Moody’s Investor Service thinks it has a tip for its friends in the field of finance. From The Hill:

“We believe the White House will reverse course and approve the Keystone XL pipeline, which would ship crude from Canada’s western oil sands to the Gulf Coast,” the ratings agency said in a wide-ranging report Monday on the implications of the elections.

At least one industry group agrees, imagining that the president’s campaign rhetoric signals a change of heart. From the Financial Times:

Jack Gerard, president of the American Petroleum Institute, the oil industry’s lobby group, said after the election that Mr Obama had moved “about 180 degrees” in his rhetoric towards support for oil and gas production.

Insiders in Mr Obama’s campaign had “implicitly promised he would approve the Keystone XL pipeline”, Mr Gerard said. He added: “It will be a threshold test as to how serious the president is about producing America’s oil and natural gas.”

Keystone XL opponents would be forgiven for responding with a hearty, “Keep dreaming.” After all, it was only 10 months ago that President Obama rejected a permit to build the pipeline.

Clearly the API and Moody’s would like to see the pipeline move forward — but it’s not at all clear why the president would change his mind.

As there were when Obama first rejected its permits, there are four primary arguments for the pipeline:

- It will create jobs.

- It will reduce American dependence on Middle Eastern oil.

- It will prevent Canadian companies from selling the oil to China.

- It will make money for domestic oil companies.

That last point is the one domestic oil companies are most concerned about, unsurprisingly — but it’s also the only one that actually holds up. On the other three points, the argument has only gotten worse since Obama declined to approve the Keystone XL pipeline in January. Let’s walk through them.

It will create jobs.

First of all, the contention that Keystone XL will create a large number of jobs is a subject of enormous debate. Cornell University suggests it will add only 500 to 1,400 temporary jobs in construction. (As ThinkProgress notes, the industry’s numbers included 51 jobs in dancing and choreography.)

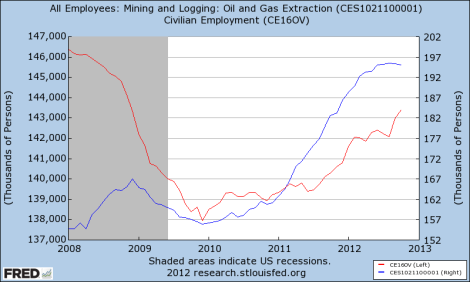

But the real issue is that creating jobs, while still important, is less urgent than it was in January. Since then, the economy has added an estimated 1.7 million jobs. Moreover, growth in oil and gas extraction employment (blue line) has risen even faster than the economy on the whole (red line) since the end of the recession. This is not an industry that needs to be goosed.

FREDClick to embiggen.

In summary: This argument is weaker than it was in January.

It will reduce American dependence on Middle Eastern oil.

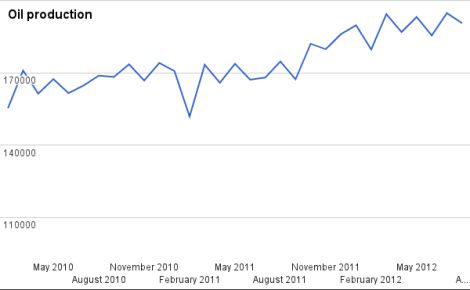

America’s fossil fuel production has gone up since January.

EIA.govClick to embiggen.

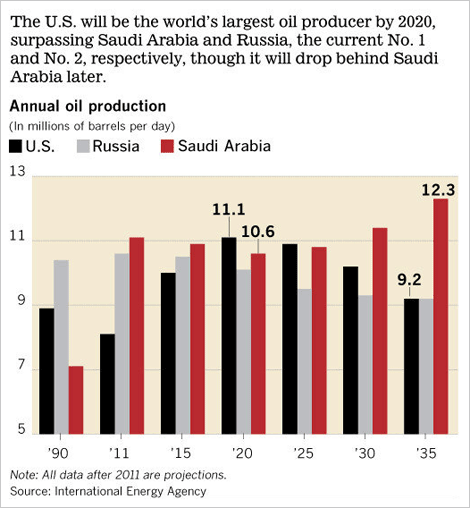

And as we noted last month and as reinforced by the International Energy Agency this week, the United States will soon be one of the top oil producers in the world — if not the largest overall.

This will not make the United States completely independent of foreign fossil fuel use, but that goal is almost certainly unattainable.

In summary: This argument is weaker than it was in January.

It will prevent Canadian companies from selling the oil to China.

This argument suffered a near-fatal blow last week. As we reported then, from the Wall Street Journal:

Amid rising costs, gyrating prices and a burst of supply competition down south, Canadian oil companies are rethinking investment in one of North America’s earliest and fastest-growing “unconventional” oil frontiers — Alberta’s oil sands.

In short, the argument is that the glut of available oil (see previous point) has made production of tar-sands oil a worse bet for oil companies. Even Moody’s notes this:

[A]pproval will not be quick. A prolonged permitting process risks missing the very oil price boom that inspired Keystone XL in the first place. Still, even if Keystone XL went into operation in 2015 or 2016, Gulf Coast refining and marketing companies would benefit from wider light/heavy crude price differentials.

But according to the Journal, those differentials would be partly dependent on the supply of oil brought by the Keystone XL pipeline.

Assuming that tar-sands producers do move ahead with extraction, getting the product to China necessitates a pipeline to Canada’s western coast — and that’s no sure thing either.

Again, in summary: This argument is weaker than it was in January.

So, as I suggested above, that leaves us with just one argument that really holds up: that Keystone XL will make money for domestic oil companies. Is that compelling enough?

Moody’s and Jack Gerard seem to be banking on the assumption that Obama’s opposition to Keystone XL a year ago was simply a function of the election. That, for some reason, he thought it was more important to cater to his environmentalist base than to curry favor with voters in the heartland. That would be a strange political calculus, to be sure. But it’s the only straw left to grasp — which may be why protests over Keystone XL are ginning back up. Environmentalists, too, fear that Obama’s opposition was only ballot-thin.

Were politics a completely rational enterprise, the evidence at hand — even leaving out the dangers of burning that tar-sands oil! — would suggest that approval of Keystone XL was a worse bet now than 10 months ago. But politics is far from a completely rational enterprise.

This post is part of our November 2012 theme: Post-election hangover — whither the climate?