Perhaps nowhere is the contrast between the science and economics of climate change as great as in the dueling metaphors governing the impact of high-end warming: “collapse” (following scientist Jared Diamond) vs. “reductions in the rate of growth” (following all standard integrated assessment models in economics, including those of Nicholas Stern and the IPCC).

By way of reference, mid-range estimates of business-as-usual warming are currently around 7.2 degrees F. During the last Ice Age, global temperatures were only 8.1 degrees F colder then they are today. Many climate scientists, I would argue, believe that high-end warming (greater than 7.2 degrees F) will likely impoverish much of humanity.

By contrast, economic models calmly integrate this warming of greater than Ice Age magnitude, only in the opposite direction, into scenarios assuming continued growth, albeit at reduced levels. Stern, for example, provided an integrated estimate of the costs of climate change, forecasting likely reductions in global output as high as 20 percent below the baseline. This is a big number, justifying immediate and large cuts in emissions on a benefit-cost basis.

And yet, even for Stern, that baseline assumes steady growth of 1.3 percent per capita, implying that by 2200, people on the planet will be 12 times as wealthy as they are today. My E3 colleague Frank Ackerman has noted that even assuming what Stern characterizes as an extreme worst case scenario — a 35 percent reduction in income below baseline — then the world would “only” be eight times richer in 2200. Similarly, the IPCC’s four “marker scenarios” all forecast developing country per capita GDP to equal that of industrial countries in 1990, beginning in 2050 (scenario A1B), to out beyond 2100 (scenario A2).

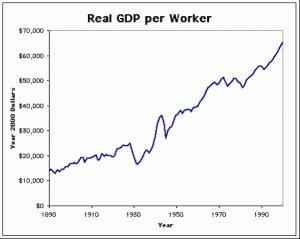

Chart: J. Bradford DeLongWhy no collapse? Most economists live with a powerful picture (U.S. version here) in their heads.

Chart: J. Bradford DeLongWhy no collapse? Most economists live with a powerful picture (U.S. version here) in their heads.

Calamities such as the Great Depression, major regional wars, global epidemics like AIDS, or the recent burst in the global housing bubble, barely put a dent in long-run growth. The default assumption is that capitalism will march relentlessly on, regardless of climate change (or peak oil, or fresh water, or top soil shortages). Sidestepping the issue of whether continued growth enhances welfare, the conventional economists’ position seems well-grounded in historical experience.

Against this record, ecological economists have developed a sophisticated neo-Malthusian response: that high population and growing affluence mean the future will not be like the past, and that the economics of a full planet make continued global economic growth untenable. As a book of cautionary tales, Diamond’s Collapse presents lesson after lesson of how resource constraints, married with an inadequate policy response, cascaded into political crisis and undermined the economic foundations of pre-industrial societies.

The climate debate between scientists and conventional economics is not about the likely physical effects of high-end warming. These impacts are incorporated into economic models. Rather, the differences emerge as economists focus on the costs of climate change that their models can measure.

At the macro level, Integrated Assessment Models develop damage functions very roughly calibrated from sectoral studies of moderate warming, that then reflect arbitrary increases in damages with greater warming. Elizabeth A. Stanton, Frank Ackerman, and Sivan Kartha (2009) point out that because William Norhdaus’s DICE model carries an exponent of two on its damage function, the model has to heat the planet up by 34 degrees F to cut global GDP in half! Increase the damage function exponent to four or five, and DICE makes collapse look somewhat more likely, but by no means inevitable.

Serious sectoral analysis of high-end warming impacts are few. One example is Robert J. Nicholls et al. (2008), who explore the case of a 16.4-feet, 100-year sea-level rise resulting from a hypothetical, rapid collapse of the Greenland and/or West Antarctic ice sheets. Some 400 million people currently live in land that would be potentially inundated. Actual inundation and relocation would depend on the degree of coastal protection initiated. The authors suggest that coastal protection of up to 50 percent would be justified on a benefit cost basis, reducing actual displacement to fewer than 15 million people over 100 years. Now this conclusion is hedged by several caveats, most prominently, that in some countries the costs of protection would rise prohibitively, to above 1 percent of GDP, and that Katrina (and add the BP blowout) show that optimal defensive investments are seldom made. Nevertheless, the paper has a startling bottom-line that is very, very far from collapse: a 16.4-feet, rapid sea level rise might imply displacement of only 150,000 people per year, on average. Nothing worse here then your average earthquake year.

To sum up: Economic models that model marginal changes have a hard time grappling with the economics of disaster. That said, academic economists nevertheless have waded in, and do tend to be aware of the limitations of their modeling exercises, providing appropriate caveats in the text. That said, those caveats often disappear from bottom line policy purposes to which studies are put. Thus the projections of continued future economic growth from the IPCC, and Stern.

In between collapse and slower growth, Martin Weitzman provides a useful metaphor for high-end warming: it will leave humanity inhabiting “a terra incognita biosphere.” In an unrecognizable bio-physical world, continued global economic growth is possible — it is hubris to categorically assert otherwise — but a Diamond-like catastrophic outcome would also seem to have uncomfortably high probabilities, especially for regional economies.

Do we require detailed quantitative macroeconomic estimates of the economic losses from collapse? Probably not. Weitzman has shown that for fat-tailed damage functions, the whole IAM modeling exercise breaks down.

Nevertheless, better sectoral analyses of the costs of high-end warming are needed. When climate scientists venture into policy, it is often with reference to the biblical hell and high-water that high-end warming will unleash: floods, droughts, famine, fire, plague, mass extinction. And yet compelling stories from economists about the relative costs of these future events are not yet well-developed. I’ll blog later on the ways in which dollar figures are important to frame the media debate, and public understanding about climate change.