Photo: Tom PlunkettCongressional Republicans are going after Obama’s EPA with both barrels blazing. Everyone who pays attention to politics knows that by now. What is somewhat less widely understood is why.

Photo: Tom PlunkettCongressional Republicans are going after Obama’s EPA with both barrels blazing. Everyone who pays attention to politics knows that by now. What is somewhat less widely understood is why.

Here’s what’s at stake: new and emerging EPA regulations are going to force a huge wave of coal-plant retirements.

I’ve written quite a bit about this if you want background. The regulations will ratchet down standards for sulfur dioxide, nitrogen oxides, mercury, and other toxics, possibly restrict coal ash for the first time, and possibly require cooling towers (so that wastewater discharge doesn’t fry river and stream ecosystems). Oh, and there’s also those pending greenhouse gas rules, though their influence will be somewhat less in the short term.

A couple of new reports have filled out more details on these coal-plant closures. I’ll take a closer look at one of them, but first it’s important to note that this isn’t some theoretical, years-out possibility. It’s already underway. Here’s a sampling of recent headlines:

- The New York Times: “Utilities shift to gas-based plants as alternative to coal“

- Wall Street Journal: “Utilities are increasingly looking to natural gas to generate electricity“

- Financial Times: “Wave of closures set to hit U.S. coal stations“

- Denver Daily News: “PUC approves retiring Denver-area coal-fired plants, switching to natural gas“

- Reuters: “Xcel to shut or convert Colorado coal power plants“

- Chattanooga Times Free Press: “TVA to shutter coal plants, turn to nuclear”

- Times Daily: “TVA to idle coal plants to cut emission output“

- Charlotte Observer: “Duke considers closing old coal plants“

I could go on.

Two new reports investigate just how big the wave of closures will be. One is from the investment bank FBR Capital Markets, which Reuters covers today. Another is from consultancy The Brattle Group. So as not to overwhelm with wonk, I’ll restrict my focus to the latter.

Brattle’s report digs into the upgrade-or-retire decision every coal plant in the U.S. will soon face, using a “retirement screening tool,” and concludes that …

… emerging EPA regulations on air quality and water for coal-fired power plants could result in over 50,000 MW of coal plant retirements and require an investment of up to $180 billion for remaining plants to comply with the likely mandates.

Both those numbers go up substantially — retirements by 11-12 GW and needed investment by $30-50 billion — if EPA requires cooling towers in addition to smokestack scrubbers. (This is consistent with the FBR Capital Markets report, which finds a total of up to 70,000 MW of coal on the line.)

By 2020, the authors say, coal plant closures will reduce coal demand by about 15 percent, increase natural gas demand by about 10 percent, and (assuming the coal is replaced by gas) reduce CO2 emissions by 150 million tons.

Those are the top line conclusions. Here are a few other interesting aspects:

The oldest and dirtiest coal plants face the most risk, but not just the oldest and dirtiest. In fact, the study finds that about a third of the closures will be plants under 40 years old and larger than 500 MW.

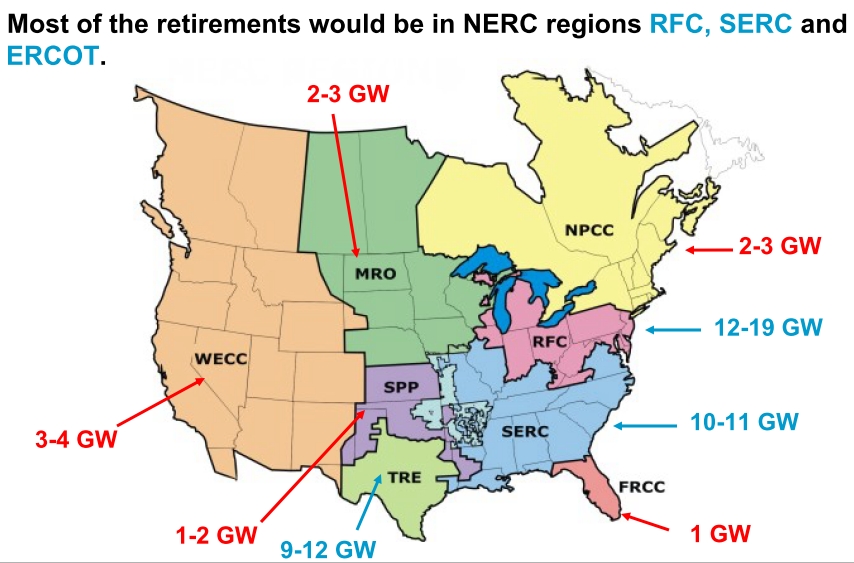

Almost all the retirements will take place at merchant coal plants, which sell power into competitive wholesale markets, rather than at regulated-utility plants, which sell power to retail customers. As a consequence, the effects will be concentrated in the Southeast (SERC), the mid-Atlantic (RFC), and Texas (ERCOT). Here’s a map:

(Note: the blue numbers indicate the areas with a large amount of capacity at risk. ERCOT doesn’t appear on the map, but it basically covers Texas — TRE is the organization charged with ensuring reliability in the ERCOT region.)

In some of those regions, the merchant coal retirements will take offline a substantial chunk of total generating capacity. ERCOT, for instance, stands to shut down some 15 percent of its capacity. If both scrubbers and cooling towers are required, it will shut down every merchant coal plant.

This will amount to a big change for the power industry in some regions, but it’s worth remembering that EPA’s new and emerging regulations are absolutely necessary. A recent report [PDF] by the Clean Air Task Force found that air pollution from coal-fired plants will lead to more than 13,000 premature deaths in America in 2010 alone. The health costs add up to $100 billion a year, and that number rises substantially if you take into account the knock-on employment and tax effects from all those illnesses and deaths.

Reducing or eliminating those health and employment effects will be a boon to the economy, not a drag. Industry always wildly exaggerates what these types of regulations will cost, but in fact EPA’s air regulations typically produce benefits wildly in excess of costs and there’s no reason to think this round will be any different.

The power industry will squawk, but there’s every reason to believe that the they can accommodate these regulations without threatening service reliability. There’s tons of idle natural gas capacity, there’s tons of new capacity in the pipeline, the recession has reduced demand growth, and utilities now have tons of demand-side options. It would be nice to see the power industry proactively embracing the future rather than fighting these endless rear-guard battles.

The long-overdue shutting down of America’s dirty coal fleet is underway and it is good news: for public health, for the national economy, even for coal-state economies.

It’s only the merchant coal operators, and the congressfolk they bankroll, that have anything to fear. The rest of us can say: good riddance.