It often surprises people to hear that big companies like Exxon use a “shadow carbon price” when assessing future investment opportunities (in other words, they assume a price on carbon even where/when there isn’t one). After all, if you only pay attention to the headlines, it sounds like the big story on climate change is that nobody’s doing anything and we’re all doomed. Why would Exxon think carbon will be priced any time soon?

Well, it turns out that carbon is getting priced, not in the big, dramatic, simple way climate hawks would prefer, but incrementally, piecemeal, country-by-country, region-by-region, still inadequately but in a way that’s starting to add up.

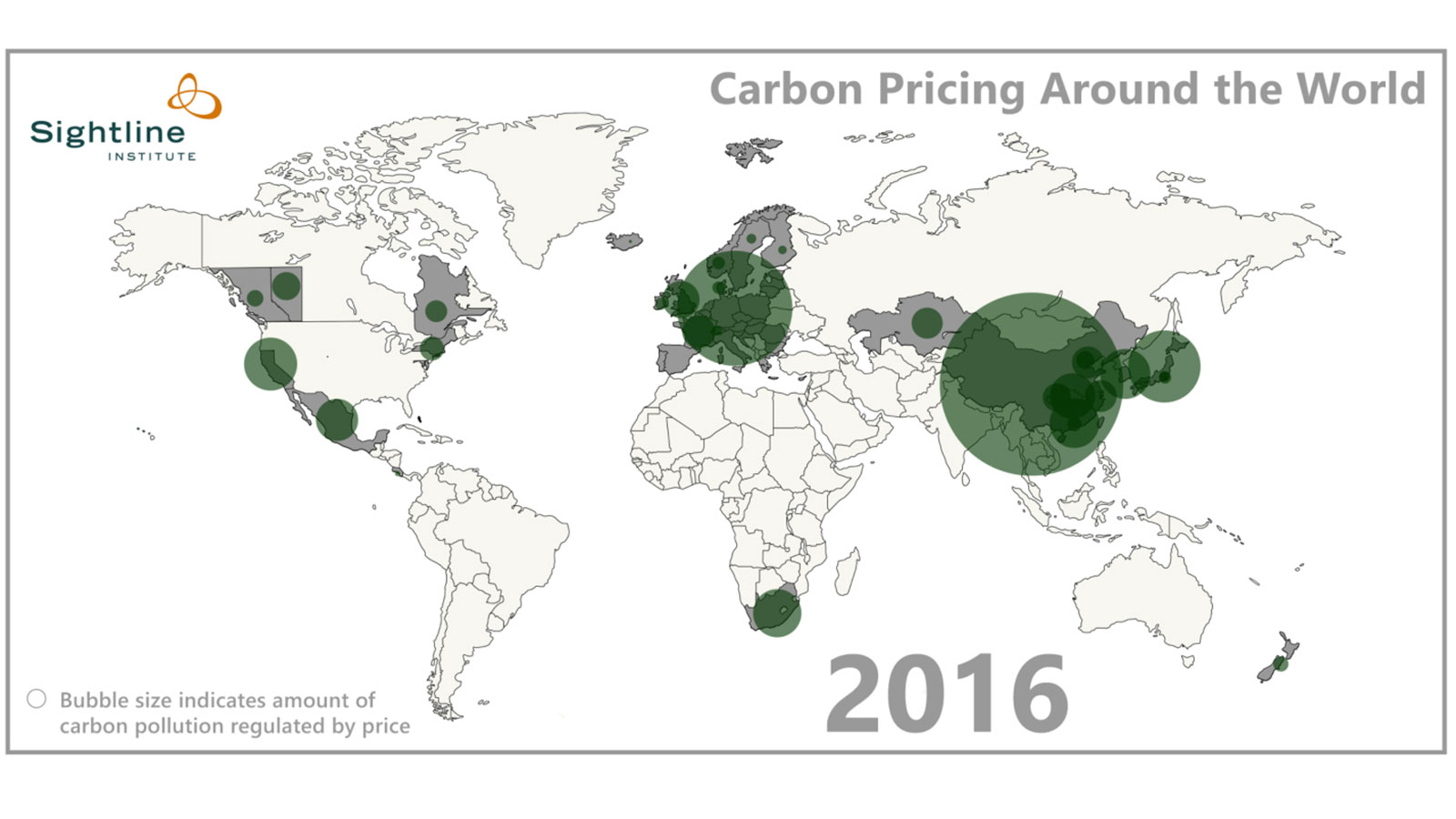

The always-excellent folks at the Sightline Institute have done the world a favor by pulling all the world’s carbon pricing systems into one place. Here’s their awesome animated map:

As you can see, the big story (as usual) is China, which is planning on rolling out a nationwide cap-and-trade system in 2016. That system will instantly become the largest in the world, covering some 5,000 million metric tons worth of emissions, about 13 percent of the the world’s total. Once that’s in place, about a quarter of the world’s total carbon emissions will be priced. Not bad!

The next biggest systems after China’s are the E.U.’s and Japan’s. America’s — RGGI on the East Coast and California’s on the West Coast — are comparatively small, especially relative to total emissions in those areas.

How high are the prices on carbon? Sightline explains:

Prices range from $1 to $168 per ton, but most cluster between $10 and $30 per ton. For example, California’s price is currently around $13 per ton, and British Columbia’s price is currently around $28. The price outlier at $168 per ton is Sweden, where a high and persistent price has helped reduce pollution 13 percent in a decade. A carbon tax of $28 plus other policies have helped Ireland slash pollution more than 15 percent since 2008.

Sightline’s post contains a bunch more insights, including what sectors are most commonly covered (electricity and large industry), the variety of uses for carbon revenue, and the ways that various systems protect heavy-emitting industries. I particularly appreciate this point:

What’s better: a cap or a tax?

Wrong question. What matters are those pesky details. A well-designed tax can deliver the same benefits as a well-designed cap. Poor design can ruin either.

Exactly.

Anyway, check out Sightline’s post, and while you’re over there, give them some money. For such a comparatively small outfit, they are creating an enormous amount of value.