I recently got a copy of a utility bill for a Minnesota business that has a 40 kilowatt (kW) solar PV array. I wanted to learn how quickly they’d pay off their array with the electricity savings.

I was shocked.

Payback time was 30 years. Even if the business owner had received a generous $2.00 per Watt rebate on top of federal tax incentives, it would still take 22 years to recoup the investment. It all came down to the way utilities account for solar power under “net metering” rules.

A quick tutorial. Net metering essentially lets a utility customer run their meter backward if they have an on-site electricity generator (like rooftop solar). So if I’m a commercial customer who uses 10,000 kilowatt-hours (kWh) a month but my solar panel generates 4,000 kWh, I only pay for the difference: 6,000 kWh. This is supposedly a great deal, because rolling back the meter at the retail rate typically beats getting paid the utility’s “avoided cost” wholesale power rate — the rate the utility pays for more power from nearby power plants.

But the trick is how the meter rolls back. You might think that your electricity bill has simple math: total electricity consumed times the rate per kWh used. In the case of this business owner, that would have been a rate of 21 cents per kWh and a payback period for their solar array of just nine years.

If you thought it was that simple, you’d be wrong.

If you thought it was that simple, you’d be wrong.

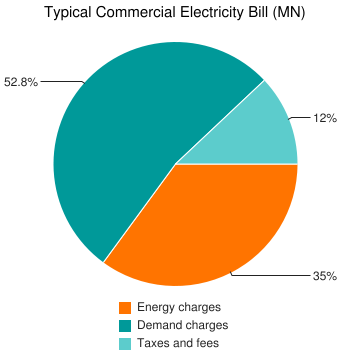

In this case, 12 percent of the electricity bill is taxes and fees. And of the remaining 88 percent of the bill, 60 percent isn’t an energy charge per kWh, but a “demand charge,” which the solar PV array doesn’t affect. So the customer can “net meter” with their solar power array, but it only affects 35 percent of their total electric bill.

So instead of rolling back their meter and saving 21 cents per kWh of electricity, this commercial customer actually receives about 5.4 cents per kWh, reflecting the energy charge portion of their bill (divided between an energy charge (41 percent), fuel cost charge (57 percent), and (tiny) environment improvement rider (2 percent)). And net metering at that rate means a payback period of 30 years.

Net metering doesn’t do a whole lot for the customer’s bill, but it sure makes the utility happy.

With net metering, the utility treats solar PV electricity generation exactly the same as it would conservation or energy efficiency (with the exception that solar usually gets a more generous rebate). And since both of these strategies are significantly less expensive than PV for reducing electricity demand, the customer loses out.

The customer loses, but the utility wins.

That’s because the energy charge doesn’t necessarily take into account the additional value that solar provides to the utility. When working with the Palo Alto, Calif., municipal utility, the CLEAN Coalition — a California renewable energy organization — found that solar PV was worth nearly 75 percent more than typical “brown power” because of its time of delivery (peak), avoided transmission access charges, renewable energy credits, and additional local value. Similar calculations were also made in Ft. Collins, Colo. That means that instead of the 3-4 cents that utilities claim they pay for an additional kWh from a cheap coal or natural gas plant, solar is actually worth far more.

Accumulating solar PV and other distributed generation sources can also allow the utility to defer infrastructure upgrades and reduce stress on the distributed grid, especially when spread over a wide geographic area.

There are a few caveats. The energy charge that individuals and businesses pay on the utility bill (5.4 cents in the case of the Minnesota business owner) may exceed what the utility pays for the power (there’s a markup in every business); even so, the structure of net metering means that the utility isn’t paying for the advantages of additional electricity generation, but only for delivering a bit less electricity. The particularly poor economics for folks who go solar in Minnesota are also a factor of the state’s rate structure. Minnesota has relatively low electricity prices with no time-of-use rates or consumption tiers that would allow solar PV to offset marginally higher rates. Other states, like California, have rate structures such that net metering values are 15 to 20 cents per kWh, rather than 5 cents.

There’s much more to net metering rules than the price, but in Minnesota and likely other states, it’s a rule that offers a lot to utilities and very little to ratepayers. We can do better.

This post originally appeared on Energy Self-Reliant States, a resource of the Institute for Local Self-Reliance’s New Rules Project.