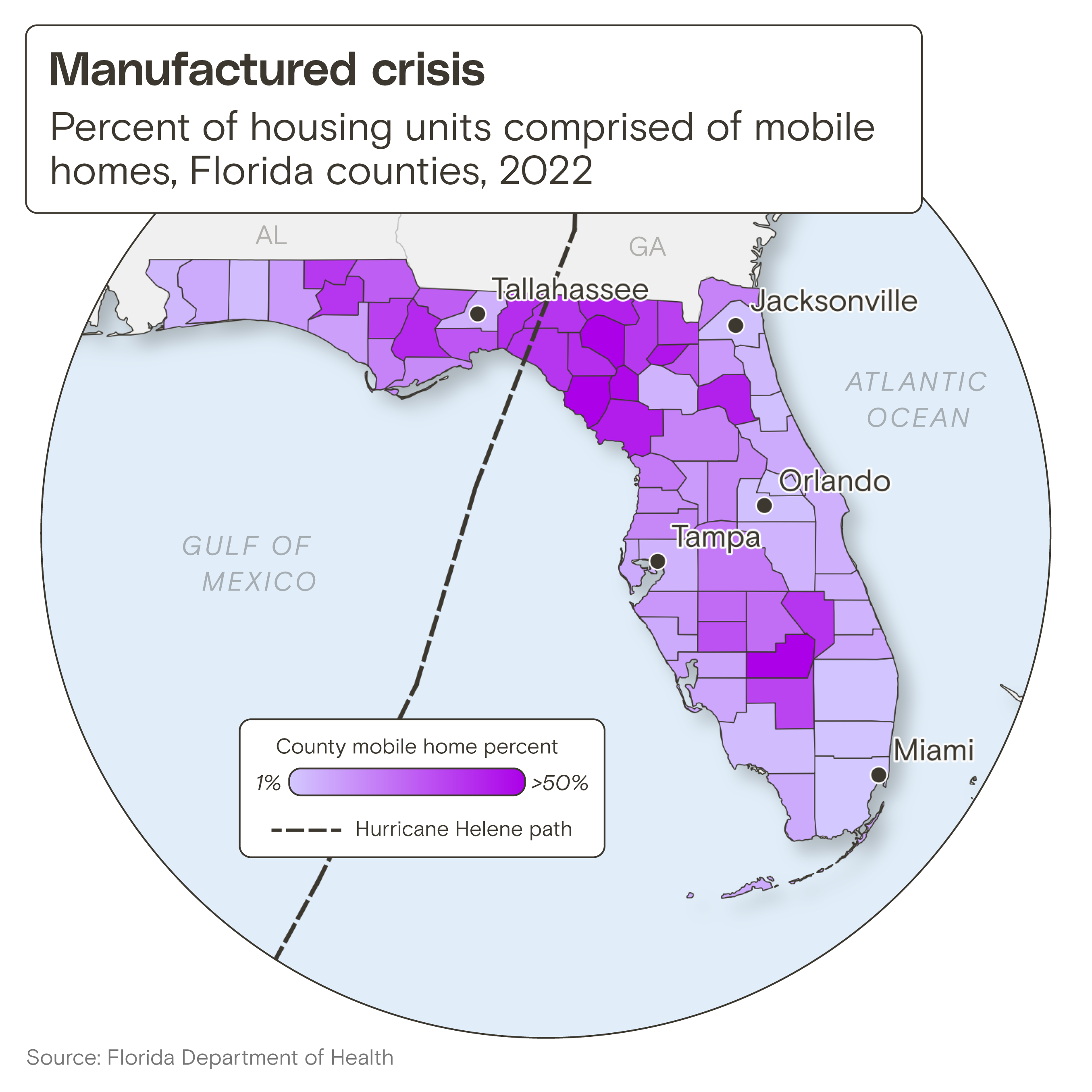

Florida’s Big Bend is nestled into the crook of the state’s Gulf Coast, largely underdeveloped and lower-income. A huge share of the region’s residents live in manufactured housing. In Taylor County, where Helene made landfall and where Milton is expected to inflict damage, more than a third of the housing stock consists of prefab units, according to census data. Many of the counties in southern Georgia, where Helene’s eye moved next, have a similar mix. And in western North Carolina, where the storm’s heavy rain caused mass flooding and landslides, around 15 percent of housing stock is manufactured — nearly triple the national average.

Communities like Robison’s — littered with crumpled trailers, scraped-off aluminum siding, and waterlogged campers — now serve as acute examples of how the climate and housing crises in the United States overlap.

Because of how mobile home units are anchored and the materials typically used to build them, manufactured houses are among the most vulnerable types of housing stock in climate disasters. They aren’t rooted as deeply into the ground, which means they can flip or collapse during wind events, and they tend to have thinner exteriors and insulation than site-built homes, which mean they are more vulnerable to leakage and the spread of mold. These problems are far more common with “mobile homes,” or manufactured homes built before the launch of 1970s-era construction guidelines, but they also exist in more recent models.

A ballooning shortage of affordable housing has pushed more people into manufactured homes at the same time that extreme weather like hurricanes are becoming more severe. Victims of climate disasters also often find themselves turning to manufactured homes in the absence of other housing stock — perpetuating a cycle of substandard living and displacement. Making matters even worse is that many mobile home residents, like those at Paradise Park, don’t own the land underneath their house.

“Families who live in manufactured home parks, their rate of poverty is about three times as much as people who have conventional housing,” said Andrew Rumbach, a senior fellow at the Urban Institute who studies household and community risk to hazards and climate change. They also either lack insurance, or are underinsured, further magnifying their chance of long-term economic disruption from a hurricane like Helene. People in these situations additionally often confront “really complicated issues” in financing a home, he noted.

“You can’t get a conventional mortgage on a manufactured home in most states, including Florida, because it’s not ‘real property.’ It’s what we call ‘chattel property’ or personal property,” he said.

More Hurricane Helene coverage

This key distinction makes it harder for those trying to rebuild a manufactured home after a disaster, because it can be more difficult to get aid, particularly when such properties are purchased informally through private sales, Rumbach said. People living in mobile home parks across the nation also often find themselves ineligible for recovery programs like buyouts because they don’t own the land below their structures.

Florida has more manufactured homes than almost any other state in the country. An estimated 12 percent of the housing stock in Helene’s path in Florida, spread across 21 counties, is made up of mobile or manufactured homes, according to an analysis provided to Grist by researchers at the Urban Institute. More than a third of those are rentals. The proportion is far higher in the Big Bend, where the storm made landfall, and in South Carolina, where it also brought damaging winds.

These homes once provided an alternative for those who couldn’t afford traditional housing, but climate change is stripping them of being this lifeline, a refuge. The cost of the average manufactured home has risen alongside the cost of building materials like wood and aluminum, and many people who lost their mobile homes during 2023’s Hurricane Idalia have struggled to purchase or rent new ones.

“The prices of mobile homes [have gone] up significantly since COVID,” said Leon Wright, the building director for Dixie County, where more than half of the housing stock consists of manufactured homes, one of the highest rates in the nation. “It’s not as affordable as it once was.” Dixie lost 130 houses to Idalia last year, and it still has yet to repair many of them. Wright said Helene destroyed far more.

One of the largest providers of manufactured homes in the Big Bend is none other than FEMA itself, which deploys them to house storm victims like Robison. The agency tends to use these units, known colloquially as “FEMA trailers,” when it cannot find enough traditional housing in a given disaster area.

Bobbi Pattison’s examines damage to her home in Steinhatchee, Florida, after 2023’s Hurricane Idalia, left, and then again in September after Hurricane Helene. Ted Richardson and Thomas Simonetti / The Washington Post via Getty Images

FEMA has drawn criticism in the past for relying on travel trailers rather than relocating disaster victims into standard homes or apartments, and for being too slow to provide these trailers. States like Louisiana have begun to buy and ship in their own manufactured homes after big storms in order to avoid federal red tape, and Florida’s top emergency official said that he would seek to do the same after Helene.

Hundreds of these trailers have become a part of the Big Bend’s manufactured housing ecosystem since Idalia, and more will arrive soon following Helene, and likely Milton. Todd Mikola, the owner of Paradise Park, told Grist two days after landfall that he is planning to clear trees and crush damaged trailers to make room for more FEMA trailers — he was in the midst of moving trees away from the former home of a woman who had lost her job and fallen behind on rent.

“I want to beautify the place,” said Mikola, who lives in Germany and bought the trailer park three years ago. He had flown in from Germany just a few days before the storm and was planning to leave town a few days later. He told Grist that Helene hadn’t damaged the park — omitting mention of the flipped and damaged trailers or the transformers that burst in Helene’s immediate aftermath.

FEMA only rents its mobile home units to storm victims for 18 months, but trailers often become a dead-end for displaced people, who in many cases cannot find affordable housing long after the disaster. A 2022 analysis by The New York Times found that a large share of victims from recent hurricanes, such as 2020’s Laura and 2021’s Ida, remained in trailers even as FEMA wound down its aid for those storms.

Tony Lacey, who also lives in a FEMA trailer just next door to Robison in Paradise Park, said he had no idea what he would do if the agency kicked him out of his home in February, the 18-month anniversary of Idalia. That storm had destroyed his home in the coastal town of Keaton Beach, landing him in Paradise Park. In the year since, he has been unable to find a job in the area, and his car permanently broke down. The agency hasn’t been receptive to his attempts to purchase the structure.

“They didn’t even talk to me about it,” he said. “[FEMA] said, ‘You don’t have income.’ And they’re intimidating when you talk to them.” A spokesperson for FEMA did not respond to Grist’s requests for comment by publication, citing the demands of the agency’s ongoing emergency response to Helene.

Robison has also been stuck in a waiting game with the agency ever since she moved in last November, unsure when or if it will force her out of her home, out of Paradise Park.

“I don’t know if they ain’t getting it, or they don’t understand, or I don’t know,” she said, “but I would like for them to give us these campers, because we don’t have homes to go to.”

Campers and mobile homes are an affordable backup for many families in areas with scarce housing, but some residents in disaster areas are starting to see them as a permanent solution — a way to avoid the high cost of building to flood and wind standards.

When a home suffers significant damage during a storm, federal regulations require the homeowner to rebuild it to a higher flood standard. For coastal homeowners on the Big Bend, that can mean elevating as much as 18 or 20 feet in the air — an expensive and lengthy process.

Those who can’t afford to elevate are turning to manufactured housing. Coastal residents can bring campers onto their land and erect “pole barns,” or rudimentary roof shelters, to protect them from the elements. Because these homes aren’t permanent structures, they aren’t subject to local building codes or insurance mandates. When big storms come, the owners can just drive them to higher ground for a few days.

Wright said more coastal residents in his county are turning to campers and that he understands why, given the stringency of state and federal building codes designed to protect against flood and wind damage.

“You always see it,” he said. “People lose freedoms in the name of security or safety.” He went on to refer to the building codes as “borderline communism.” He added, however, that the conversion of many homes to camper parking spaces could deal a big hit to the Dixie County budget, which relies to a great extent on property tax revenue from coastal homes. The taxable value of a pole barn lot is much lower than that of an actual house.

Rumbach, the hazard and housing expert, worries about more residents utilizing this sort of largely unregulated manufactured housing. The financial strain of hurricanes, he said, compounded by a shortage of affordable housing, could force people to make decisions that put them at greater risk during future disasters.

“I worry about [this] being maladaptation,” he said. “I’m concerned that the outcome of this storm could be that we are more vulnerable next time, not less.”

Chandan Khanna / AFP via Getty Images

Clint and Brooke Hiers, longtime residents of Horseshoe Beach, a town of just 170 people, are considering a transition to this tentative form of housing. After evacuating to higher ground ahead of Helene, they drove back to their seaside community in Dixie County on Friday to find it reduced to a maze of splinters and debris. Their home, which was elevated around 5 feet, had been pushed off its pilings by storm surge and fallen into a neighbor’s yard. Brooke’s sister’s house next door had been sheared apart by the water.

“You can’t rebuild down here, because if you do, you got to go to code,” said Clint, staring at what remained of his house, stuck in a stand of waterlogged trees. He estimated that elevating his house to 18 feet would cost a few hundred thousand dollars. Even then, he would still have to pay more than $10,000 a year for flood and windstorm insurance, assuming insurance companies would sell it to him.

Given those costs, it seemed far easier for him and Brooke to adopt a more tentative form of residence on the coast.

“I could take that lot and build a pretty good-sized pole barn to put a camper on,” he said. “Then when the storm comes, you just pull it out. You don’t have to have insurance. That’s what everybody’s going to after Idalia — a lot of people already did that down here.”

As Brooke examined the damage, she seemed to be thinking along the same lines. “Everybody’s bone-ass broke right now from everything we had to do for Idalia,” she said. “We are broke, broke. Spent all our savings. And now it’s just gone.”