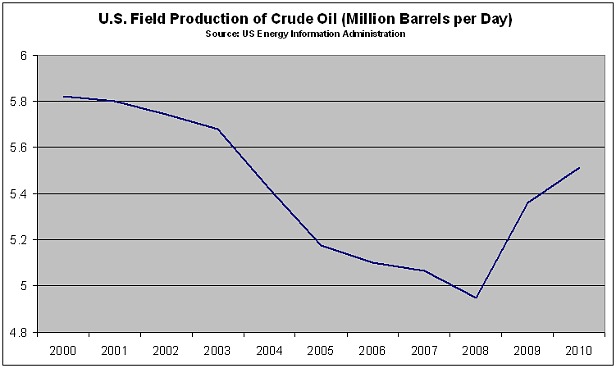

U.S. oil production last year rose to its highest level in almost a decade …

As a result, analysts believe the U.S. was the largest contributor to the increase in global oil supplies last year over 2009, and is on track to increase domestic production by 25 percent by the second half of the decade.

Domestic oil production is soaring, but so are global prices. It should be obvious that yet more drilling can’t have any significant impact on oil prices — particularly since the U.S. Energy Information Administration (EIA) has been making that precise point for years now.

The only thing that can protect Americans from the inevitably increasing oil shocks of peak oil is an aggressive strategy to reduce the country’s oil intensity (oil/GDP), including a steady increase the fuel efficiency of our vehicles — policies that conservatives have fought for decades.

But that doesn’t stop those same conservatives — including former Big Oil lobbyist and current Mississippi Gov. Haley Barbour — from trying to blame Obama for high oil prices. ThinkProgress has a rundown of all the absurd attacks:

Political opportunists in the Republican Party have already sought to blame this inherently unstable situation on President Obama. Mississippi Gov. Haley Barbour (R) — a possible 2012 presidential candidate and former oil industry lobbyist — has suggested that not only are increased prices Obama’s fault, but that he desired and created them. “His administration’s policies have been designed to drive up the cost of energy in the name of reducing pollution, in the name of making very expensive alternative fuels more economically competitive,” Barbour told the U.S Chamber of Commerce last week. “Their policy is to drive up energy prices.” Rep. Michele Bachmann (R-Minn.), chair of the House Tea Party Caucus and also a potential 2012 presidential candidate, said of high gas prices, “This is exactly what the ambition of the Obama administration is, because they want to move people toward green energy.” In a post on Redstate.com titled “Blame the Democrats for high gas prices,” CNN political commentator Erick Erickson argued that “Democrats have been politicizing and blocking expanded oil drilling for quite some time.” Similarly, Rep. Bill Johnson (R-Ohio) blamed Democrats’ unwillingness to open up more domestic drilling sites for the spike. “We seem to have our hands behind our back,” Johnson said. “And this lack of permitting — this lack of going after resources that we have right here in America — is indicative of a failed energy policy.

That is all pure BS, the exact opposite of the truth. As the Financial Times reported:

The revival of U.S. production has been made possible by a rush of small and mid-sized companies into onshore regions such as the Bakken shale in North Dakota, the Permian Basin in west Texas, and the Eagle Ford shale in south Texas.

North Dakota’s production has doubled since 2008, reaching 355,000 barrels per day in November. Extraction of oil reserves in these regions was thought to be uneconomic, but has been made commercially viable by the transfer of techniques successfully used to extract shale gas; in particular, long horizontal wells and “fracking”, pumping water under high pressure to crack the rock and enable the oil to flow.

Dave Hager, vice-president for exploration and production at Devon Energy, one of the companies pioneering the development of the new onshore fields, said new technology had transformed production economics at its mixed gas and oilfields in north Texas.

Like it or not, Obama actually campaigned on opening up oil production in the Bakken shale, so he is delivering on a campaign promise there.

Of course, more domestic production simply can’t have any significant impact on global prices, as the U.S. Energy Information Administration has made clear many times.

The EIA’s 2009 report, “Impact of Limitations on Access to Oil and Natural Gas Resources in the Federal Outer Continental Shelf,” analyzed the difference between full offshore drilling (reference case) and restriction to offshore drilling (Outer Continental Shelf limited case). In 2020, there is no impact on gasoline prices. In 2030, U.S. gasoline prices would be three cents a gallon lower. Woohoo!

I have previously written about the trivial impact of opening the OCS further to drilling — the oil companies already have access to some 30 billion barrels of offshore oil they have barely begun to develop.

If you are concerned about the impact of high oil prices from Middle East instability, the only viable long-term strategy is one aimed at ending our addiction to this climate-destroying fossil fuel. Even the once-staid and conservative International Energy Agency understands that. And Obama has taken aggressive action in this area, raising new car fuel efficiency standard to 35.5 mpg by 2016, the biggest step the U.S. government has ever proposed to cut oil use.

So why are Barbour and the conservatives shilling for Big Oil? ThinkProgress explains:

There is a notable theme here — aside from crass political point scoring, these attacks are calibrated to protect oil as a primary energy source at the expense of cheaper green alternatives, while pushing for even more oil drilling here in the United States. These opportunistic attacks come as the oil industry prepares to pump unprecedented sums of money into the political process. Since the midterm elections, the oil industry has “been very aggressive right out of the gate because of the huge opportunity with the election of their allies,” as Daniel J. Weiss, the director of climate strategy at the Center for American Progress Action Fund, told the Houston Chronicle yesterday. Oil and gas companies spent $146.3 million on lobbying last year, and that number is poised to rise as the presidential election approaches. For example, the American Petroleum Institute will start donating money to political campaigns this year.

… the big five oil companies — BP, Chevron, ConocoPhillips, ExxonMobil, and Shell — made $893 billion in profits from 2001 to 2010.

It’s a “virtuous” cycle. Big Oil gets politicians elected who push for more drilling and try to block strategies that could actually reduce our oil addiction. Oil profits keep going up — and that means more money for Big Oil to invest in those politicians.

Note: For the EIA data in the top figure, go here.