This post originally appeared on the Great Energy Challenge blog, in partnership with National Geographic and Planet Forward.

Despite my seriously mixed feelings about the State of the Union speeches, I tuned in to this year’s speech for the first time in several years. Like many, I was disappointed if not surprised that President Obama didn’t mention climate change even once. Climate policy is hard sell in a down economy. I hope Mother Nature understands.

Less disappointing, and less surprising, is that he called for the economy to reduce our oil consumption. I’m sorry to be unimpressed, but when a Texas oil man turned Republican president can bemoan our “addiction” to oil, having anyone else do it seems a little passé.

Though he loses some style points, there is actually some merit in the substance of Obama’s proposal. As if having some actual substance weren’t innovative enough, he went one step further and displayed a remarkable degree of common sense in calling for an end to subsidies to oil companies.

It has long seemed to me, and others, that if we can’t bring ourselves to make oil companies pay for the environmental risks and costs their products impose on us, the least we could do is to stop paying them for the privilege.

So rather than talk vaguely about the need to reduce our oil dependence (as if we were all just going to stop driving to work and school) or disingenuously about the need to get off foreign oil (as if we could ever produce anywhere near enough oil to make a dent in our dependence on stable global oil markets), the president offered an approach that would at least get us started in the right direction, and if nothing else, would help cut the deficit, something politicians of all stripes could support, right?

One word of warning to the president: Finding these subsidies is a lot harder than you might think.

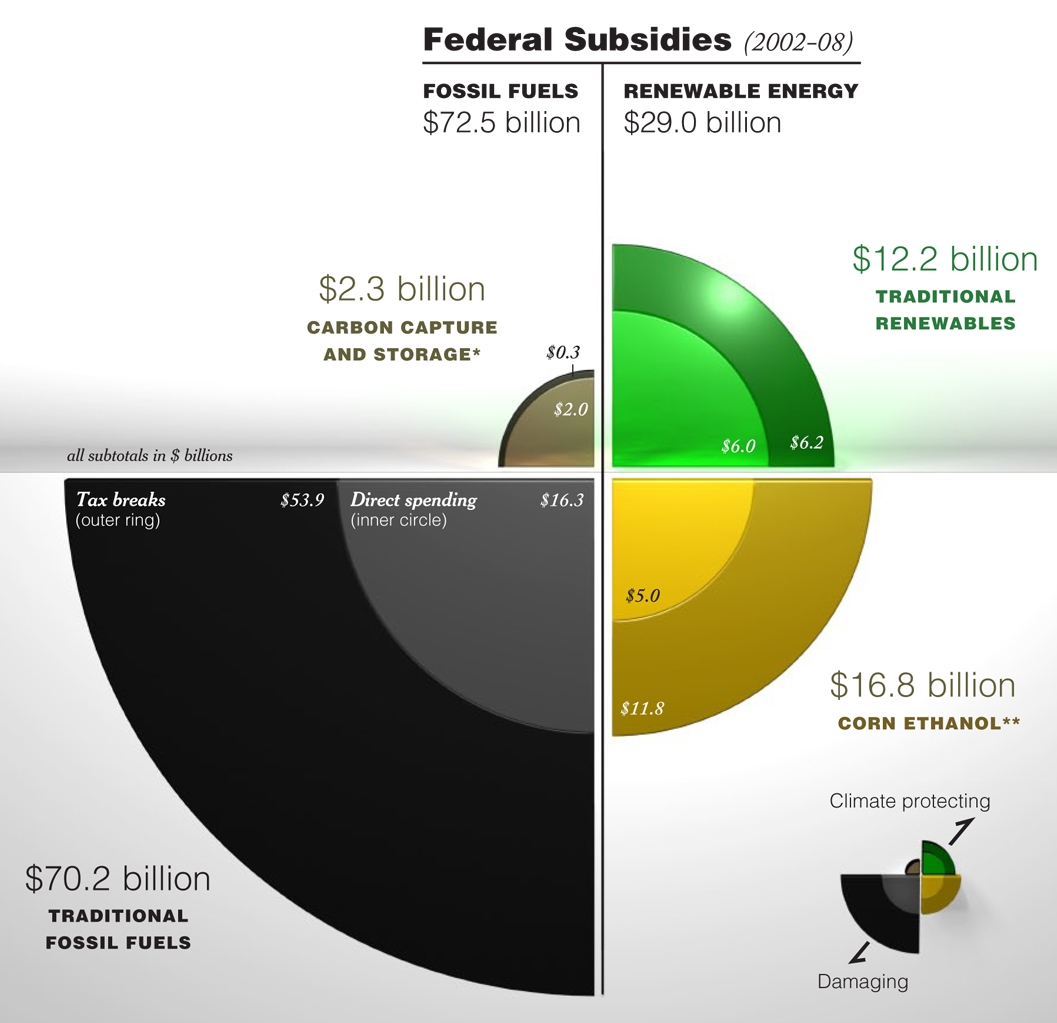

Not long ago, I helped the nice people at the Environmental Law Institute work on a project to identify and quantify federal subsidies to various energy industries. The end result was a very good report and this nifty graphic to go with it:

It turns out that the hardest part of the project was defining what a subsidy is. We wanted to be objective and clear, and to err on the side of being overly conservative. And while the “You know it when you see it” standard would have been much easier to apply, we came up with a working definition that defined a subsidy as a deliberate decision, action, or failure to act taken by the federal government that conferred some economic benefit on industry participants that directly and negatively impacted the federal budget. We measured the subsidy as the size of the budget impact (as opposed to the value conferred on the industry).

Equipped with a solid working definition, we still spent more time than I can remember debating what fit and what didn’t. What we found, which seems obvious in retrospect, is that the vast majority of subsidies don’t come in the form of government payments to industry, but rather the less obvious tweaks and exemptions to various tax laws.

Oddly enough, the largest, and most interesting subsidy to the oil industry that fit our definition was actually a slight change of a few definitions in Saudi Arabian tax law.

If you are an American company that has to pay income taxes to a foreign government, the IRS gives you a tax credit that essentially pretends as though you paid those taxes to the U.S. The idea is actually sound, because it avoids taxing the same corporate income twice. If you make money selling widgets in Canada, and the Canadian government treats those profits as taxable income, even though your company is American, then the IRS won’t make you pay taxes on those profits again.

However, if you have to pay some expenses in a foreign country, even to a foreign government, for operating licenses, for example, the IRS treats those as business expenses, just as it does with other costs of doing business, like labor or materials. In this case, companies can deduct those expenses from their income, reducing the amount of money they have to pay taxes on. With a corporate tax rate of 35 percent, every dollar a company can deduct from their income saves them 35 cents. As useful as this is, the tax credit is much more valuable, since every dollar of tax credit saves the company a whole dollar in payments.

All of this matters, because in the 1950’s, the Saudi Arabian and other Persian Gulf governments wanted to increase their share of oil revenues from U.S. based oil companies, and were considering raising their royalty payments. Royalty payments are like licensing fees that oil companies pay to the countries they drill in for the right extract the oil. The IRS treats them as a deductible business expense.

The U.S. State Department, eager to keep the Saudi government happy and the oil in the hands of U.S. companies, negotiated a deal whereby the governments would raise their royalty payments the companies had to pay them, but to reclassify them as income taxes. In the end, these governments collected more money from the oil companies, but the oil companies got a dollar-for-dollar reduction in their U.S. tax liabilities, so that the net effect was a reduction in U.S. tax revenues — to the tune of $15 billion total in just the years between 2002 and 2008 — while the oil companies themselves came out no worse, or perhaps slightly better off.

I highly recommend reading the whole paper, if only to emphasize the point that, much like the politics of the issue, defining and identifying energy subsidies is a far more convoluted undertaking than the common sense nature of the issue indicates.