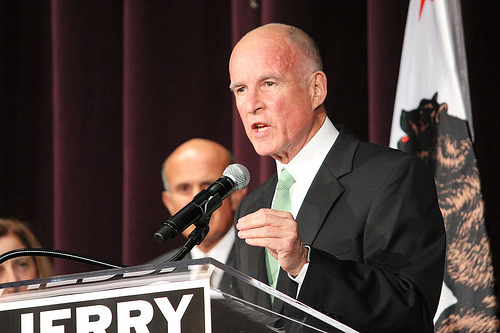

Jerry Brown wants to face Fannie and Freddie down.California Attorney General (and candidate for governor) Jerry Brown sued Fannie Mae and Freddie Mac today for blocking Property Assessed Clean Energy (PACE) programs. There’s a good chance that Fannie and Freddie’s legal costs from defending this suit will add up to more than they ever stood to lose from the clean-energy programs, but here we are. The town of Babylon, N.Y., has also been threatening to sue over the same issue, but Brown was quicker.

Jerry Brown wants to face Fannie and Freddie down.California Attorney General (and candidate for governor) Jerry Brown sued Fannie Mae and Freddie Mac today for blocking Property Assessed Clean Energy (PACE) programs. There’s a good chance that Fannie and Freddie’s legal costs from defending this suit will add up to more than they ever stood to lose from the clean-energy programs, but here we are. The town of Babylon, N.Y., has also been threatening to sue over the same issue, but Brown was quicker.

Todd Woody reports at the New York Times’ Green blog:

The suit alleges that the [actions of the Federal Housing Finance Agency, which regulates Fannie and Freddie] violated California law, which authorizes PACE programs, and are “severely hampering California’s efforts to assist thousands of California homeowners to reduce their energy and water use, help drive the state’s green economy, and create significant numbers of skilled, stable and well-paying jobs.”

“The actions of these government-sponsored, shareholder-owned private corporations have placed California’s PACE programs — and the hundreds of millions of dollars in federal stimulus money supporting them — at immediate risk while benefiting their own pecuniary interests,” the suit states.

The housing agency said it would mount an aggressive defense. “In keeping with our safety and soundness obligations, the Federal Housing Finance Agency will defend vigorously its actions that aim to protect taxpayers, lenders, Fannie Mae and Freddie Mac,” Edward DeMarco, the agency’s acting director, said in a statement.

“Homeowners should not be placed at risk by programs that alter lien priorities and fail to operate with sound underwriting guidelines and consumer protections,” he said. “Mortgage holders should not be forced to absorb new credit risks after they have already purchased or guaranteed a mortgage.”

Interesting:

The suit’s most novel allegation is that the agency violated federal environmental law by not conducting a review of the potential environmental impact of restricting PACE programs.

“F.H.F.A. has effectively precluded PACE programs in California and deprived California and its citizens of the associated residential energy and water efficiency and renewable energy benefits, thereby significantly impacting the human environment, without completing the required environmental review under the National Environmental Policy Act,” the suit states.

After Fannie and Freddie warned lenders away from PACE, many municipalities froze their PACE programs. But on Tuesday, Sonoma County, Calif., voted to reopen its Energy Independence PACE program, and Missouri’s governor signed PACE-enabling legislation (joining at least 22 other states). Clearly many people have confidence that this model will survive once the Fannie/Freddie dispute gets resolved.